Vodafone 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance Governance Financials Additional informationBusiness review

33

Vodafone Group Plc

Annual Report 2012

Discipline of regular business reviews

We regularly review the cash needs of

eachofour existing businesses across

theglobe, taking into account their

performance andcompetitive position.

Wemake capital investments, such as

fornewequipment or spectrum, in our

businessesto improve their performance

anddrive organic growth.

Returns to shareholders

We thoroughly review the best ways to

providereturns to our shareholders. We have

atarget of increasing dividends per share

byatleast 7% a year until the nancial year

ending 31 March 2013. When we have

surplusfunds we consider additional returns

toshareholders through special dividends

orshare buyback programmes.

Selective acquisitions

When managing capital we also consider

whether to strengthen the Group by

acquiringother companies to increase

ouroperations in a particular market.

Allpotential acquisitions are judged on strict

nancial and commercial criteria, especially

whether they would provide meaningful

scalein a particular segment, the cost of

theacquisition and the ability to enhance

theGroup’s free cash ow.

£0.9bn

In the last two years we have taken

outsome £0.9billion from the cost base

which hasbeen used in part to offset

inationary pressures orcope with the

volume of extra trafc on ournetworks.

The net saving has been around

£0.3billion, which has been partly

usedto invest in commercial activities.

Deliver value and

efciencyfromscale

Vodafone is one of the world’s largest

mobilecompanies. Our networks support

404 million customers and carry nearly one

trillion minutes of callsand 324 billion texts

each year. Our scale enables usto secure

considerable unit costsavings invarious

ways including purchasing, standardisation

ofprocesses, off-shoring activities to

lowercost locations, outsourcingnon-core

activities to third parties and sharing

common resources withother operators.

Generate liquidity or

free cash owfrom

non-controlled interests

In 2010 we identied six non-controlled

assets in which Vodafone was the

minoritypartner, that would either be

soldorfrom which we extract additional

cash ow in order to fund protable

investment or enhance shareholder returns.

Since 2010 we have made considerable

progress in this strategy by raising a total

of£17.7 billion from the sale of assets

andadditional dividends.

Apply rigorous

capital discipline to

investment decisions

We are focused on enhancing returns to

our shareholders and are therefore careful

how we invest shareholders’ money.

We apply rigorous commercial analysis

and set demanding investment criteria

to ensure that any investment, whether

in existing businesses or acquisitions,

will enhance value for shareholders.

Weremain committed to our target

creditrating of low single A for long-term

debt as this provides us with a low cost of

debt and good access to liquidity.

Purchasing

We use the Vodafone Procurement Company,

the central Group procurement function based

in Luxembourg to leverage our scale and to

achieve better prices and more value.

Standardisation

We have developed one integrated data centre

cloud across Europe and Africa and are well

underway to extending it to Asia this year which

enables us to operate highly resilient services

and to be faster to market with our new services.

Off-shoring

We use shared service centres in Hungary,

Indiaand Egypt to provide nancial,

administrative, IT,customer operations and

human resource services for our operations in

over 30 countries which helps us to standardise

and optimise the way we run our businesses.

Outsourcing

We have outsourced day-to-day network

maintenance in ten countries enabling

signicant scale economies for the chosen

supplier which are passed on to us in the form

oflower costs.

Sharing

Over 70% of the new radio base station sites

deployed this year were built as shared sites

with other operators to reduce costs.

Businesses we have recently sold

In September 2010 we sold our 3.2% stake

inChina Mobile Limited for £4.3 billion.

In November 2010 we agreed to sell our

remaining interest in SoftBank of Japan

for£2.9billion and the transaction was

completedin April 2012.

In June 2011 we sold our 44% holding in

SFRofFrance for £6.8 billion.

In November 2011 we sold our 24.4% share

ofPolkomtel in Poland for £0.8 billion.

Dividends received from our

non-controlled assets

In January 2012 we received a £2.9 billion

income dividend from our 45% interest in

Verizon Wireless in the US. £2.0 billion of this

was paid to Vodafone shareholders in the form

of a special dividend. This was the rst income

dividend received since 2005.

Remaining non-controlled interests

We retain an indirect 4.4% interest in Bharti

inIndia.

The proceeds raised from non-controlled

interests are being used to fund the current

£6.8 billion share buyback programme,

ofwhich £5.7 billion wascompleted at

31March 2012.

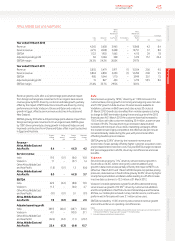

2010

2011

2012

5.7

7.6

0.5

0.5

3.0

Dividends and sale proceeds

fromnon-controlled interests

£bn

Income dividend from non-controlled interests

Cash received from the sale of non-controlled interests

4.6Ordinary dividends paid

Share buyback

Special dividend paid

3.6

2.0

Returns to shareholders 2012 £bn