Vodafone 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Vodafone Group Plc

Annual Report 2012

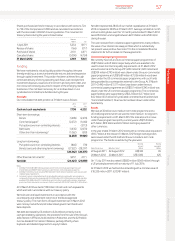

Dividends from associates and to non-controlling

shareholders

Dividends from our associates are generally paid at the discretion of

theboard of directors or shareholders of the individual operating and

holding companies and we have no rights to receive dividends except

where specied within certain of the Group’s shareholders’ agreements.

Similarly, we do not have existing obligations under shareholders’

agreements to pay dividends to non-controlling interest partners of our

subsidiaries or joint ventures, except as specied below.

During the year we received distributions totalling £3.8 billion from

Verizon Wireless, which included a one-off US$4.5 billion (£2.9 billion)

income dividend received in January 2012 and a tax distribution amount

of £965 million (2011: £1,024 million) which is included in dividends

received from associates and investments as shown on page 55. Until

April 2005 Verizon Wireless’ distributions were determined by the terms

of the partnership agreement distribution policy and comprised income

distributions and tax distributions. SinceApril 2005 only tax distributions

have been issued, with the exception of the one-off income dividend

received in January 2012. Following the announcement of Verizon

Wireless’ acquisition of Alltel, certain additional tax distributions were

agreed in addition to the tax distributions required by the partnership

agreement. Current projections forecast that tax distributions will cover

the United States tax liabilities arising from our partnership interest in

Verizon Wireless.

Under the terms of the partnership agreement the Verizon Wireless

board has no obligation to effect additional distributions above the level

of the tax distributions. However, the Verizon Wireless board has agreed

that it will review distributions from Verizon Wireless on a regular basis.

When considering whether distributions will be made each year, the

Verizon Wireless board will take into account its debt position, the

relationship between debt levels and maturities, and overall market

conditions in the context of the ve year business plan.

In June 2011 we sold our entire 44% interest in SFR and received a

naldividend from SFR of €200 million (£178 million) (2011: dividend

received of £373 million). Future cash ows will be reduced by the loss

of dividends from SFR.

Verizon Communications Inc. has an indirect 23.1% shareholding in

Vodafone Italy and under the shareholders’ agreement the shareholders

have agreed to take steps to cause Vodafone Italy to pay dividends at

least annually, provided that such dividends will not impair the nancial

condition or prospects of Vodafone Italy including, without limitation,

itscredit standing. During the 2012 nancial year Vodafone Italy

paiddividends net of withholding tax totalling €289 million (2011:

€325million) to Verizon Communications Inc.

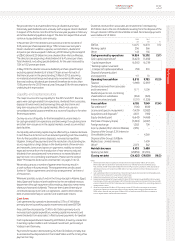

Acquisitions and disposals

We received a net £4,872 million (2011: invested £183 million), net of

cash and cash equivalents disposed and acquired, from acquisition and

disposal activities during the year.

On 16 June 2011 we sold our entire 44% interest in SFR to Vivendi for

acash consideration of €7.75 billion (£6.8 billion) before tax and

transaction costs and received a nal dividend from SFR of €200 million

(£178 million). Vodafone and SFR also entered into a partner market

agreement which will maintain their commercial cooperation.

On 1 July 2011 we acquired an additional 22% stake in Vodafone

IndiaLimited (‘VIL’) from the Essar Group for a cash consideration of

US$4.2billion (£2.6 billion) including withholding tax.

On 9 November 2011 we sold our entire 24.4% interest in Polkomtel

inPoland for cash consideration of approximately €918 million

(£784million) before tax and transaction costs.

On 23 April 2012 we announced a recommended cash offer to acquire

the entire issued ordinary share capital of Cable & Wireless Worldwide

plc, at a value of approximately £1,045 million. For further details refer

tonote 33 to the consolidated nancial statements.

Treasury shares

The Companies Act 2006 permits companies to purchase their own

shares out of distributable reserves and to hold shares in treasury. While

held in treasury, no voting rights or pre-emption rights accrue and no

dividends are paid in respect of treasury shares. Treasury shares may be

sold for cash, transferred (in certain circumstances) for the purposes of

an employee share scheme or cancelled. If treasury shares are sold,

such sales are deemed to be a new issue of shares and will accordingly

count towards the 5% of share capital which the Company is permitted

to issue on a non pre-emptive basis in any one year as approved by its

shareholders at the AGM. The proceeds of any sale of treasury shares up

to the amount of the original purchase price, calculated on a weighted

average price method, is attributed to distributable prots which would

not occur in the case of the sale of non-treasury shares. Any excess

above the original purchase price must be transferred to the share

premium account.

Following the disposal of our 3.2% interest in China Mobile Limited

on10 September 2010, we initiated a £2.8 billion share buyback

programme under the authority granted by our shareholders at the

2010 AGM which was completed in June 2011. Under this programme

the Group purchased a total of 1,631,662,645 shares at an average price

per share, including transaction costs, of 171.60 pence.

Following the disposal of our entire 44% interest in SFR to Vivendi on

16June 2011, we initiated a £4.0 billion share buyback programme.

TheGroup placed irrevocable purchase instructions with a number of

banks to enable the banks to buy back shares on our behalf when we

may otherwise have been prohibited from buying in the market. Details

of the shares purchased to date, including those purchased under

irrevocable instructions, are shown below:

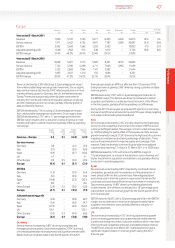

Date of share purchase

Number of shares

purchased1

’000

Average price

paid per

share

inclusive of

transaction

costs

Pence

Total number of

shares

purchased

under share

repurchase

programme2

’000

Maximum

value of shares

that may yet be

purchased

under the

programme3

£m

June 2011 95,908 164.15 95,908 3,843

July 2011 178,643 163.77 274,551 3,550

August 2011 196,798 165.14 471,349 3,225

September 2011 199,672 162.77 671,021 2,900

October 2011 173,100 172.69 844,121 2,601

November 2011 201,279 174.42 1,045,400 2,250

December 2011 125,000 175.60 1,170,400 2,030

January 2012 158,400 177.22 1,328,800 1,750

February 2012 181,200 174.42 1,510,000 1,434

March 2012 197,700 171.37 1,707,700 1,095

April 2012 149,800 172.63 1,857,500 836

May 2012 117,000 170.86 1,974,500 636

Total 1,974,5004170.35 1,974,500 636

Notes:

1 The nominal value of shares purchased is 113⁄7 US cents each.

2 No shares were purchased outside the publicly announced share buyback programme.

3 In accordance with shareholder authority granted at the 2011 AGM.

4 The total number of shares purchased represents 4.0% of our issued share capital at 21 May 2012.

The aggregate amount of consideration paid by the Company for the

shares at 21 May 2012 was £3,364 million.

Financial position and resources (continued)