Vodafone 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Vodafone Group Plc

Annual Report 2012

Guidance

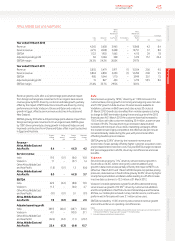

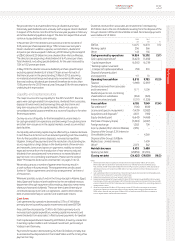

Performance against 2012 nancial year guidance

Based on guidance foreign exchange rates, our adjusted operating

protfor the 2012 nancial year was £11.8 billion, at the top end of the

£11.0billion to £11.8 billion range set in May 2011. On the same basis,

ourfree cash ow was £6.2 billion, in the middle of the £6.0 billion to

£6.5billion range.

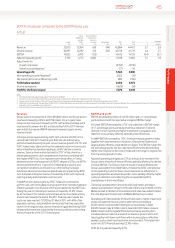

2013 nancial year guidance

Adjusted

operating

prot

£bn

Free

cash ow

£bn

2012 reported performance 11.5 6.1

SFR/Polkomtel contribution and

restructuring cost – (0.2)

Foreign exchange1(0.4) (0.3)

2012 nancial rebased reported 11.1 5.6

2013 nancial year guidance 11.1 – 11.9 5.3 – 5.8

Note:

1 Impact of rebasing the 2012 reported performance using the 2013 nancial year guidance foreign

exchange rates of £1:€1.23 and £1:$US1.62.

Guidance for the 2013 nancial year is based on our current assessment

of the global macroeconomic outlook and assumes foreign exchange

rates of £1:€1.23 and £1: US$1.62. In addition, we will no longer receive

adividend from SFR after the sale of our stake during the 2012 nancial

year. We have restated the 2012 nancial year adjusted operating prot

and free cash ow for both these changes in the table above.

Therefore, on an underlying basis, we expect growth in adjusted

operating prot, and stability in free cash ow, compared with the 2012

nancial year.

Adjusted operating prot is expected to be in the range of £11.1 billion to

£11.9 billion and free cash ow in the range of £5.3 billion to £5.8 billion,

excluding any income dividends received from Verizon Wireless.

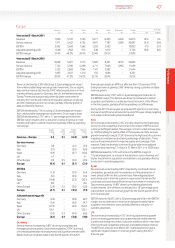

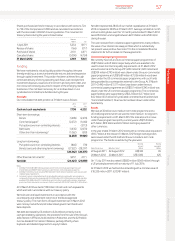

We expect the Group EBITDA margin decline to continue its improving

trend, supported by continued strong growth and operating leverage in

our AMAP region, and improving control of commercial costs in Europe.

We expect capital expenditure to remain broadly steady on a constant

currency basis.

In November 2010 we gave annual guidance ranges for organic service

revenue growth and free cash ow which were based on the prevailing

macroeconomic environment, regulatory framework and foreign

exchange rates. Given larger MTR reductions than previously envisaged,

we now expect organic service revenue growth in the 2013 nancial

year to be slightly below our previous medium term guidance range.

Wewill provide an update on revenue prospects for the 2014 nancial

year when we publish our results for the year ending 31 March 2013.

Weexpect the Group EBITDA margin to stabilise by March 2014.

Our medium term free cash ow guidance is £5.5 billion to £6.5 billion

per annum to March 2014. This was based on the prevailing foreign

exchange rates in November 2010, including an exchange rate of

£1: €1.15. Based on the £1: €1.23 foreign exchange rate used for

the2013 nancial guidance, the equivalent range is £5.2 billion

to£6.2billion. This cash generation underpins the three year 7%

perannum dividend per share growth target issued in May 2010.

Wecontinue to expect that total ordinary dividends per share will

benoless than 10.18 pence for the 2013 nancial year.

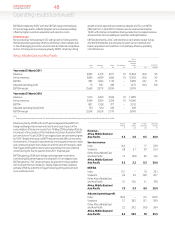

Assumptions

Guidance for the 2013 nancial year and the medium term is based

onour current assessment of the global macroeconomic outlook and

assumes foreign exchange rates of £1:€1.23 and £1:US$1.62. It excludes

the impact of licence and spectrum purchases, income dividends from

Verizon Wireless, material one-off tax-related payments, restructuring

costs and any fundamental structural change to the eurozone. It also

assumes no material change to the current structure of the Group.

With respect to the 7% per annum dividend per share growth target, as

the Group’s free cash ow is predominantly generated by companies

operating within the eurozone, we have assumed that the euro to

sterling exchange rate remains within 5% of the above guidance foreign

exchange rate.

Actual foreign exchange rates may vary from the foreign exchange rate

assumptions used. A 1% change in the euro to sterling exchange rate

would impact adjusted operating prot by £40 million and free cash

ow by approximately £30 million and a 1% change in the dollar to

sterling exchange rate would impact adjusted operating prot by

approximately £50 million.