Vodafone 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

Vodafone Group Plc

Annual Report 2012

Letter from the Remuneration Committee

Dear shareholder

The subject of executive reward has been, and continues to be, an issue of concern both to shareholders and the wider public. In September the

department of Business Skills and Innovation (‘BIS’) issued two consultative papers on the subject and although Vodafone shareholders seem

satised with the present remuneration report, we have incorporated a number of amendments to it to respond to some legitimate concerns.

Specically we have divided the report into the following discrete sections to make it clearer and easier to understand:

a Page 75. The composition and activities of the Remuneration Committee.

a Pages 76 to 77. A summary of remuneration for the 2012 nancial year including a table that shows a single gure for total remuneration paid

during the year along with a detailed justication of any incentive payments.

a Pages 77 to 81. A forward-looking statement setting out our reward philosophy, details of our current reward packages and a table that sets out

the value of these packages under different performance scenarios.

a Pages 82 to 87. All other disclosures currently required by statute or best practice guidelines.

Summary of key decisions on remuneration

Our remuneration policies and executive pay packages are designed to be competitive and drive behaviour in order to achieve long-term strategic

goals such as the £20.9 billion in adjusted free cash ow produced over the last three year period and rewarded under our long-term plan. When

making decisions we are mindful of the wider economic conditions and shareholder feedback as well as the need to adapt to our market and

competitive environment. The Remuneration Committee receives regular updates on corporate governance as well as pay increase budgets and

incentive plan payouts in our local markets.

We also consider the total amount spent on executive pay (as detailed

on page 76) in relation to the dividends and prot for the nancial year.

As can be seen from the enclosed chart for 2012, in both cases

executive pay at Vodafone was very small in comparison.

Total cost of executive pay in relation to dividends

and adjusted prot attributable to equity shareholders

7,000

8,000

6,000

5,000

4,000

3,000

2,000

1,000

0

Dividends Prot Executive pay

£m

The key decisions and rationale made during the year are described in more detail on the following pages but in summary were:

a Awarding no pay increases for the executive directors in the coming year;

a Continuing our practice of setting stretching performance targets thus ensuring pay is rmly linked to performance;

a Approving an annual bonus payment for the year of 93.4% of target;

a Approving the vesting of the 2008 share award (that vested in July 2011) at 30.6% of maximum;

a Reducing the value of the maximum possible payments on future long-term incentive awards from four times the target value to three times the

target value; and

a Further strengthening the share ownership culture. As at 31 March the Executive Committee collectively owned shares with a value of £22

million. Vittorio Colao personally held shares with a value of just under six times his salary and, by committing to hold the shares that vest in July

2012, this will be further increased to over ten times.

Consultation with shareholders

As in previous years the Remuneration Committee has had dialogue with its shareholders – the largest shareholders are invited to meet with me in

person or by video conference and all letters or emails from other shareholders are always replied to. The Remuneration Committee continues to

take an active interest in investors’ views and were delighted that last year the remuneration report received a 96.12% vote in favour. We sincerely

hope to receive your continued support at the AGM on 24 July 2012.

Luc Vandevelde

Chairman of the Remuneration Committee

22 May 2012

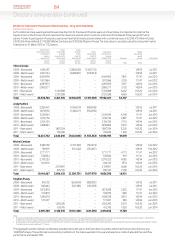

Directors’ remuneration