Vodafone 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

57

Vodafone Group Plc

Annual Report 2012

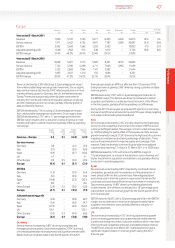

Shares purchased are held in treasury in accordance with sections 724

to 732 of the Companies Act 2006 and are cancelled in accordance

with the Association of British Insurers guidelines. The movement in

treasury shares during the year is shown below:

Number

Million £m

1 April 2011 5,234 8,171

Reissue of shares (166) (277)

Purchase of shares 2,101 4,671

Cancelled shares (3,000) (4,724)

31 March 2012 4,169 7,841

Funding

We have maintained a robust liquidity position throughout the year

thereby enabling us to service shareholder returns, debt and expansion

through capital investment. This position has been achieved through

continued delivery of strong operating cash ows, cash receipts from

investment disposals, issuances of short-term and long-term debt, and

non-recourse borrowing assumed in respect of the emerging market

businesses. It has not been necessary for us to draw down on our

syndicated committed bank facilities during the year.

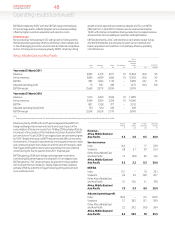

Net debt

Our consolidated net debt position at 31 March was as follows:

2012 2011

£m £m

Cash and cash equivalents 7,138 6,252

Short-term borrowings:

Bonds (1,289) (2,470)

Commercial paper1(2,272) (1,660)

Put options over non-controlling interests – (3,113)

Bank loans (1,635) (2,070)

Other short-term borrowings2(1,062) (593)

(6,258) (9,906)

Long-term borrowings:

Put options over non-controlling interests (840) (78)

Bonds, loans and other long-term borrowings (27,522) (28,297)

(28,362) (28,375)

Other nancial instruments33,057 2,171

Net debt (24,425) (29,858)

Notes:

1 At 31 March 2012 US$1,689 million was drawn under the US commercial paper programme, and

€1,226million and US$309 million were drawn under the euro commercial paper programme.

2 At 31 March 2012 the amount includes £980 million (2011: £531 million) in relation to cash received under

collateral support agreements.

3 Comprises i) mark-to-market adjustments on derivative nancial instruments which are included as a

component of trade and other receivables (2012: £2,959 million; 2011: £2,045 million) and trade and other

payables (2012: £889 million; 2011: £548 million) and ii) short-term investments primarily in index linked

government bonds included as a component of other investments (2012: £987 million; 2011: £674 million).

At 31 March 2012 we had £7,138 million of cash and cash equivalents

which are held in accordance with our treasury policy.

We hold cash and liquid investments in accordance with the

counterparty and settlement risk limits of the Board approved

treasurypolicy. The main forms of liquid investment at 31 March 2012

were money market funds, UK index linked government bonds and

bankdeposits.

Net debt decreased by £5.4 billion to £24.4 billion primarily due to

cashgenerated by operations, the proceeds from the sale of the Group’s

44% interest in SFR and 24.4% interest in Polkomtel, and the £2.9 billion

income dividend from Verizon Wireless, partially offset by share

buybacks and dividend payments to equity holders.

Net debt represented 28.6% of our market capitalisation at 31 March

2012 compared to 32.8% at 31 March 2011. Average net debt at month

end accounting dates over the 12 month period ended 31 March 2012

was £25.6 billion and ranged between £22.3 billion and £29.6 billion

during the year.

The cash received from collateral support agreements mainly reects

the value of our interest rate swap portfolio which is substantially

netpresent value positive. See note 21 to the consolidated nancial

statements for further details on these agreements.

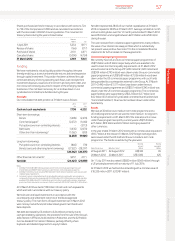

Commercial paper programmes

We currently have US and euro commercial paper programmes of

US$15 billion and £5 billion respectively which are available to be

usedto meet short-term liquidity requirements. At 31 March 2012

amounts external to the Group of €1,226 million (£1,022 million) and

US$309million (£193 million) were drawn under the euro commercial

paper programme and US$1,689 million (£1,056 million) was drawn

down under the US commercial paper programme, with such funds

being provided by counterparties externalto the Group. At 31 March

2011 €1,490 million (£1,317 million) was drawn under the euro

commercial paper programme and US$551million (£343 million) was

drawn under the US commercial paper programme. The commercial

paper facilities were supported by US$4.2 billion (£2.7 billion) and

€4.2billion (£3.5 billion) of syndicated committed bank facilities (see

“Committed facilities”). No amounts had been drawn under either

bankfacility.

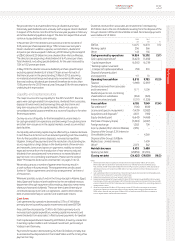

Bonds

We have a €30 billion euro medium-term note programme and a

USshelf programme which are used to meet medium- to long-term

funding requirements. At 31 March 2012 the total amounts in issue

under these programmes split by currency were US$13.3 billion,

£2.5billion, €8.9billion and £0.2 billion sterling equivalent of

othercurrencies.

In the year ended 31 March 2012 bonds with a nominal value equivalent

of £0.7 billion at the relevant 31 March 2012 foreign exchange rates

were issued under the US shelf and the euro medium-term note

programme. The bonds issued during the year were:

Date of bond issue Maturity of bond

Nominal

amount

Million

Sterling

equivalent

Million

22 August 2011 22 August 2012 US$100 65

20 March 2012 20 March 2017 US$1,000 625

On 11 July 2011 we also raised US$850 million (£543 million) through

aUS private placement with a maturity of 11 July 2016.

At 31 March 2012 we had bonds outstanding with a nominal value of

£18,333 million (2011: £20,987 million).