Vodafone 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

55

Vodafone Group Plc

Annual Report 2012

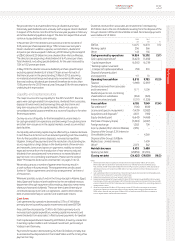

We provide returns to shareholders through dividends and have

historically paid dividends semi-annually, with a regular interim dividend

in respect of the rst six months of the nancial year payable in February

and a nal dividend payable in August. The directors expect that we will

continue to pay dividends semi-annually.

In November 2011 the directors announced an interim dividend of

3.05pence per share representing a 7.0% increase over last year’s

interim dividend. In addition a special, second interim, dividend of

4.0pence per share was paid in February 2012 following the receipt of

aUS$4.5 billion (£2.9 billion) income dividend from Verizon Wireless.

Thedirectors are proposing a nal dividend of 6.47pence per share.

Total dividends, excluding special dividends, for the year increased by

7.0% to 9.52pence per share.

In May 2010 the directors issued a dividend per share growth target,

excluding special dividends, of at least 7% per annum for each of

thenancial years in the period ending 31 March 2013, assuming

nomaterial adverse foreign exchange rate movements. We expect

thattotal ordinary dividends per share will therefore be no less than

10.18pence for the 2013 nancial year. See page 50 for the assumptions

underlying thisexpectation.

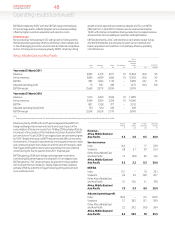

Liquidity and capital resources

The major sources of Group liquidity for the 2012 and 2011 nancial

years were cash generated from operations, dividends from associates,

disposal of investments and borrowings through short-term and

long-term issuances in the capital markets. We do not use non-

consolidated special purpose entities as a source of liquidity or for other

nancing purposes.

Our key sources of liquidity for the foreseeable future are likely to

becash generated from operations and borrowings through long-term

and short-term issuances in the capital markets as well as committed

bank facilities.

Our liquidity and working capital may be affected by a material decrease

in cash ow due to factors such as reduced operating cash ow resulting

from further possible business disposals, increased competition,

litigation, timing of tax payments and the resolution of outstanding tax

issues, regulatory rulings, delays in the development of new services

and networks, licence and spectrum payments, inability to receive

expected revenue from the introduction of new services, reduced

dividends from associates and investments or increased dividend

payments to non-controlling shareholders. Please see the section

titled“Principal risk factors and uncertainties” on pages 51 to 53.

We are also party to a number of agreements that may result in

acashoutow in future periods. These agreements are discussed

furtherin “Option agreements and similar arrangements” at the end

ofthis section.

Wherever possible, surplus funds in the Group (except in Albania, Egypt,

India, Qatar and Vodacom) are transferred to the centralised treasury

department through repayment of borrowings, deposits, investments,

share purchases and dividends. These are then loaned internally or

contributed as equity to fund our operations, used to retire external

debt, invested externally or used to fund shareholder returns.

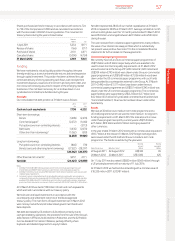

Cash ows

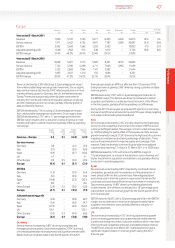

Cash generated by operations decreased by 3.7% to £14.8 billion

primarily driven by working capital movements and lower EBITDA.

Free cash ow decreased by 13.4% to £6.1 billion primarily due to

increased cash capital expenditure, working capital movements and

lower dividends from associates1, offset by lower payments for taxation.

Cash capital expenditure increased by £0.8 billion, driven by a reduction

in working capital creditors and increased investment, particularly in

Vodacom and Germany.

Payments for taxation decreased by 24.2% to £2.0 billion primarily due

to accelerated tax depreciation in the United States and the timing of tax

payments in Italy.

Dividends received from associates and investments1 decreased by

£0.3billion due to the loss of dividends resulting from the disposal of the

Group’s interest in SFR and China Mobile Limited. Net interest payments

were stable at £1.3 billion.

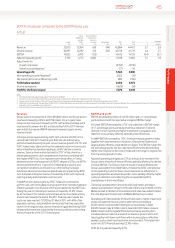

2012 2011

£m £m %

EBITDA 14,475 14,670 (1.3)

Working capital 206 566

Other 143 156

Cash generated by operations 14,824 15,392 (3.7)

Cash capital expenditure2(6,423) (5,658)

Capital expenditure (6,365) (6,219)

Working capital movement

in respect of capital expenditure (58) 561

Disposal of property, plant

and equipment 117 51

Operating free cash ow 8,518 9,785 (12.9)

Taxation (1,969) (2,597)

Dividends received from associates

and investments11,171 1,509

Dividends paid to non-controlling

shareholders in subsidiaries (304) (320)

Interest received and paid (1,311) (1,328)

Free cash ow 6,105 7,049 (13.4)

Tax settlement3(100) (800)

Licence and spectrum payments (1,429) (2,982)

Acquisitions and disposals44,872 (183)

Equity dividends paid (6,643) (4,468)

Purchase of treasury shares (3,583) (2,087)

Foreign exchange 1,283 709

Income dividend from Verizon Wireless 2,855 –

Disposal of the Group’s 3.2% interest in

China Mobile Limited – 4,269

Disposal of the Group’s SoftBank

Mobile Corp. Limited interests – 1,409

Other52,073 542

Net debt decrease 5,433 3,458

Opening net debt (29,858) (33,316)

Closing net debt (24,425) (29,858) (18.2)

Notes:

1 Dividends received from associates and investments for the year ended 31 March 2012 includes

£965million (2011: £1,024 million) tax distribution from our 45% interest in Verizon Wireless and a

naldividend of £178 million (2011: £383 million) from SFR prior to the completion of the disposal of our

44% interest. It does not include the £2,855 million income dividend from Verizon Wireless received in

January 2012.

2 Cash capital expenditure comprises the purchase of property, plant and equipment and intangible assets,

other than licence and spectrum payments, during the year.

3 Related to a tax settlement in the year ended 31 March 2011.

4 Acquisitions and disposals for the year ended 31 March 2012 primarily includes £6,805 million proceeds

from the sale of the Group’s 44% interest in SFR, £784 million proceeds from the sale of the Group’s 24.4%

interest in Polkomtel and £2,592 million payment in relation to the purchase of non-controlling interests in

Vodafone India Limited.

5 Other for the year ended 31 March 2012 primarily includes £2,301 million movement in the written

putoptions in relation to India and the return of a court deposit made in respect of the India tax case

(£310million). Other for the year ended 31 March 2011 primarily includes £356 million in relation to

acourtdeposit made in respect of the India tax case.