Vodafone 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

Vodafone Group Plc

Annual Report 2012

Notes to the consolidated nancial statements (continued)

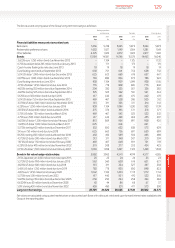

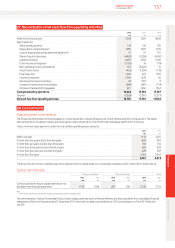

29. Contingent liabilities

2012 2011

£m £m

Performance bonds 270 94

Credit guarantees – third party indebtedness 77 114

Other guarantees and contingent liabilities 551 1,527

Performance bonds

Performance bonds require the Group to make payments to third parties in the event that the Group does not perform what is expected of it under

the terms of any relatedcontracts or commercial arrangements.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities including those in respect of the Group’s associates

andinvestments.

Other guarantees and contingent liabilities

At 31 March 2011 other guarantees principally comprised of commitments to the India Supreme Court of INR 85 billion (£1,188 million) pending nal

adjudication in relation to the case with the Indian Tax Authority, see “Legal Proceedings”.

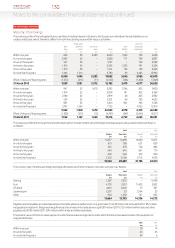

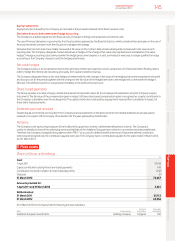

The Group also enters into lease arrangements in the normal course of business which are principally in respect of land, buildings and equipment.

Further details on the minimum lease payments due under the non-cancellable operating lease arrangements can be found in note 28.

The Company has covenanted to provide security in favour of the Trustee of the Vodafone Group UK Pension Scheme whilst there is a decit in the

scheme. The decit is measured on a prescribed basis agreed between the Company and Trustee. In 2010 the Company and Trustee agreed security

of a charge over UK index linked gilts (‘ILG’) held by the Company. An initial charge in favour of the Trustee was agreed over ILG 2016 with a notional

value of £100 million and ILG 2013 with a notional value of £48.9 million to secure the decit at that time of approximately £450 million. In December

2011, the security was increased by an additional charge over ILG 2017 with a notional value of £177.7 million due to an increase in the decit. The

security may be substituted either on a voluntary or mandatory basis. As and when alternative security is provided, the Company has agreed that

the security cover should include additional headroom of 33%, although if cash is used as the security asset the ratio will revert to 100% of the

relevant liabilities or where the proposed replacement security asset is listed on an internationally recognised stock exchange in certain core

jurisdictions, the Trustee may decide to agree a lower ratio than 133%.

Legal proceedings

The Company and its subsidiaries are currently, and may be from time to time, involved in a number of legal proceedings including inquiries from,

ordiscussions with, governmental authorities that are incidental to their operations. However, save as disclosed below, the Company and its

subsidiaries are not currently involved in any legal or arbitration proceedings (including any governmental proceedings which are pending or known

to be contemplated) which may have, or have had in the 12 months preceding the date of this report, a signicant effect on the nancial position or

protability of the Company and its subsidiaries. Due to inherent uncertainties, no accurate quantication of any cost, or timing of such cost, which

may arise from any of the legal proceedings outlined below can be made.

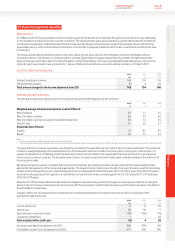

In October 2009 Telecom Egypt commenced arbitration against Vodafone Egypt in Cairo alleging breach of non-discrimination provisions in an

interconnection agreement as a result of allegedly lower interconnection rates paid to Vodafone Egypt by Mobinil. Telecom Egypt has also sought

tojoin Vodafone International Holdings BV (‘VIHBV’), Vodafone Europe BV (‘VEBV’) and Vodafone Group Plc (who Telecom Egypt alleges should be

held jointly liable with Vodafone Egypt) to the arbitration. VIHBV, VEBV and Vodafone Group Plc deny that they were subject to the interconnection

agreement or any arbitration agreement with Telecom Egypt. Telecom Egypt initially quantied its claim at approximately €190 million in 2009.

Thiswas subsequently amended and increased to €551 million in January 2011 and further increased to its current value of just over €1.2 billion

inNovember 2011. The Company disputes Telecom Egypt’s claim (and assertion of jurisdiction over VIHBV, VEBV and Vodafone Group Plc) and will

continue to defend its position vigorously. Final submissions are due on 29 June 2012 and the arbitration hearing is currently scheduled to last ten

days, commencing 6 September 2012.

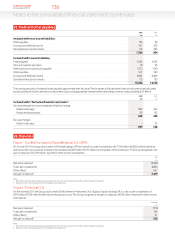

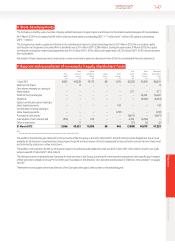

Vodafone India Limited (‘VIL’) and VIHBV each received notices in August 2007 and September 2007, respectively, from the Indian tax authority

alleging potential liability in connection with alleged failure by VIHBV to deduct withholding tax from consideration paid to the Hutchison

Telecommunications International Limited group (‘HTIL’) in respect of HTIL’s gain on its disposal to VIHBV of its interests in a wholly-owned subsidiary

that indirectly holds interests in VIL. Following the receipt of such notices, VIL and VIHBV each led writs seeking orders that their respective notices

be quashed and that the Indian tax authority take no further steps under the notices. Initial hearings were held before the Bombay High Court and, in

the case of VIHBV, the Bombay High Court admitted the writ for nal hearing in June 2008. In December 2008, the Bombay High Court dismissed

VIHBV’s writ. VIHBV subsequently led a special leave petition to the Supreme Court to appeal the Bombay High Court’s dismissal of the writ. On

23January 2009 the Supreme Court referred the question of the tax authority’s jurisdiction to seek to pursue tax back to the tax authority for

adjudication on the facts, with permission granted to VIHBV to appeal that decision back to the Bombay High Court should VIHBV disagree with the

tax authority’s ndings. On 30 October 2009 VIHBV received a notice from the tax authority requiring VIHBV to show cause as to why it believed that

the Indian tax authority did not have competent jurisdiction to proceed against VIHBV for the default of non-deduction of withholding tax from

consideration paid to HTIL. VIHBV provided a response on 29 January 2010. On 31 May 2010 VIHBV received an order from the Indian tax authority

conrming their view that they did have jurisdiction to proceed against VIHBV, as well as a further notice alleging that VIHBV should be treated as the

agent of HTIL for the purpose of recovering tax on the transaction. VIHBV appealed this ruling to the Bombay High Court, as well as led a new writ

petition against the notice seeking to treat it as an agent of HTIL. On 8 September 2010 the Bombay High Court ruled that the tax authority had

jurisdiction to decide whether the transaction or some part of the transaction could be taxable in India. VIHBV appealed this decision to the Supreme

Court on 14 September 2010. A hearing before the Supreme Court took place on 27 September 2010 at which time the Supreme Court noted the

appeal and asked the Indian tax authority to quantify any liability. On 22 October 2010 the Indian tax authority quantied the alleged tax liability and

issued a demand for payment of INR 112.2 billion (£1.6 billion) of tax and interest. VIHBV contested the amount of such demand both on the basis of