Vodafone 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

Vodafone Group Plc

Annual Report 2012

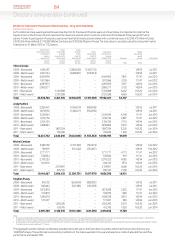

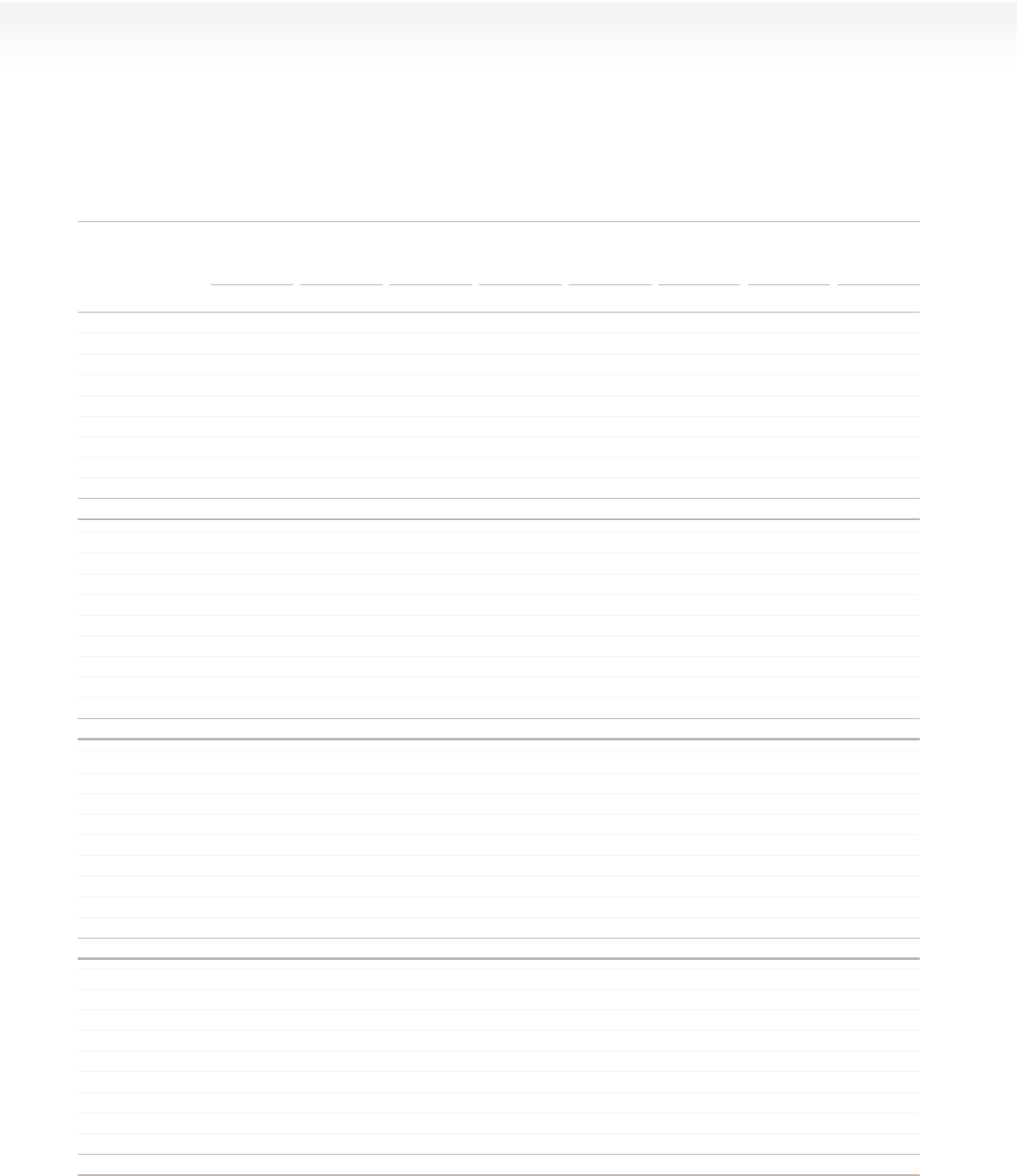

Directors’ interests in the shares of the Company – long-term incentives

Performance shares

GLTI conditional share awards granted to executive directors for the relevant nancial years are shown below. It is important to note that the

guresshown in the rst two columns represent the maximum amount which could vest at the end of the relevant three year performance

period.In order to participate in these plans, executives have had to invest personal shares with a combined value of: £3,342,473 (Vittorio Colao);

£2,035,516 (Andy Halford); £1,118,582 (Michel Combes); and £762,856 (Stephen Pusey). The total value is calculated using the closing mid-market

share price on 31March 2012 of 172.2 pence.

