Vodafone 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Vodafone Group Plc

Annual Report 2012

Notes to the consolidated nancial statements (continued)

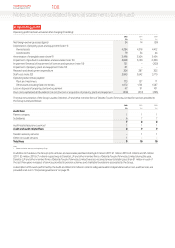

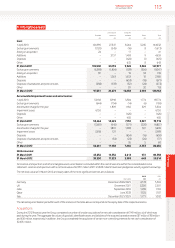

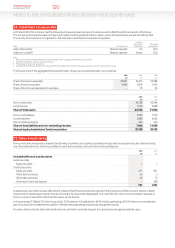

Tax (credited)/charged directly to other comprehensive income

2012 2011 2010

£m £m £m

Current tax credit (5) (14) (38)

Deferred tax (credit)/charge (119) (117) 137

Total tax (credited)/charged directly to other comprehensive income (124) (131) 99

Tax credited directly to equity

2012 2011 2010

£m £m £m

Current tax credit (1) (5) (1)

Deferred tax credit (1) (19) (10)

Total tax credited directly to equity (2) (24) (11)

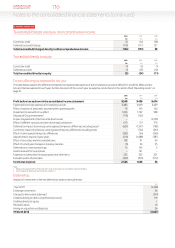

Factors affecting tax expense for the year

The table below explains the differences between the expected tax expense, at the UK statutory tax rate of 26% (2011 and 2010: 28%), and the

Group’s total tax expense for each year. Further discussion of the current year tax expense can be found in the section titled “Operating results” on

page 41.

2012 2011 2010

£m £m £m

Prot before tax as shown in the consolidated income statement 9,549 9,498 8,674

Expected income tax expense at UK statutory tax rate 2,483 2,659 2,429

Effect of taxation of associates, reported within operating prot 78 145 160

Impairment losses with no tax effect 1,053 1,722 588

Disposal of Group investments1(718) (763) –

Impact of agreement of German write down losses – – (2,103)

Effect of different statutory tax rates of overseas jurisdictions 675 371 370

Deferred tax impact of previously unrecognised temporary differences including losses2(634) (1,247) (198)

Current tax impact of previously unrecognised temporary differences including losses – (734) (261)

Effect of unrecognised temporary differences (285) 366 (260)

Adjustments in respect of prior years (210) (1,088) (387)

Effect of secondary and irrecoverable taxes 159 91 49

Effect of current year changes in statutory tax rates (3) 29 35

Deferred tax on overseas earnings 15 143 5

Assets revalued for tax purposes – 121 –

Expenses not deductible for tax purposes and other items 235 332 201

Exclude taxation of associates (302) (519) (572)

Income tax expense 2,546 1,628 56

Notes:

1 Relates to the disposal of SFR and Polkomtel. 2011 relates to the disposal of China Mobile Limited and SoftBank.

2 See note regarding deferred tax asset recognition on page 111.

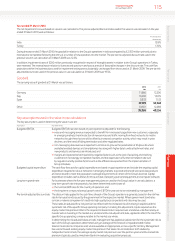

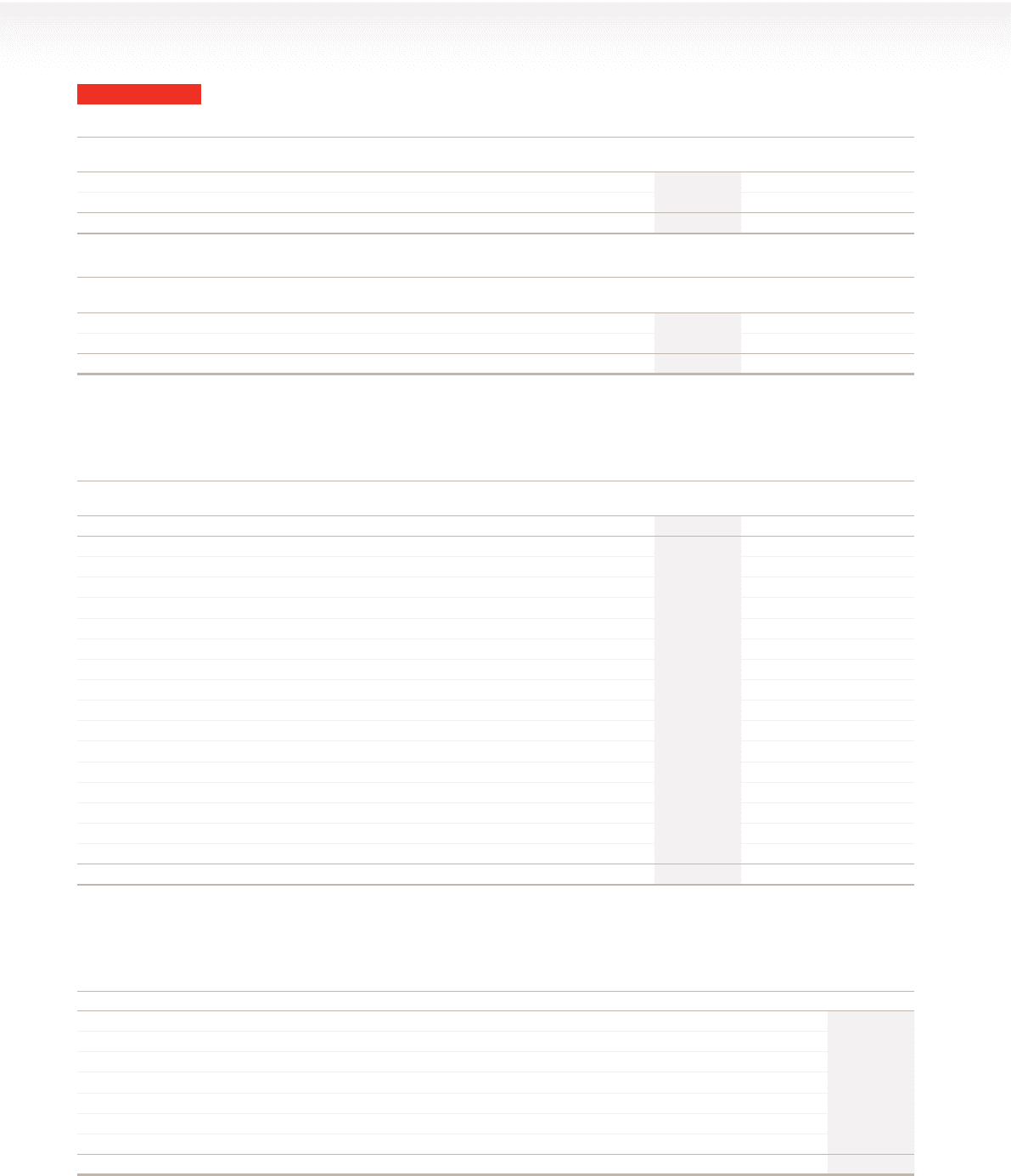

Deferred tax

Analysis of movements in the net deferred tax balance during the year:

£m

1 April 2011 (4,468)

Exchange movements 26

Charged to the income statement (341)

Credited directly to other comprehensive income 119

Credited directly to equity 1

Reclassications 10

Arising on acquisition and disposals 26

31 March 2012 (4,627)

6. Taxation (continued)