Vodafone 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

15

Vodafone Group Plc

Annual Report 2012

Group adjusted operating prot was

£11.5billion, down 2.4% year-on-year but at

the top of our guidance range of £11.0 billion

– £11.8 billion based on guidance exchange

rates. The decline in adjusted operating prot

was due to the sale of our interest in SFR at the

start of the year; on an organic basis, adjusted

operating prot was up 2.5%*, as a result of the

good performance at VZW.

We recognised £3.5 billion of net gains on the

disposals of our interests in SFR and Polkomtel,

and we recorded impairment charges of

£4.0billion relating to our businesses in Italy,

Spain, Portugal and Greece primarily driven

bylower projected cash ows within business

plans and an increase in discount rates,

resulting from adverse changes in the

economic environment.

Free cash ow was £6.1 billion and within our

guidance range of £6.0 billion – £6.5 billion for

the year. The year-on-year decline reected

the loss of dividends from China Mobile

Limited, the reduction in dividends from SFR,

and the conclusion of our prior year working

capital programme. Capex was up 2.3% at

£6.4billion, as we continued to maintain our

signicant level of investment to support our

network strategy. In addition to our reported

free cash ow we received an income dividend

of US$4.5 billion (£2.9 billion) from VZW.

Adjusted earnings per share was 14.91 pence,

down 11.0% on last year. The decline was driven

by the loss of our share of SFR and Polkomtel

prots, the loss of income from our interests in

China Mobile Limited and SoftBank, and higher

nance charges as the result of our decision to

take advantage of low prevailing interest rates to

x a higher proportion of our debt.

The Board is recommending a nal dividend

per share of 6.47 pence, to give total ordinary

dividends per share of 9.52 pence, up 7.0%

year-on-year. During the year we also paid a

special dividend of 4.0 pence per share, paid

out of the income dividend we received from

VZW. Total dividends per share were therefore

up 51.9%.

Europe

Organic service revenue in Europe was down

1.1%* year-on-year. Excluding the impact of

regulated cuts to mobile termination rates

(‘MTRs’), service revenue grew by 1.4%*. As in

the prior year, we saw a broad divide between

the more stable major markets of northern

Europe, with Germany, the UK and the

Netherlands all growing; and the much weaker

markets of southern Europe, with Italy and

Spain suffering from strong competition and a

very poor macroeconomic environment.

Data revenue growth was strong at 20.2%*,

with smartphone penetration on contract

customers of 44.9%, up 11.5 percentage points

during the year. We have continued our major

commercial push towards integrated voice,

SMS and data tariffs, so that in the nal quarter,

43.2% of consumer contract service revenue

in our major European markets came from

customers on integrated tariffs.

Organic EBITDA was down 4.5%*, and the

EBITDA margin fell 1.5* percentage points.

Thedecline in EBITDA margin was almost

entirely driven by margin erosion in Spain,

where we put through signicant price cuts

during the year. Elsewhere, we beneted from

increased cost efciency.

AMAP

Organic service revenue growth in AMAP was

8.0%*. Our two major businesses, India and

Vodacom, reported growth of 19.5%* and 7.1%*

respectively. In India, pricing showed clear

signs of stabilisation after a prolonged price

war. In South Africa, growth continued to be

strong, despite signicant price cuts on data

tariffs. In Australia, revenue declined sharply

asour network perception continued to suffer

after service issues experienced more than a

year ago.

Organic EBITDA was up 7.8%* with EBITDA

margin down 0.1* percentage points. EBITDA

margins in our two biggest AMAP businesses,

Vodacom and India, increased, but this positive

impact was offset by a signicant decline in the

EBITDA margin in Australia.

Verizon Wireless

Our share of the net income of VZW

represented 42.2% of our Group adjusted

operating prot. VZW enjoyed another very

strong year, with organic service revenue

up7.3%* and EBITDA up 7.9%*. Our share of

protsfrom VZW amounted to £4.9 billion,

up9.3%* year-on-year. In December 2011

VZWannounced the proposed acquisition

of122Advanced Wireless Services spectrum

licenses, covering a population of 259 million,

from SpectrumCo for US$3.6 billion

(£2.3billion).

For a detailed analysis of our nancial

performance for the year, please turn to

page40.

