Vodafone 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Vodafone Group Plc

Annual Report 2012

Operating results

This section presents our operating performance, providing commentary on how the revenue and the EBITDA performance of the Group and its

operating segments within Europe, Africa, Middle East and Asia Pacic, and Non-Controlled Interests and Common Functions have developed in

the last three years.

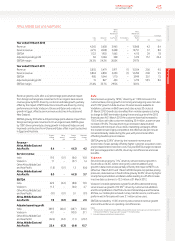

2012 nancial year compared to the 2011 nancial year

Group1

Europe

£m

Africa,

Middle East

and Asia

Pacic

£m

Non-Controlled

Interests and

Common

Functions2

£m

Eliminations

£m

2012

£m

2011

£m

% change

£ Organic

Revenue 32,181 13,868 423 (55) 46,417 45,884 1.2 2.2

Service revenue 29,914 12,751 272 (52) 42,885 42,738 0.3 1.5

EBITDA 10,445 4,115 (85) – 14,475 14,670 (1.3) (0.6)

Adjusted operating prot 5,260 1,472 4,800 – 11,532 11,818 (2.4) 2.5

Adjustments for:

Impairment loss (4,050) (6,150)

Other income/(expense)33,705 (72)

Operating prot 11,187 5,596

Non-operating (expense)/income4(162) 3,022

Net (nancing costs)/investment income (1,476) 880

Prot before taxation 9,549 9,498

Income tax expense (2,546) (1,628)

Prot for the nancial year 7,003 7,870

Notes:

1 Current year results reect average foreign exchange rates of £1:€1.16 and £1:US$1.60.

2 Common Functions primarily represent the results of the partner markets and the net result of unallocated central Group costs.

3 Other income/(expense) for the year ended 31 March 2012 includes a £3,419 million gain on disposal of the Group’s 44% interest in SFR and a £296 million gain on disposal of the Group’s 24.4% interest in Polkomtel.

Theyearended 31 March 2011 included £56 million representing the net loss on disposal of certain Alltel investments by Verizon Wireless. This is included within the line item “Share of results in associates” in the

consolidated income statement.

4 Non-operating (expense)/income for the year ended 31 March 2011 included £3,019 million prot arising on the sale of the Group’s 3.2% interest in China Mobile Limited.

Revenue

Group revenue was up 1.2% to £46.4 billion, with service revenue

of £42.9 billion, an increase of 1.5%* on an organic basis. Our overall

performance reects continued strong demand for data services

and further voice penetration growth in emerging markets, offset by

regulatory changes, ongoing competitive pressures and challenging

macroeconomic conditions in a number of our mature markets. As a

result of the leap year, service revenue growth of 2.3%* in Q4 beneted

from the additional day by around 1 percentage point.

AMAP service revenue was up by 8.0%*, with a strong performance in

India, Qatar, Ghana and Vodacom and a return to growth in Egypt offset

by a decline in Australia.

In Europe, service revenue was down by 1.1%* reecting challenging

macroeconomic conditions in Southern Europe partially offset by

growth in Germany, the UK, the Netherlands and Turkey.

EBITDA and prot

Group EBITDA was down 1.3% to £14.5 billion, as revenue growth was

offset by higher customer investment due to increased smartphone

penetration.

Adjusted operating prot was down 2.4% to £11.5 billion, driven by a

reduction in our share of prots from associates following the disposal

ofour 44% interest in SFR in June 2011. Our share of prots of Verizon

Wireless grew by 9.3%* to £4.9 billion.

Operating prot increased by 100% to £11.2 billion, primarily due to the

gain on disposal of the Group’s 44% interest in SFR and 24.4% interest in

Polkomtel, and lower impairment losses compared to the prior year.

An impairment loss of £4.0 billion was recorded in relation to Italy, Spain,

Portugal and Greece, primarily driven by lower projected cash ows

within business plans and an increase in discount rates, resulting from

adverse changes in the economic environment.

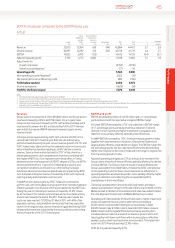

Net (nancing costs)/investment income

2012

£m

2011

£m

Investment income 456 1,309

Financing costs (1,932) (429)

Net (nancing costs)/investment income (1,476) 880

Analysed as:

Net nancing costs before income

from investments (1,642) (852)

Potential interest credit/(charges) arising on

settlement of outstanding tax issues19 (46)

Income from investments 19 83

Foreign exchange2 138 256

Equity put rights and similar arrangements3– 95

Interest related to the settlement of tax cases – 872

Disposal of SoftBank Mobile Corp. Limited

nancial instruments – 472

(1,476) 880

Notes:

1 Excluding interest credits related to a tax case settlement.

2 Comprises foreign exchange rate differences reected in the income statement in relation to certain

intercompany balances and the foreign exchange rate differences on nancial instruments received as

consideration on the disposal of Vodafone Japan to SoftBank in April 2006.

3 The year ended 31 March 2011 included foreign exchange rate movements, accretion expense and fair

value charges.

Net nancing costs before income from investments increased from

£852 million to £1,642 million, primarily due to the decision to increase

the xed rate debt mix, which is expected to result in lower interest in

future periods, and the subsequent recognition of mark-to-market

losses. Income from investments decreased by £64 million as a result of

the disposal of the Group’s 3.2% interest in China Mobile Limited and the

Group’s interests in SoftBank Mobile Corp. Limited during the 2011

nancial year.