Vodafone 2012 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

159

Vodafone Group Plc

Annual Report 2012

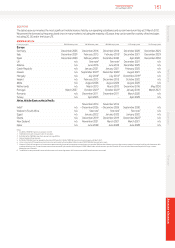

The licences will expire in 2030. Our 900 MHz licence has been modied

to allow refarming and we have the option to extend it until 2030. The

licence currently expires in2020. In November 2011 we acquired 2x10

MHz of 2.6 GHz TDD spectrum at a cost of €10.4 million (£8.7 million).

In December 2011 the National Competition Authority issued a draft

decision which proposes that Vodafone, Telefonica and Orange have

abused a collective dominant position in the provision of wholesale

origination of SMS and MMS and abused an individual dominant

positionin the provision of SMS and MMS termination services in setting

excessive prices. The Council of the National Competition Authority

must now take the nal decision and consider the imposition of nes.

In January 2012 the National Competition Authority informed Vodafone,

Orange and Telefonica that they were investigating claims from BT Spain

that the operators had engaged in an unlawful price squeeze in the

market for xed and mobile services for business users. We have since

received a questionnaire, to which we have responded.

In February 2012 the government announced its intention to merge

thenational telecommunications regulator into a new regulatory body

called the National Markets and Competition Commission.

United Kingdom

Our regulated average MTR at 31 March 2012 was 3.02 pence per

minute. The national regulator proposed a glidepath with annual

adjustments that would see a reduction to 0.69 pence per minute

(plusination adjustment) by 1 April 2014. Following appeals of this

decision, the rate of 0.69 pence per minute (plus ination adjustment)

will have to be reached one year earlier (by 1 April 2013). All 2G licences

have beenmodied to allow refarming to 3G. All 3G licences will also be

made indenite rather than expiring in 2021.

The national regulator has consulted on the release of 800 MHz

and2.6GHz spectrum, including proposals for the auction design.

Theauction is expected to take place in the rst quarter of 2013.

Other Europe

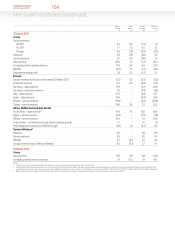

Albania

AMC (Deutsche Telekom) launched its 3G services in the market in

January 2012. The national regulator launched a public tender in

February 2012 to award the third 3G licence in the market but the

minimum bid price set by the Telecoms Minister was not met and the

tender failed.

Czech Republic

In March 2012 the government released a consultation on the auction

of 800 MHz, 1800 MHz, and 2.6 GHz spectrum, which is expected to

take place in November 2012. The government proposes to reserve

aportion of 1800 MHz spectrum for a new entrant and to require

licensees to provide access for MVNOs.

The national regulator is currently reviewing the market for mobile

origination and access to determine whether mobile operators should

be obliged to provide regulated access to MVNOs.

Greece

In November 2011 we acquired 2x15 MHz of 900 MHz spectrum

and2x10 MHz of 1800 MHz spectrum for a cost of €169 million

(£142million). The licences are valid until 2026.

Hungary

In October 2010 the Hungarian Parliament adopted a law which

imposes a signicant additional tax burden on the telecommunications,

retail and energy sectors. The law came into force in December 2010

and will apply until at least January 2013. We paid HUF 7,119,714,000

(£23 million) in relation to the 2011 nancial year. InMarch 2012

theCommission announced that it would commence infringement

proceedings in the European Court of Justice on the basis that the tax

isunlawful.

We acquired an additional 2x2 MHz of 900 MHz for HUF 15.7 billion

(£44million) spectrum through anauction in January 2012. We and

other operators are, however, challenging the award of certain spectrum

to a new entrant during thatprocedure.

At the end of April 2012 the government proposed the introduction of a

new end-user tax on both mobile and xed phone trafc of HUF 2.0 per

minute and per SMS/MMS. The new tax would generate tax revenue

ofHUF 52 billion (£147.3 million) a year, which is close to 10% of the

relevant service revenue of the whole market, and would be in force

from 1 July 2012.

Ireland

The national regulator is planning to auction all spectrum in the

900/1800 MHz spectrum bands at the same time as the 800 MHz band

in mid 2012, with the 800 MHz spectrum awarded under the auction

available in 2013. In the meantime, Vodafone’s and O2’s 900 MHz

licences will be renewed until the commencement of the new licences

in 2013.

Netherlands

Our MTR reduced to 4.20 eurocents per minute in January 2011

following a proposal by the national regulator to reduce it to 1.2

eurocents per minute by September 2012. Following an appeal, the

court directed that the MTR should instead reduce to 2.4 eurocents by

September 2012. The Commission has suggested that it may challenge

this decision, but we do not believe it has the legal grounds to do so.

The government has announced plans to auction 800 MHz, 900 MHz,

1800 MHz, 2.1 GHz and 2.6 GHz spectrum in October 2012. The

government will reserve 2x5 MHz in the 900 MHz band for new

entrants, in addition to 2x10 MHz in the 800 MHz band.

In May 2012 the Dutch Parliament adopted amendments to the

Telecommunications Act which are intended to limit the circumstances

in which operators are able to engage in network management and to

prevent operators from varying the charges to end users by reference

tothe type of internet service or application they wish to use. The

cumulative effect of these measures is to prevent operators from

blocking or otherwise charging specically for voice over internet

protocol (‘VOIP’) and other internet services. These measures are

expected to apply from January 2013.

Portugal

The national regulator will reduce MTRs to 1.27 eurocents per minute as

from 31 December 2012.

In November 2011 we acquired 2x10 MHz of 800 MHz spectrum,

2x5MHz of 900 MHz spectrum, 2x14 MHz of 1800 MHz spectrum and

2x20 MHz of 2.6 GHz spectrum for a cost of €146 million (£123 million).

The licences are valid until 2026.

Romania

The government agreed to renew our 900/1800 MHz licences for a

further period of one year (until December 2012) for a fee of €6.4million

(£5.4 million). In the meantime, the government plans tooffer the

licences for a further 15 year term during an auction in mid-2012 which

will also include the 800 MHz and 2.6 GHz bands.

In February 2011 Vodafone was ned €28 million (£23.3 million) by the

competition authority in relation to an alleged refusal to interconnect

with another party in 2006. We appealed this decision in April 2011.

Other enquiries remain ongoing. In April 2011 we were advised that a

new proceeding inrelation to MTRs and on-net pricing has commenced

and have sincereceived a questionnaire, to which we intend to respond.

A competition investigation regarding prepaid distribution is in the nal

stage of being closed without any ne.