Vodafone 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Performance Governance Financials Additional information

59

Vodafone Group Plc

Annual Report 2012

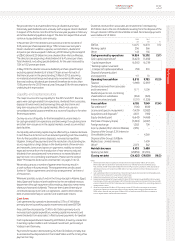

Financial assets and liabilities

Analysis of nancial assets and liabilities including the maturity prole

ofdebt, currency and interest rate structure are included in notes 18

and 22 to the consolidated nancial statements. Details of our treasury

management and policies are included within note 21 to the

consolidated nancial statements.

Option agreements and similar arrangements

Potential cash outows

In respect of our interest in the Verizon Wireless partnership, an option

granted to Price Communications, Inc. by Verizon Communications Inc.

was exercised on 15 August 2006. Under the option agreement Price

Communications, Inc. exchanged its preferred limited partnership

interest in Verizon Wireless of the East LP for 29.5 million shares

ofcommon stock in Verizon Communications Inc. Verizon

Communications Inc. has the right, but not the obligation, to

contributethe preferred interest to the Verizon Wireless partnership

diluting our interest. However, we also have the right to contribute

further capital to the Verizon Wireless partnership in order to maintain

our percentage partnership interest. Such amount, if contributed,

wouldbe US$0.8 billion.

In respect of our interest in Vodafone India Limited (‘VIL’), Piramal

Healthcare (‘Piramal’) acquired approximately 11% shareholding in VIL

from Essar during the 2012 nancial year. The agreements contemplate

various exit mechanisms for Piramal including participating in an initial

public offering by VIL or, if such initial public offering has not completed

by 18 August 2013 or 8 February 2014 respectively or Piramal chooses

not to participate in such initial public offering, Piramal selling its

shareholding to the Vodafone Group in two tranches of 5.485% for an

aggregate price of between approximately INR 70 billion (£0.8 billion)

and INR 83 billion (£1.0 billion).

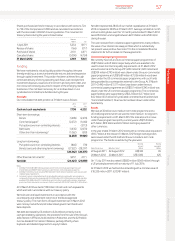

Off-balance sheet arrangements

We do not have any material off-balance sheet arrangements as

denedin item 5.E.2. of the SEC’s Form 20-F. Please refer to notes 28

and 29 to the consolidated nancial statements for a discussion of our

commitments and contingent liabilities.

Quantitative and qualitative disclosures about

marketrisk

A discussion of our nancial risk management objectives and policies

and the exposure of the Group to liquidity, market and credit risk is

included within note 21 to the consolidated nancial statements.