Vodafone 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

41

Vodafone Group Plc

Annual Report 2012

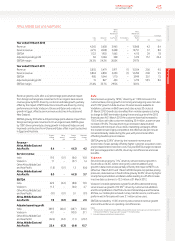

Taxation

2012

£m

2011

£m

Income tax expense 2,546 1,628

Tax on adjustments to derive

adjusted prot before tax (242) (232)

Tax benet related to

settlement of tax cases – 929

Adjusted income tax expense 2,304 2,325

Share of associates’ tax 302 519

Adjusted income tax expense for

purposes of calculating adjusted

taxrate 2,606 2,844

Prot before tax 9,549 9,498

Adjustments to derive adjusted

prot before tax1369 1,505

Adjusted prot before tax 9,918 11,003

Add: Share of associates’ tax and

non-controlling interest 382 604

Adjusted prot before tax for the

purpose of calculating adjusted

effective tax rate 10,300 11,607

Adjusted effective tax rate 25.3% 24.5%

Note:

1 See “Earnings per share”.

The adjusted effective tax rate for the year ended 31 March 2012 was

25.3%. This is in line with our mid 20s adjusted effective tax rate

guidance range.

The Group’s share of associates’ tax declined due to the absence of

thetax related to SFR following the disposal of our 44% interest in

June2011.

Income tax expense has increased in the year ended 31 March 2012

largely due to the favourable impact of a tax settlement in the 2011

nancial year.

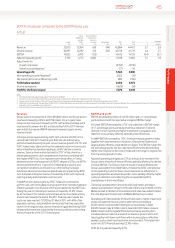

Earnings per share

Adjusted earnings per share was 14.91 pence, a decline of 11.0%

year-on-year, reecting the loss of our 44% interest in SFR and

Polkomtel’s prots, the loss of interest income from investment

disposals and mark-to-market items charged through nance costs,

partially offset by a reduction in shares arising from the Group’s share

buyback programme. Basic earnings per share was 13.74 pence (2011:

15.20 pence), reecting the prot on disposal of our 44% interest in SFR

and 24.4% interest in Polkomtel and lower impairment charges

compared to the prior nancial year, all of which are excluded from

adjusted earnings per share.

2012

£m

2011

£m

Prot attributable to equity shareholders 6,957 7,968

Pre-tax adjustments:

Impairment loss14,050 6,150

Other income and expense1 2 (3,705) 72

Non-operating income and expense1 3162 (3,022)

Investment income and nancing costs4(138) (1,695)

369 1,505

Taxation1242 (697)

Non-controlling interests (18) –

Adjusted prot attributable to equity

shareholders 7,550 8,776

Million Million

Weighted average number of shares outstanding

Basic 50,644 52,408

Diluted 50,958 52,748

Notes:

1 Taxation for the 2012 nancial year includes a £206 million charge in respect of the disposal of the Group’s

24.4% interest in Polkomtel. The 2011 nancial year included £929 million credit in respect of a tax

settlement and a £208 million charge in respect of the disposal of the Group’s 3.2% interest in China Mobile

Limited. The impairment charges of £4,050 million and £6,150 million in the 2012 and 2011 nancial years

respectively do not result in any tax consequences. The disposal of our 44% interest in SFR did not give rise

to a tax charge.

2 Other income and expense for the 2012 nancial year includes a £3,419 million gain on disposal of the

Group’s 44% interest in SFR and a £296 million gain on disposal of the Group’s 24.4% interest in Polkomtel.

The 2011 nancial year includes £56 million representing the net loss on disposal of certain Alltel

investments by Verizon Wireless. This is included within the line item “Share of results in associates” in the

consolidated income statement.

3 Non-operating income and expense for the 2011 nancial year includes £3,019 million prot arising on the

sale of the Group’s 3.2% interest in China Mobile Limited.

4 See notes 2 and 3 in “Net (nancing costs)/investment income” on page 40.

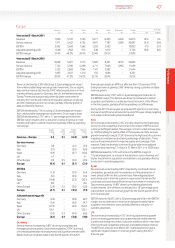

Europe

Germany

£m

Italy

£m

Spain

£m

UK

£m

Other

£m

Eliminations

£m

Europe

£m

% change

£m Organic

Year ended 31 March 2012

Revenue 8,233 5,658 4,763 5,397 8,352 (222) 32,181 0.5 (0.1)

Service revenue 7,669 5,329 4,357 4,996 7,780 (217) 29,914 (0.6) (1.1)

EBITDA 2,965 2,514 1,193 1,294 2,479 – 10,445 (3.5) (4.5)

Adjusted operating prot 1,491 1,735 566 402 1,066 – 5,260 (8.1) (9.6)

EBITDA margin 36.0% 44.4% 25.0% 24.0% 29.7% 32.5%

Year ended 31 March 2011

Revenue 7,900 5,722 5,133 5,271 8,253 (264) 32,015 (2.5) 0.6

Service revenue 7,471 5,432 4,735 4,931 7,787 (259) 30,097 (3.4) (0.4)

EBITDA 2,952 2,643 1,562 1,233 2,433 – 10,823 (7.1) (3.7)

Adjusted operating prot 1,548 1,903 915 348 1,012 – 5,726 (9.8) (6.1)

EBITDA margin 37.4% 46.2% 30.4% 23.4% 29.5% – 33.8%