Vodafone 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

Vodafone Group Plc

Annual Report 2012

Shareholder information (continued)

ShareGift

We support ShareGift, the charity share donation scheme (registered

charity number 1052686). Through ShareGift, shareholders who

haveonly a very small number of shares, which might be considered

uneconomic to sell, are able to donate them to charity. Donated shares

are aggregated and sold by ShareGift, the proceeds being passed on to

awide range of UK charities.

Further details about ShareGift can be obtained from its website at

www.ShareGift.org or by calling +44 (0)20 7930 3737.

Asset Checker Limited

We participate in Asset Checker, the online service which provides

asearch facility for solicitors and probate professionals to quickly and

easily trace UK shareholdings relating to deceased estates. For further

information visit www.assetchecker.co.uk or call 0870 707 4004.

Warning to shareholders (“Boiler room” scams)

Over recent years we have become aware of investors who have

received unsolicited calls or correspondence, in some cases purporting

to have been issued by the Company, concerning investment matters.

These typically make claims of highly protable opportunities in UK

orUS investments which turn out to be worthless or simply do not

exist.Approaches such as these are usually made by unauthorised

companies and individuals and are commonly known as “boiler room”

scams. Investors are advised to be wary of any unsolicited advice or

offers to buy shares. If it sounds too good to be true, it often is.

More detailed information about this or similar activity can be found on

the FSA website www.fsa.gov.uk/consumer.

Registrars and transfer ofce

The registrars Holders of ordinary shares resident in Ireland:

Computershare Investor Services PLC Computershare Investor Services (Ireland) Ltd

The Pavilions PO Box 9742

Bridgwater Road, Bristol BS99 6ZZ, England Dublin 18, Ireland

Telephone: +44 (0)870 702 0198 Telephone: +353 (0)818 300 999

www.investorcentre.co.uk/contactus www.investorcentre.co.uk/contactus

ADS depositary

The Bank of New York Mellon

PO Box 358516

Pittsburgh, PA 15252-8516, US

Telephone: +1 800 233 5601 (toll free) or, for calls outside the US,

+1 201 680 6837 (not toll free) and enter company number 2160

Email: shrrelations@bnymellon.com

Share price history

Upon otation of the Company on 11 October 1988 the ordinary

shareswere valued at 170 pence each. When the Company was nally

demerged on 16 September 1991 the base cost of Racal Electronics Plc

shares for UK taxpayers was apportioned between the Company

andRacal Electronics Plc for capital gains tax purposes in the ratio

of80.036% and 19.964% respectively. Opening share prices on

16September 1991 were 332 pence for each Vodafone share and

223pence for each Racal share.

On 21 July 1994 the Company effected a bonus issue of two new shares

for every one then held and on 30 September 1999 it effected a bonus

issue of four new shares for every one held at that date. The otation

and demerger share prices therefore may be restated as 11.333 pence

and 22.133 pence respectively.

On 31 July 2006 the Group returned approximately £9 billion to

shareholders in the form of a B share arrangement. As part of

thisarrangement, and in order to facilitate historical share price

comparisons, the Group’s share capital was consolidated on the basis

ofseven new ordinary shares for every eight ordinary shares held at

thisdate.

The closing share price at 31 March 2012 was 172.2 pence

(31March2011: 176.5 pence). The closing share price on 21 May 2012

was 165.0 pence.

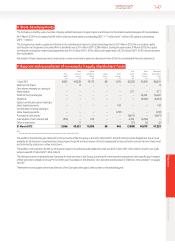

The following tables set out, for the periods indicated, i) the reported

high and low middle market quotations of ordinary shares on the

London Stock Exchange, and ii) the reported high and low sales

pricesofADSs on the New York Stock Exchange (‘NYSE’)/NASDAQ.

TheCompany transferred its ADS listing from the NYSE to NASDAQ on

29October 2009.

London Stock

Exchange

Pounds per

ordinary share

NYSE/NASDAQ

Dollars per ADS

Year ended 31 March High Low High Low

2008 1.98 1.36 40.87 26.88

2009 1.70 0.96 32.87 15.30

2010 1.54 1.11 24.04 17.68

2011 1.85 1.27 32.70 18.21

2012 1.84 1.54 29.46 24.31

London Stock

Exchange

Pounds per

ordinary share

NYSE/NASDAQ

Dollars per ADS

Quarter High Low High Low

2010/2011

First quarter 1.53 1.27 23.79 18.21

Second quarter 1.65 1.36 25.80 20.71

Third quarter 1.80 1.57 28.52 28.84

Fourth quarter 1.85 1.67 32.70 26.34

2011/2012

First quarter 1.83 1.58 29.46 25.67

Second quarter 1.75 1.54 28.75 24.31

Third quarter 1.84 1.63 29.28 25.42

Fourth quarter 1.82 1.65 28.37 26.00

2012/2013

First quarter11.77 1.64 28.39 26.00

Note:

1 Covering period up to 21 May 2012.