Vodafone 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

85

Vodafone Group Plc

Annual Report 2012

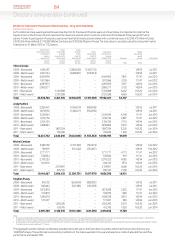

Share options

No share options have been granted to directors during the year. The following information summarises the executive directors’ options under the

Vodafone Group 2008 Sharesave Plan (‘SAYE’), the Vodafone Group Plc 1999 Long-Term Stock Incentive Plan (‘LTSIP’) and the Vodafone Global

Incentive Plan (‘GIP’). HMRC approved awards may be made under all of the schemes mentioned. No other directors have options under any of

these schemes.

Options under the Vodafone Group 2008 Sharesave Plan were granted at a discount of 20% to the market value of the shares at the time of the

grant. No other options may be granted at a discount.

At

1 April 2011

or date of

appointment

Options

granted

during the

2012 nancial

year

Options

exercised

during the

2012 nancial

year

Options

lapsed

during the

2012 nancial

year

Options

held at

31 March 2012

Option

price Date from

which

exercisable

Expiry

date

Market

price on

exercise

Grant

date

Number

of shares

Number

of shares

Number

of shares

Number

of shares

Number

of shares Pence1Pence

Vittorio Colao

GIP Nov 2006 3,472,975 – – – 3,472,975 135.50 Nov 2009 Nov 2016 –

GIP2Jul 2007 3,003,575 – – – 3,003,575 167.80 Jul 2010 Jul 2017 –

SAYE Jul 2009 16,568 – – – 16,568 93.85 Sep 2014 Feb 2015 –

Total 6,493,118 – – – 6,493,118

Andy Halford

LTSIP Jul 2001 152,400 – (152,400) – 151.56 Jul 2004 Jul 2011 163.3

LTSIP Jul 2005 1,291,326 – – – 1,291,326 145.25 Jul 2008 Jul 2015 –

GIP2Jul 2007 2,295,589 – – – 2,295,589 167.80 Jul 2010 Jul 2017 –

SAYE Jul 2009 9,669 – – – 9,669 93.85 Sep 2012 Feb 2013 –

Total 3,748,984 – (152,400) 3,596,584

Michel Combes

SAYE Jul 2009 9,669 – – – 9,669 93.85 Sep 2012 Feb 2013 –

Total 9,669 – – – 9,669

Stephen Pusey

GIP Sep 2006 1,034,259 – – – 1,034,259 113.75 Sep 2009 Aug 2016 –

GIP2Jul 2007 947,556 – – – 947,556 167.80 Jul 2010 Jul 2017 –

SAYE Jul 2009 9,669 – – – 9,669 93.85 Sep 2012 Feb 2013 –

Total 1,991,484 – – – 1,991,484

Notes:

1 The closing mid-market share price on 31 March 2012 was 172.2 pence. The highest mid-market share price during the year was 183.9 pence and the lowest price was 154.0 pence.

2 The performance condition on these options is a three year cumulative growth in adjusted earnings per share. The options vested at 100% on 24 July 2010.

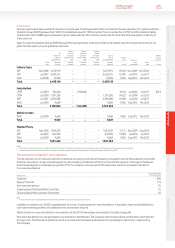

Non-executive directors’ remuneration

The remuneration of non-executive directors is reviewed annually by the Chairman following consultation with the Remuneration Committee

Chairman. Our policy is to pay competitively for the role including consideration of the time commitment required. In this regard, the fees are

benchmarked against a comparator group of the FTSE 15 companies. Following the 2012 review there will be no increases to the fees of

non-executive directors.

Position/role

Fee payable (£’000)

From 1 April 2012

Chairman1600

Deputy Chairman 175

Non-executive director 115

Chairmanship of Audit and Risk Committee 25

Chairmanship of Remuneration Committee 25

Note:

1 The Chairman’s fee also includes the fee for the Chairmanship of the Nominations and Governance Committee.

In addition, an allowance of £6,000 is payable each time a non-Europe based non-executive director is required to travel to attend Board and

committee meetings to reect the additional time commitment involved.

Details of each non-executive director’s remuneration for the 2012 nancial year are included in the table on page 86.

Non-executive directors do not participate in any incentive or benet plans. The Company does not provide any contribution to their pension

arrangements. The Chairman is entitled to use of a car and a driver whenever and wherever he is providing his services to or representing

theCompany.