Vodafone 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

Vodafone Group Plc

Annual Report 2012

Notes to the consolidated nancial statements (continued)

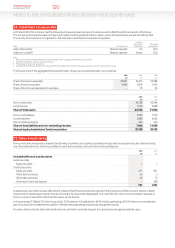

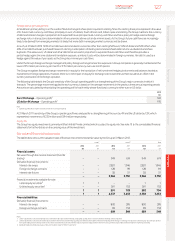

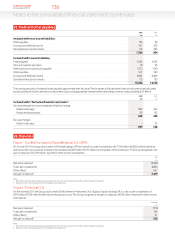

Maturity of borrowings

The maturity prole of the anticipated future cash ows including interest in relation to the Group’s non-derivative nancial liabilities on an

undiscounted basis, which, therefore, differs from both the carrying value and fair value, is as follows:

Redeemable Loans in fair

Bank preference Commercial Other value hedge

loans shares paper Bonds liabilities relationships Total

£m £m £m £m £m £m £m

Within one year 684 56 2,283 2,000 1,044 199 6,266

In one to two years 2,983 56 – 2,828 771 199 6,837

In two to three years 567 56 – 3,197 – 762 4,582

In three to four years 1,316 56 – 3,536 1,235 191 6,334

In four to ve years 1,574 56 – 1,541 726 169 4,066

In more than ve years 1,466 1,214 – 6,780 69 4,465 13,994

8,590 1,494 2,283 19,882 3,845 5,985 42,079

Effect of discount/nancing rates (1,331) (213) (11) (4,130) (366) (1,408) (7,459)

31 March 2012 7,259 1,281 2,272 15,752 3,479 4,577 34,620

Within one year 947 52 1,670 3,292 3,766 203 9,930

In one to two years 1,914 52 – 2,009 191 203 4,369

In two to three years 2,748 52 – 2,919 60 203 5,982

In three to four years 529 52 – 3,251 60 763 4,655

In four to ve years 987 52 – 3,613 901 195 5,748

In more than ve years 2,197 1,240 – 7,725 – 4,752 15,914

9,322 1,500 1,670 22,809 4,978 6,319 46,598

Effect of discount/nancing rates (1,380) (331) (10) (4,293) (249) (2,054) (8,317)

31 March 2011 7,942 1,169 1,660 18,516 4,729 4,265 38,281

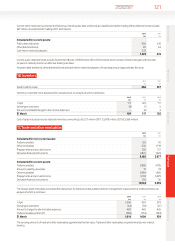

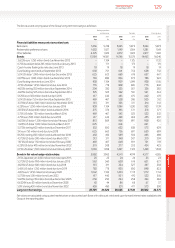

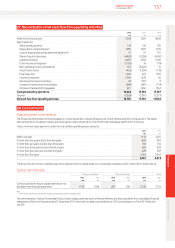

The maturity prole of the Group’s nancial derivatives (which include interest rate and foreign exchange swaps), using undiscounted cash ows, is

asfollows:

2012 2011

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 14,357 14,498 14,840 15,051

In one to two years 675 786 631 829

In two to three years 561 678 724 882

In three to four years 540 641 667 770

In four to ve years 402 520 619 690

In more than ve years 2,533 3,566 3,715 4,592

19,068 20,689 21,196 22,814

The currency split of the Group’s foreign exchange derivatives, all of which mature in less than one year, is as follows:

2012 2011

Payable Receivable Payable Receivable

£m £m £m £m

Sterling 1,287 7,070 – 10,198

Euro 4,793 2,613 11,422 2,832

US dollar 4,415 2,445 13 387

Japanese yen 2,207 23 2,164 23

Other 962 1,552 727 832

13,664 13,703 14,326 14,272

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The £39million net receivable (2011: £54million

net payable) in relation to foreign exchange nancial instruments in the table above is split £89million (2011: £153million) within trade and other

payables and £128million (2011: £99million) within trade and other receivables.

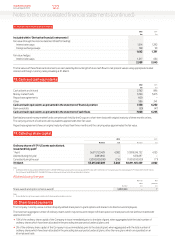

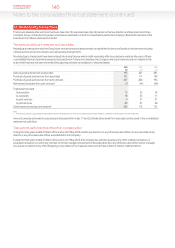

The present value of minimum lease payments under nance lease arrangements under which the Group has leased certain of its equipment is

analysed as follows:

2012 2011

£m £m

Within one year 18 14

In two to ve years 34 45

In more than ve years 34 6

22. Borrowings (continued)