Vodafone 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

47

Vodafone Group Plc

Annual Report 2012

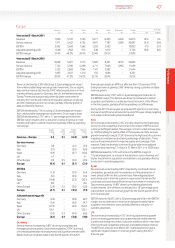

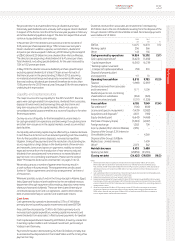

Europe

Germany

£m

Italy

£m

Spain

£m

UK

£m

Other

£m

Eliminations

£m

Europe

£m

% change

£m Organic

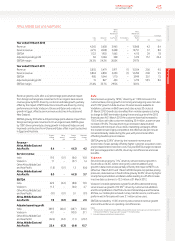

Year ended 31 March 2011

Revenue 7,900 5,722 5,133 5,271 8,253 (264) 32,015 (2.5) 0.6

Service revenue 7,471 5,432 4,735 4,931 7,787 (259) 30,097 (3.4) (0.4)

EBITDA 2,952 2,643 1,562 1,233 2,433 – 10,823 (7.1) (3.7)

Adjusted operating prot 1,548 1,903 915 348 1,012 – 5,726 (9.8) (6.1)

EBITDA margin 37.4% 46.2% 30.4% 23.4% 29.5% 33.8%

Year ended 31 March 2010

Revenue 8,008 6,027 5,713 5,025 8,357 (297) 32,833

Service revenue 7,722 5,780 5,298 4,711 7,943 (295) 31,159

EBITDA 3,122 2,843 1,956 1,141 2,582 – 11,644

Adjusted operating prot 1,695 2,107 1,310 155 1,084 – 6,351

EBITDA margin 39.0% 47.2% 34.2% 22.7% 30.9% 35.5%

Revenue declined by 2.5% reecting a 3.2 percentage point impact

from unfavourable foreign exchange rate movements. On an organic

basis service revenue declined by 0.4%* reecting reductions in most

markets offset by growth in Germany, the UK, the Netherlands and

Turkey. The decline was primarily driven by lower voice revenue

resulting from continued market and regulatory pressure on pricing

andthe challenging economic climate, partially offset by growth in

dataand xed line revenue.

EBITDA decreased by 7.1% including a 3.5 percentage point impact

fromunfavourable exchange rate movements. On an organic basis

EBITDA decreased by 3.7%*, with a 1.7 percentage point decline in

EBITDA margin resulting from a reduction in service revenue in most

markets and higher customer investment, partially offset by operating

cost savings.

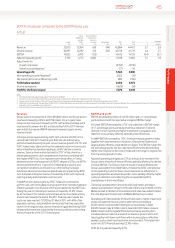

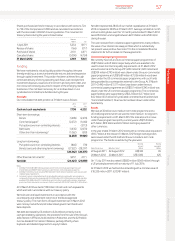

Organic

change

%

M&A

activity

pps

Foreign

exchange

pps

Reported

change

%

Revenue – Europe 0.6 0.1 (3.2) (2.5)

Service revenue

Germany 0.8 – (4.1) (3.3)

Italy (2.1) – (3.9) (6.0)

Spain (6.9) – (3.7) (10.6)

UK 4.7 – – 4.7

Other Europe 0.5 0.5 (3.0) (2.0)

Europe (0.4) 0.1 (3.1) (3.4)

EBITDA

Germany (1.5) – (3.9) (5.4)

Italy (3.1) – (3.9) (7.0)

Spain (16.8) – (3.3) (20.1)

UK 8.0 – – 8.0

Other Europe (2.4) 0.2 (3.6) (5.8)

Europe (3.7) 0.1 (3.5) (7.1)

Adjusted operating prot

Germany (4.9) – (3.8) (8.7)

Italy (5.9) – (3.8) (9.7)

Spain (27.3) – (2.9) (30.2)

UK 125.1 – – 125.1

Other Europe (2.0) 0.3 (4.9) (6.6)

Europe (6.1) 0.1 (3.8) (9.8)

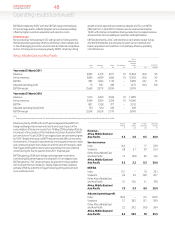

Germany

Service revenue increased by 0.8%* driven by strong data and

messaging revenue growth. Data revenue grew by 27.9%* as a result

ofincreased penetration of smartphones and Superat Internet tariffs.

Mobile revenue remained stable in the fourth quarter of the 2011

nancial year despite anMTR cut effective from 1 December 2010.

Enterprise revenue grew by 3.6%* driven by strong customer and data

revenuegrowth.

EBITDA declined by 1.5%*, with a 1.6 percentage point reduction in

theEBITDA margin. This decline was driven by increased customer

acquisition and retention, contributed to by the launch of the iPhone

inthe third quarter, partially offset by operating cost efciencies.

During the 2011 nancial year we acquired LTE spectrum in Germany

and launched LTE services towards the end of the year, initially targeting

rural areas underserved by xed broadband.

Italy

Service revenue declined by 2.1%* primarily driven by the challenging

economic and competitive environment, the impact of MTR cuts and

customer tariff optimisation. The average contract customer base grew

by 12.6% enabling the partial offset of these pressures. Datarevenue

growth remained strong at 21.5%* driven by the high level of customers

migrating to smartphones and taking advantage of data plans. There

was continued investment to improve quality and coverage of the

network. Fixed line revenue continued to grow with the broadband

customer base reaching 1.7 million at 31 March 2011 on a100% basis.

EBITDA decreased by 3.1%*, with a fall in the EBITDA margin of

1.0percentage point, as a result of the decline in service revenue and

higher investment in acquisition and retention costs partially offset by

areduction in operating expenses.

Spain

Service revenue declined by 6.9%* impacted by continued intense

competition, general economic weakness and the penetration of

lowerpriced tariffs into the customer base. New integrated plans

wereintroduced in the third quarter in response to the demand for

combined voice and data tariffs driven by the increase in smartphones.

Data revenue grew by 14.8%* driven by mobile broadband and

mobileinternet. One-off items contributed to a 1.8* percentage point

improvement to service revenue growth for the fourth quarter of the

2011 nancial year.

EBITDA declined 16.8%*, with a 3.8 percentage point fall in the EBITDA

margin, due to lower service revenue and proportionately higher

acquisition and retention costs, partially offset by a reduction in

operating expenses.

UK

Service revenue increased by 4.7%* driven by data revenue growth

dueto increasing penetration of smartphones and mobile internet

bundles and strong net contract customer additions, which more than

offset continued competitive pressures and weaker prepaid revenue.

The MTR cuts announced in March 2011 were expected to have a

signicant negative impact on revenue growth during the 2012

nancialyear.