Vodafone 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Vodafone Group Plc

Annual Report 2012

Focusing on growth in:

Emerging

markets

Emerging markets such as India and Africa represent

a signicant opportunity for growth. Last year the

Indian mobile market added 140 million customers –

over two times the size of the UK population.

The attraction of emerging markets

Over 70% of the world’s six billion mobile

phone users are in emerging markets, where

incomes are generally lower than mature

markets such as Europe. Emerging markets

tend to have stronger growth prospects than

mature markets, as a smaller share of the

population in these countries have mobile

phones and the pace of economic and

population growth tends to be higher.

Duringthe year mobile service revenue

growth in ouremerging markets increased

by13.2%*, including 19.5%* in India and 25.1%*

in Turkey. This was driven by continued

strongeconomic growth and rising mobile

penetration. Incontrast revenue growth in

Europe declined 1.1%*

.

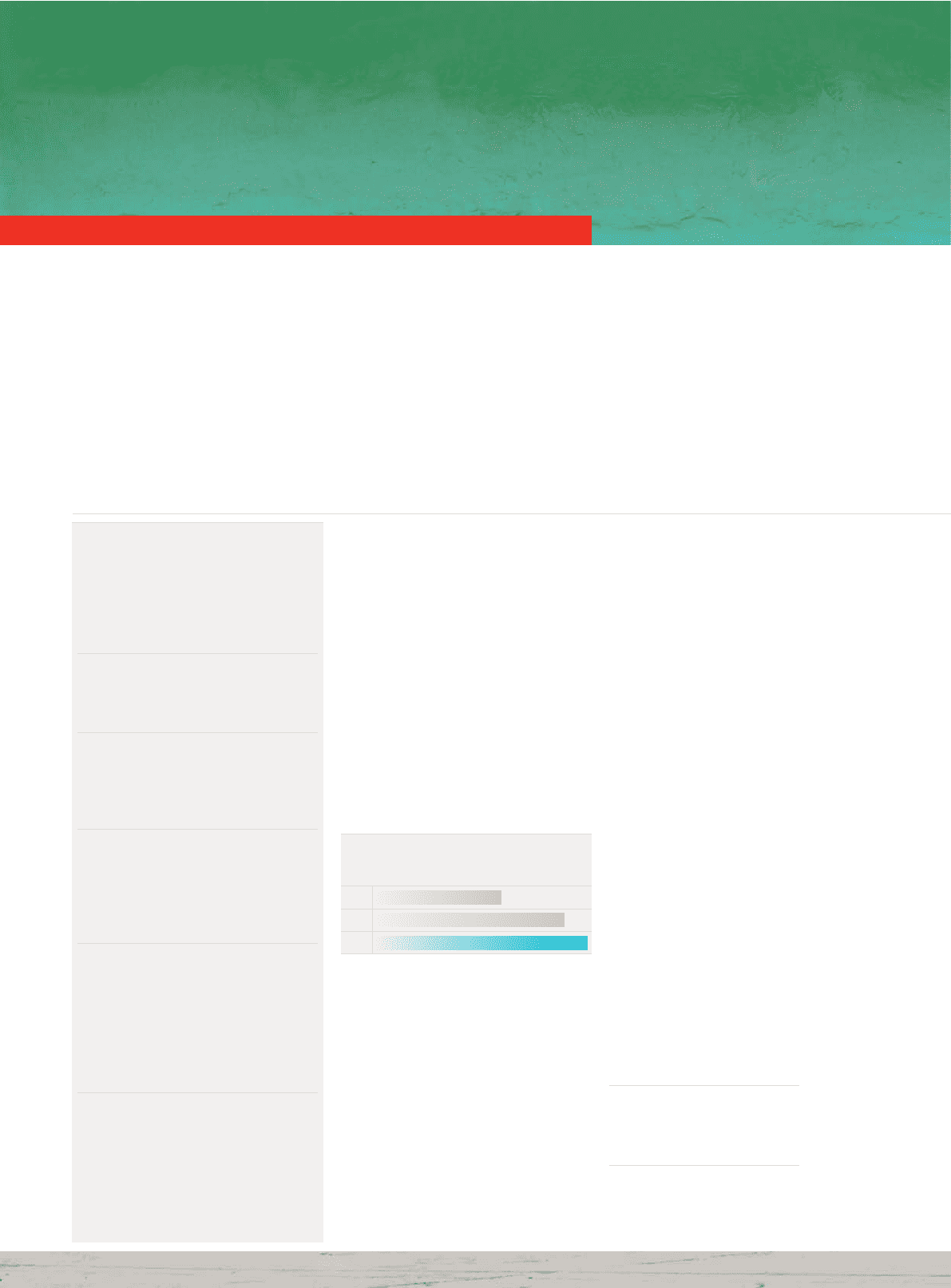

+7.92010

2011

2012

+11.8

+13.2

Emerging market service

revenue growth*

%

The data opportunity

in emerging markets

Mobile data is increasingly popular in emerging

markets given the lack of alternative xed line

infrastructure. For many people in emerging

markets their rst internet experience has

been on a mobile device and we expect this

tobe the case going forward. The demand

fordata is expected to grow strongly as only

around 29% of our customers in these

marketscurrently use data services, compared

to about 42% in Europe. At 31 March 2012

overhalf of our mobile data users were from

emergingmarkets.

Our money transfer

service, M-Pesa, supports

economic development

in emerging markets

Mobile services are a key driver of economic

development in emerging markets.

Accordingto a World Bank study, a 10%

increase in mobile penetration can add 1.2%

toannual economic growth in an emerging

economy. Our Vodafone money transfer

service, M-Pesa, is also contributing to

economic growth in countries that lack

banking services. It enables millions of people

who have a mobile phone, but with limited or

no access toa bank account, to send and

receive money, top-up airtime and make bill

payments. Wenow have just over 14 million

active M-Pesa customers, who transfer up

to£600million per month. The service is

established in Kenya, Tanzania, South Africa,

Afghanistan, Qatar and Fiji. Duringthe nancial

year, we launched M-Pesa on a trial basis in

Rajasthan, India, in preparation for a full launch

later this year across the country.

29%

of our service revenue is from

emergingmarkets.

£600m

transferred person to person over our

M-Pesa platform per month.

Emerging markets represent around

29% of our service revenue and the

share is likely to grow over the medium

to longer term driven by continued

strong economic growth and the

increase in mobile penetration towards

mature market levels.

Market context:

Almost all of the 1.5 billion newmobile

phone users over thenext four years are

expected to come from emerging markets.1

Goals:

We are steadily increasing our exposure

toemerging markets given the stronger

growthprospects that they offer relative

todeveloped markets.

Strengths:

We operate mobile networks in a number of

emerging markets including India, Vodacom,

Egypt, Turkey, Ghana, Qatar and Fiji – in

which we hold either a number one or two

revenue market share position.

Actions:

Our high quality networks combined

withlow cost devices and innovative

servicessuch asmobile payments and

mobile healthsolutions help to support

economic development in underdeveloped

communities (see below and “Sustainable

business” on page 36 for more information).

Progress:

Emerging markets represent our fastest

growing geographies, delivering service

revenue growth of 13.2%*, compared to

a fall of 1.1%*, for our Europe region.

Note:

1 Sourced from IDC.

Strategy (continued)