Total interest in

performance shares

at 1 April 2011

or date of

appointment

Shares

conditionally

awarded

during the 2012

nancial year1

Shares

forfeited

during

the 2012

nancial year2

Shares

vested during

the 2012

nancial year2

Total interest

in performance

shares at

31 March 2012 Total value

Market

price at date

awards

granted Vesting date

Number

of shares

Number

of shares

Number

of shares

Number

of shares

Number

of shares £’000 Pence

Vittorio Colao

2008 – Base award 4,126,587 – (2,863,852) (1,262,735) – – 129.95 Jul 2011

2008 – Match award 3,001,154 – (2,082,801) (918,353) – – 129.95 Jul 2011

2009 – Base award 4,564,995 – – – 4,564,995 7,861 117.47 Jun 2012

2009 – Match award 1,817,866 – – – 1,817,866 3,130 117.47 Jun 2012

2010 – Base award 4,097,873 – – – 4,097,873 7,057 142.94 Jun 2013

2010 – Match award 2,980,271 – – – 2,980,271 5,132 142.94 Jun 2013

2011 – Base award – 3,740,808 – – 3,740,808 6,442 163.20 Jun 2014

2011 – Match award – 2,720,588 – – 2,720,588 4,685 163.20 Jun 2014

Total 20,588,746 6,461,396 (4,946,653) (2,181,088) 19,922,401 34,307

Andy Halford

2008 – Base award 2,282,447 – (1,584,019) (698,428) – – 129.95 Jul 2011

2008 – Match award 2,074,952 – (1,440,017) (634,935) – – 129.95 Jul 2011

2009 – Base award 2,524,934 – – – 2,524,934 4,348 117.47 Jun 2012

2009 – Match award 1,676,756 – – – 1,676,756 2,887 117.47 Jun 2012

2010 – Base award 2,154,750 – – – 2,154,750 3,710 142.94 Jun 2013

2010 – Match award 1,958,863 – – – 1,958,863 3,373 142.94 Jun 2013

2011 – Base award – 1,887,254 – – 1,887,254 3,250 163.20 Jun 2014

2011 – Match award – 756,036 – – 756,036 1,302 163.20 Jun 2014

Total 12,672,702 2,643,290 (3,024,036) (1,333,363) 10,958,593 18,870

Michel Combes

2008 – Base award 2,589,782 – (1,797,309) (792,473) – – 129.95 Feb 2012

2008 – Match award 736,919 – (511,422) (225,497) – – 129.95 Feb 2012

2009 – Base award 2,771,771 – – 2,771,771 4,773 117.47 Jun 2012

2009 – Match award 533,854 – – – 533,854 919 117.47 Jun 2012

2010 – Base award 2,370,225 – – – 2,370,225 4,082 142.94 Jun 2013

2010 – Match award 1,144,116 – – – 1,144,116 1,970 142.94 Jun 2013

2011 – Base award – 2,129,901 – – 2,129,901 3,668 163.20 Jun 2014

2011 – Match award – 876,531 – – 876,531 1,509 163.20 Jun 2014

Total 10,146,667 3,006,432 (2,308,731) (1,017,970) 9,826,398 16,921

Stephen Pusey

2008 – Base award 942,132 – (653,840) (288,292) – – 129.95 Jul 2011

2008 – Match award 500,844 – (347,586) (153,258) – – 129.95 Jul 2011

2009 – Base award 1,872,818 – – – 1,872,818 3,225 117.47 Jun 2012

2009 – Match award 510,879 – – – 510,879 880 117.47 Jun 2012

2010 – Base award 1,693,018 – – – 1,693,018 2,915 142.94 Jun 2013

2010 – Match award 571,097 – – – 571,097 983 142.94 Jun 2013

2011 – Base award – 1,550,245 – – 1,550,245 2,670 163.20 Jun 2014

2011 – Match award – 612,745 – – 612,745 1,055 163.20 Jun 2014

Total 6,090,788 2,162,990 (1,001,426) (441,550) 6,810,802 11,728

Notes:

1 The awards were granted during the year under the Vodafone GIP using the closing share price on the day before the grant which was 163.2 pence. These awards have a performance period running from 1 April 2011 to

31March 2014. The performance conditions are a matrix of adjusted free cash ow performance and relative TSR. The vesting date will be in June 2014.

2 Shares granted on 29 July 2008 vested on 29 July 2011. The performance conditions on these awards were a matrix of adjusted free cash ow performance and relative TSR, and the resulting vesting was 30.6% of maximum.

Theshareprice on the vesting date was 171.7 pence.

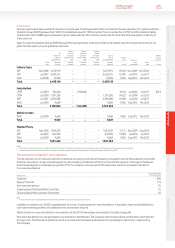

The aggregate number of shares conditionally awarded during the year to the Executive Committee, other than the executive directors, was

10,865,023 shares. The performance and vesting conditions on the shares awarded in the year are based on a matrix of adjusted free cash ow

performance and relative TSR.

Directors’ remuneration (continued)