Vodafone 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

Vodafone Group Plc

Annual Report 2012

Notes to the consolidated nancial statements (continued)

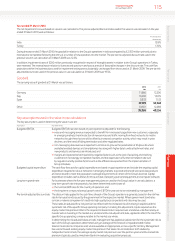

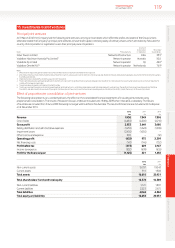

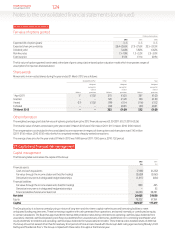

14. Investments in associates

At 31 March 2012 the Company had the following principal associates carrying on businesses which affect the prots and assets of the Group.

TheCompany’s principal associates all have share capital consisting solely of ordinary shares, unless otherwise stated, and are all indirectly held.

Thecountry of incorporation or registration of all associates is also their principal place of operation.

Country of

incorporation Percentage1

Name Principal activity or registration shareholdings

Cellco Partnership2Network operator US 45.0

Safaricom Limited3 4 Network operator Kenya 40.0

Notes:

1 Effective ownership percentages of Vodafone Group Plc at 31 March 2012, rounded to the nearest tenth of one percent.

2 Cellco Partnership trades under the name Verizon Wireless.

3 The Group also holds two non-voting shares.

4 At 31 March 2012 the fair value of Safaricom Limited was KES 51 billion (£386million) based on the closing quoted share price on the Nairobi Stock Exchange.

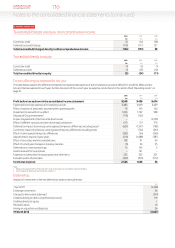

The Group’s share of the aggregated nancial information of equity accounted associates is set out below.

2012 2011 2010

£m £m £m

Share of revenue in associates 20,601 24,213 23,288

Share of result in associates 4,963 5,059 4,742

Share of discontinued operations in associates – 18 93

2012 2011

£m £m

Non-current assets 38,788 45,446

Current assets 3,764 5,588

Share of total assets 42,552 51,034

Non-current liabilities 3,990 5,719

Current liabilities 2,888 6,656

Non-controlling interests 566 554

Share of total liabilities and non-controlling interests 7,444 12,929

Share of equity shareholders’ funds in associates 35,108 38,105

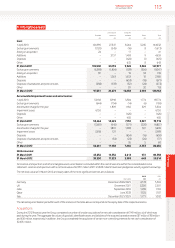

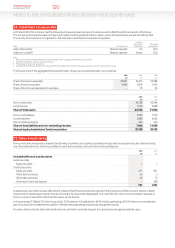

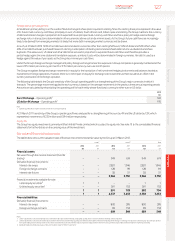

15. Other investments

Non-current other investments comprise the following, all of which are classied as available-for-sale, with the exception of public debt and bonds,

and other debt and bonds, which are classied as loans and receivables, and cash held in restricted deposits:

2012 2011

£m £m

Included within non-current assets:

Listed securities:

Equity securities 1 1

Unlisted securities:

Equity securities 671 967

Public debt and bonds 54 3

Other debt and bonds 65 72

Cash held in restricted deposits – 338

791 1,381

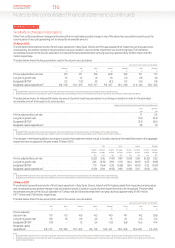

Unlisted equity securities include a 26% interest in Bharti Infotel Private Limited through which the Group has a 4.39% economic interest in Bharti

Airtel Limited. Unlisted equity investments are recorded at fair value where appropriate, or at cost if their fair value cannot be reliably measured as

there is no active market from which their fair values can be derived.

In the year ended 31 March 2011 the Group sold its 3.2% interest in China Mobile for £4,264 million generating a £3,019 million income statement

gain, including income statement recognition of foreign exchange rate gains previously recognised in equity.

For public debt and bonds, other debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.