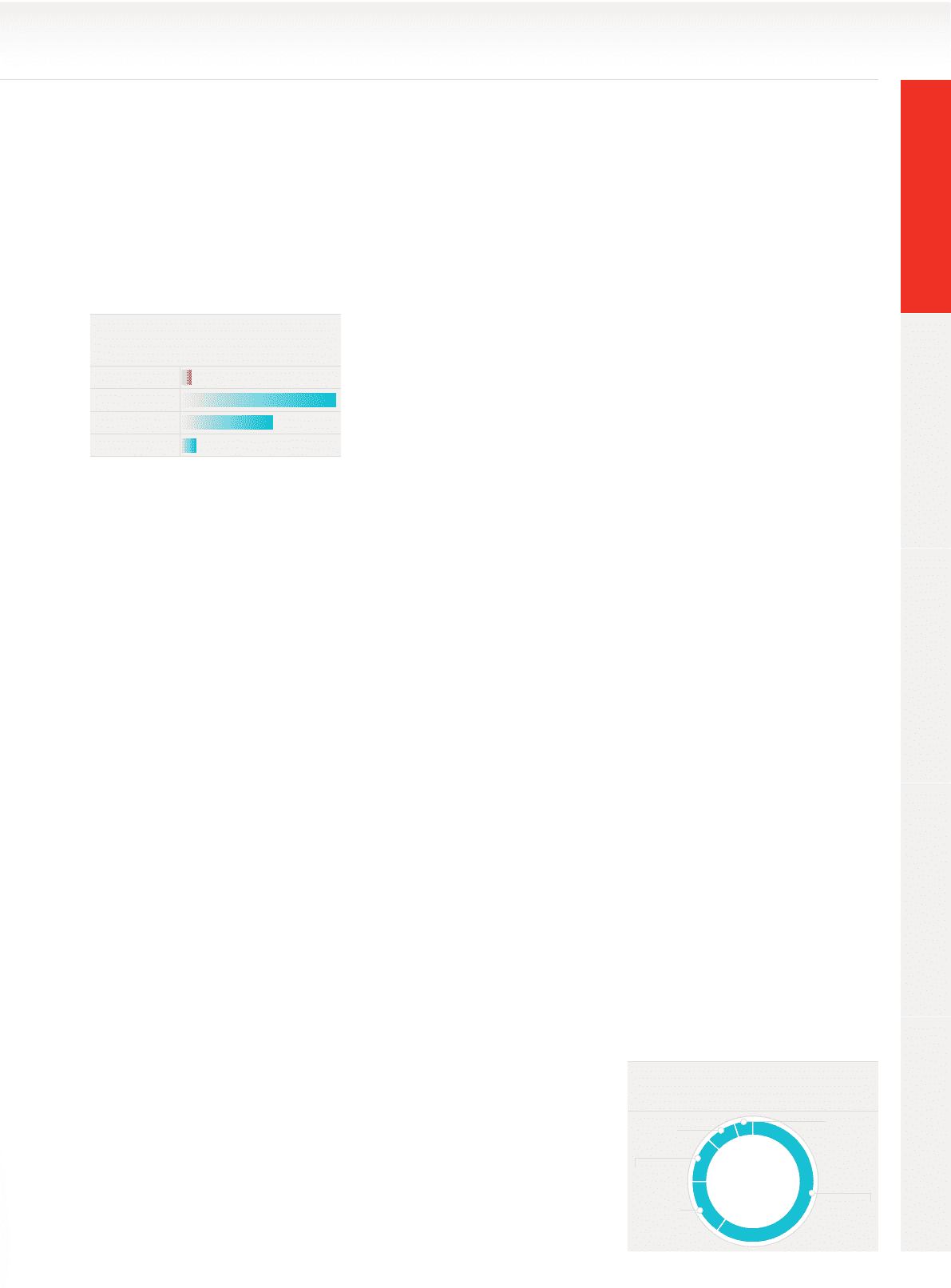

+1.5Group

Data

Emerging markets

+22.2

+13.2

Enterprise +2.2

Service revenue growth 2012* %

Service revenue by type 2012

Fixed: 8% Other: 5%

Messaging:

12%

Data: 15% Voice: 60%