Vodafone 2012 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

Vodafone Group Plc

Annual Report 2012

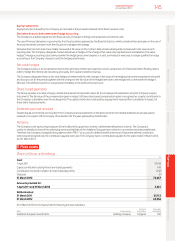

10. Equity dividends

2012 2011

£m £m

Declared during the nancial year:

Final dividend for the year ended 31 March 2011: 6.05 pence per share (2010: 5.65 pence per share) 3,102 2,976

Interim dividend for the year ended 31 March 2012: 3.05 pence per share (2011: 2.85 pence per share) 1,536 1,492

Second interim dividend for the year ended 31 March 2012: 4.00 pence per share (2011: nil) 2,016 –

6,654 4,468

Proposed after the balance sheet date and not recognised as a liability:

Final dividend for the year ended 31 March 2012: 6.47 pence per share (2011: 6.05 pence per share) 3,195 3,106

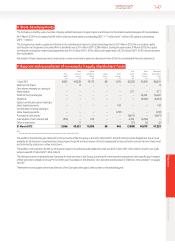

11. Contingent liabilities

2012 2011

£m £m

Performance bonds 165 3

Other guarantees and contingent liabilities 1,655 3,113

Performance bonds

Performance bonds require the Company to make payments to third parties in the event that the Company or its subsidiaries do not perform what is

expected of them under the terms of any related contracts.

Other guarantees and contingent liabilities

Other guarantees at 31 March 2012 principally comprise the Company’s guarantee of the Group’s 50% share of a AUD 1.7 billion loan facility of its

joint venture, Vodafone Hutchison Australia Pty Limited, and the counter indemnication by the Company of guarantees provided by an indirect

subsidiary of the Company to Piramal Healthcare Limited (‘Piramal’) for INR 89.2 billion (£1,096 million). The guarantees to Piramal were made

inrespect to its acquisition of approximately 11% shareholding in Vodafone India Limited (‘VIL’) during the 2012 nancial year. The acquisition

agreements dated 10 August 2011 and 28 December 2011 contemplate various exit mechanisms for Piramal including participating in an initial

public offering by VIL or, if such initial public offering has not completed by 18 August 2013 or 8 February 2014 respectively or Piramal chooses not

to participate in such initial public offering, Piramal selling its shareholding to the Vodafone Group in two tranches of 5.485% for an aggregate price

ofbetween approximately INR 70 billion (£0.8 billion) and INR 83 billion (£1.0 billion).

Other guarantees at March 2011 comprised the Company’s guarantee over underwritten put options over 33% of VIL owned by the Essar

Group.The total consideration due under these options was US$5 billion (£3.1 billion). The transfer of a 22% shareholding in VIL to Vodafone was

completedin two tranches on 1 June 2011 and 1 July 2011. Under separate agreement, the Essar Group sold a 11% shareholding in VIL to Piramal

asdescribed above.

As discussed in note 29 to the consolidated nancial statements the Company has covenanted to provide security in favour of the trustee of the

Vodafone Group UK Pension Scheme in respect of the funding decit in the scheme.

Legal proceedings

Details regarding certain legal actions which involve the Company are set out in note 29 to the consolidated nancial statements.

Notes to the Company nancial statements (continued)