Vodafone 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152

Vodafone Group Plc

Annual Report 2012

Shareholder information (continued)

All of the Company’s ordinary shares are fully paid. Accordingly, no

further contribution of capital may be required by the Company from

the holders of such shares.

English law species that any alteration to the articles of association

must be approved by a special resolution of the shareholders.

Articles of association

By a special resolution passed at the 2010 AGM the Company removed

its object clause together with all other provisions of its memorandum

of association which, by virtue of the Companies Act 2006, are treated as

forming part of the Company’s articles of association. Accordingly, the

Company’s articles of association do not specically restrict the objects

of the Company.

Directors

The Company’s articles of association provide for a Board of directors,

consisting of not fewer than three directors, who shall manage the

business and affairs of the Company.

The directors are empowered to exercise all the powers of the Company

subject to any restrictions in the articles of association, the Companies

Act (as dened in the articles of association) and any special resolution.

Under the Company’s articles of association a director cannot vote in

respect of any proposal in which the director, or any person connected

with the director, has a material interest other than by virtue of the

director’s interest in the Company’s shares or other securities. However,

this restriction on voting does not apply to resolutions (i) giving the

director or a third party any guarantee, security or indemnity in respect

of obligations or liabilities incurred at the request of or for the benet

ofthe Company, (ii) giving any guarantee, security or indemnity to the

director or a third party in respect of obligations of the Company for

which the director has assumed responsibility under an indemnity

orguarantee, (iii) relating to an offer of securities of the Company in

whichthe director is entitled to participate as a holder of shares or

othersecurities or in the underwriting of such shares or securities,

(iv)concerning any other company in which the director (together with

any connected person) is a shareholder or an ofcer or is otherwise

interested, provided that the director (together with any connected

person) is not interested in 1% or more of any class of the Company’s

equity share capital or the voting rights available to its shareholders,

(v)relating to the arrangement of any employee benet in which the

director will share equally with other employees and (vi) relating to any

insurance that the Company purchases or renews for its directors or any

group of people including directors.

The directors are empowered to exercise all the powers of the Company

to borrow money, subject to the limitation that the aggregate amount of

all liabilities and obligations of the Group outstanding at any time shall

not exceed an amount equal to 1.5 times the aggregate of the Group’s

share capital and reserves calculated in the manner prescribed in the

articles of association unless sanctioned by an ordinary resolution of the

Company’s shareholders.

The Company can make market purchases of its own shares or agree

todo so in the future provided it is duly authorised by its members in a

general meeting and subject to and in accordance with section 701 of

the Companies Act 2006.

At each AGM all directors who were elected or last re-elected at or

before the AGM held in the third calendar year before the current year

shall automatically retire. In 2005 the Company reviewed its policy

regarding the retirement and re-election of directors and, although

itisnot intended to amend the Company’s articles of association in

thisregard, the Board has decided in the interests of good corporate

governance that all of the directors wishing to continue in ofce should

offer themselves for re-election annually.

Directors are not required under the Company’s articles of association

tohold any shares of the Company as a qualication to act as a director,

although executive directors participating in long-term incentive plans

must comply with the Company’s share ownership guidelines.

Inaccordance with best practice in the UK for corporate governance,

compensation awarded to executive directors is decided by

aremuneration committee consisting exclusively of non-

executivedirectors.

In addition, as required by The Directors’ Remuneration Report

Regulations, the Board has, since 2003, prepared a report to

shareholders on the directors’ remuneration which complies with

theregulations (see pages 74 to 87). The report is also subject to

ashareholder vote.

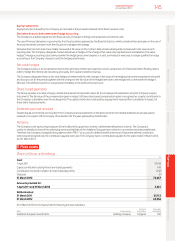

Rights attaching to the Company’s shares

At 31 March 2012 the issued share capital of the Company was

comprised of 50,000 7% cumulative xed rate shares of £1.00 each

and49,645,940,182 ordinary shares (excluding treasury shares) of

113⁄7US cents each.

Dividend rights

Holders of 7% cumulative xed rate shares are entitled to be paid

inrespect of each nancial year, or other accounting period of the

Company, a xed cumulative preferential dividend of 7% per annum on

the nominal value of the xed rate shares. A xed cumulative preferential

dividend may only be paid out of available distributable prots which the

directors have resolved should be distributed. The xed rate shares do

not have any other right to share in the Company’s prots.

Holders of the Company’s ordinary shares may, by ordinary resolution,

declare dividends but may not declare dividends in excess of the

amount recommended by the directors. The Board of directors may

also pay interim dividends. No dividend may be paid other than out of

prots available for distribution. Dividends on ordinary shares can be

paid to shareholders in whatever currency the directors decide, using

anappropriate exchange rate for any currency conversions which

arerequired.

If a dividend has not been claimed for one year after the date of the

resolution passed at a general meeting declaring that dividend or the

resolution of the directors providing for payment of that dividend, the

directors may invest the dividend or use it in some other way for the

benet of the Company until the dividend is claimed. If the dividend

remains unclaimed for 12 years after the relevant resolution either

declaring that dividend or providing for payment of that dividend, it

willbe forfeited and belong to the Company.

Voting rights

The Company’s articles of association provide that voting on substantive

resolutions (i.e. any resolution which is not a procedural resolution) at a

general meeting shall be decided on a poll. On a poll, each shareholder

who is entitled to vote and is present in person or by proxy has one vote

for every share held. Procedural resolutions (such as a resolution to

adjourn a general meeting or a resolution on the choice of Chairman of

a general meeting) shall be decided on a show of hands, where each

shareholder who is present at the meeting has one vote regardless

ofthe number of shares held, unless a poll is demanded. In addition,

thearticles of association allow persons appointed as proxies of

shareholders entitled to vote at general meetings to vote on a show

ofhands, as well as to vote on a poll and attend and speak at general

meetings. The articles of association also allow persons appointed

asproxies by two or more shareholders entitled to vote at general

meetings to vote for and against a resolution on a show of hands.

Under English law two shareholders present in person constitute a

quorum for purposes of a general meeting unless a company’s articles

of association specify otherwise. The Company’s articles of association

do not specify otherwise, except that the shareholders do not need to

be present in person and may instead be present by proxy to constitute

a quorum.