Vodafone 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

137

Vodafone Group Plc

Annual Report 2012

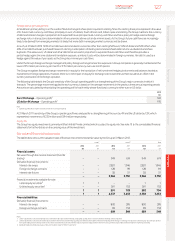

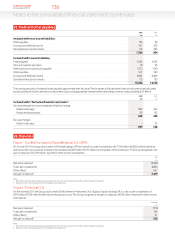

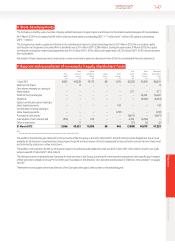

27. Reconciliation of net cash ow from operating activities

2012 2011 2010

£m £m £m

Prot for the nancial year 7,003 7,870 8,618

Adjustments for:

Share-based payments 143 156 150

Depreciation and amortisation 7,859 7,876 7,910

Loss on disposal of property, plant and equipment 47 91 101

Share of result in associates (4,963) (5,059) (4,742)

Impairment losses 4,050 6,150 2,100

Other income and expense (3,705) 16 (114)

Non-operating income and expense 162 (3,022) 10

Investment income (456) (1,309) (716)

Financing costs 1,932 429 1,512

Income tax expense 2,546 1,628 56

Decrease/(increase) in inventory 24 (107) 2

Increase in trade and other receivables (689) (387) (714)

Increase in trade and other payables 871 1,060 1,164

Cash generated by operations 14,824 15,392 15,337

Tax paid (2,069) (3,397) (2,273)

Net cash ow from operating activities 12,755 11,995 13,064

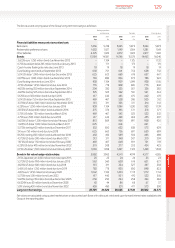

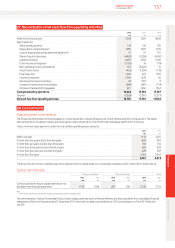

28. Commitments

Operating lease commitments

The Group has entered into commercial leases on certain properties, network infrastructure, motor vehicles and items of equipment. The leases

have various terms, escalation clauses, purchase options and renewal rights, none of which are individually signicant to the Group.

Future minimum lease payments under non-cancellable operating leases comprise:

2012 2011

£m £m

Within one year 1,110 1,225

In more than one year but less than two years 893 958

In more than two years but less than three years 740 746

In more than three years but less than four years 624 638

In more than four years but less than ve years 528 602

In more than ve years 2,246 2,344

6,141 6,513

The total of future minimum sublease payments expected to be received under non-cancellable subleases is £252million (2011: £240million).

Capital commitments

Company and subsidiaries Share of joint ventures Group

2012 2011 2012 2011 2012 2011

£m £m £m £m £m £m

Contracts placed for future capital expenditure not

provided in the nancial statements11,735 1,786 283 338 2,018 2,124

Note:

1 Commitment includes contracts placed for property, plant and equipment and intangible assets.

The commitments of Cellco Partnership (‘Cellco’), which trades under the name of Verizon Wireless, are disclosed within the consolidated nancial

statements of Cellco for the year ended 31 December 2011, which are included as an exhibit to our 2012 annual report on Form 20-F led with

theSEC.