Vodafone 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Creating a

more valuable

Vodafone

Vodafone Group Plc

Registered Ofce:

Vodafone House

The Connection

Newbury

Berkshire

RG14 2FN

England

Registered in England No. 1833679

Telephone: +44 (0) 1635 33251

Fax: +44 (0) 1635 238080

www.vodafone.com

Contact details:

Registrars shareholder helpline

Telephone: +44 (0) 870 702 0198

(In Ireland): +353 (0) 818 300 999

Investor Relations

Email: ir@vodafone.co.uk

Website: www.vodafone.com/investor

Media Relations

Telephone: +44 (0) 1635 664444

Email: groupmediarelations@vodafone.com

Website: www.vodafone.com/media

Sustainability

Email: sustainability@vodafone.com

Website: www.vodafone.com/sustainability

Vodafone Group Plc

Annual Report

for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Access our online Annual Report at:

vodafone.com/ar2012

Table of contents

-

Page 1

Vodafone Group Plc Annual Report for the year ended 31 March 2012 Creating a more valuable Vodafone -

Page 2

... strategy is focused on four areas of growth potential and founded on strong capital and cost discipline. This is delivering results: we have outperformed our key competitors in most major markets, and returned over £10 billion to shareholders in the last 12 months. £46.4bn £11.5bn Group revenue... -

Page 3

... Governance 32 34 36 38 39 30 Core strengths Our people Sustainable business Mobile for Good Risk overview Mobile data Emerging markets Enterprise and total communications New services Financials 88 89 90 91 93 94 142 143 Contents Directors' statement of responsibility# Audit report on internal... -

Page 4

Vodafone Group Plc Annual Report 2012 02 Who we are We are a global communications business giving people the power to connect with each other - and to learn, work, play, be entertained and broaden their horizons - wherever and however they choose. The numbers speak for themselves. At the last ... -

Page 5

Business review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2012 03 -

Page 6

... to develop new services and ways of working. Ambitious and competitive We bring energy and passion to our work, setting ourselves high standards. We measure our success compared to our competitors not just to our plans. One company, local roots We operate as one company across diverse teams and... -

Page 7

Business review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2012 05 -

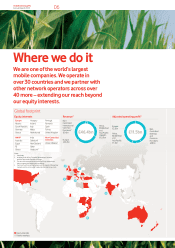

Page 8

... of the world's largest mobile companies. We operate in over 30 countries and we partner with other network operators across over 40 more - extending our reach beyond our equity interests. Global footprint Equity interests Europe Albania Czech Republic Germany Greece AMAP Australia Egypt Fiji Ghana... -

Page 9

... mobile phone call in 1985 and we were the first UK mobile network operator to launch commercial 3G services in 2001. Our business has expanded rapidly and today we account for 26% of the UK market (measured by revenue) and have a market leading 37% share of the mobile enterprise market. Financials... -

Page 10

... mobile, devices more secure and the convergence of fixed and wireless communications. Learn more about why we are well placed to succeed Pages 28 and 29 Shareholder returns Reinvestment Liquidity and cash flow Read more Pages 55 and 56 New services Machine-to-machine, mobile commerce services... -

Page 11

Business review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2012 09 -

Page 12

... to capital discipline. Target: Dividend per share growth of at least 7% per year to March 2013 (excluding special dividends). 2010 2011 2012 +6.9% +7.1% +7.0% 82% of European 3G network at least 14.4 Mbps, up from 66% in 2011 5/7 on-track We gained mobile service revenue market share in... -

Page 13

Vodafone Group Plc Annual Report 2012 11 Business review Performance Governance Free cash flow Our regular dividend is paid out of free cash flow, so maintaining a high level of cash generation (even after significant continued investment in capex) is key to delivering our dividend growth target.... -

Page 14

..., the key governance issues facing the Board, his interactions with management, and the approach to management and shareholder remuneration. Summary of key points a Our strategy is working well to deliver superior operational performance, a high level of free cash flow and significant returns to... -

Page 15

.... Cash returns to shareholders 7000 2009 5500 4000 2010 2011 2012 Ordinary dividends paid Share buyback Special dividends paid £bn 4.0 1.0 4.1 4.5 4.6 2.1 3.6 2.0 How is the Board currently functioning? The Board's primary focus is to support and advise the executive management on the... -

Page 16

... generation and shareholder remuneration, even after sustained network investment, continue to be significant. Group revenue for the year was up 1.2% to £46.4 billion, with Group organic service revenue up 1.5%* and data revenue up 22.2%*. Group EBITDA margin fell 0.8 percentage points, as a result... -

Page 17

... level of investment to support our network strategy. In addition to our reported free cash flow we received an income dividend of US$4.5 billion (£2.9 billion) from VZW. Governance Financials Additional information Service revenue by type 2012 Other: 5% Fixed: 8% Messaging: 12% Data: 15% Voice... -

Page 18

...by encouraging customers to upgrade to smartphones, and offering a broad portfolio of these handsets across a range of price points." Our strategic priorities: a Mobile data a Emerging markets a Enterprise and total communications a New services Priorities All the elements of our Group strategy are... -

Page 19

...costs in Europe. We remain committed to continuing to deliver a good return to our shareholders through the achievement of our targets for free cash flow and dividend growth; our focused investment in profitable growth areas; and our ongoing capital discipline. Business review Performance Employee... -

Page 20

... with more mobile phone users and some customers using their devices ever more frequently, global industry revenue remains on a positive trend and expanded 5% in 20111. Outgoing voice prices per minute (year-on-year change) Vodafone data 2010 2011 2012 -16 -21 % -22 The industry data on pages 18... -

Page 21

...to-machine and operator billing, which are discussed in more detail on pages 30 and 31. Service revenue growth 2012* Vodafone data Voice Messaging Data Fixed +5.4 -4.0 +4.4 % Governance +22.2 Smartphone share of handset shipments Industry data calendar year 2006 2010 2011 8 21 % Financials 39... -

Page 22

... network experience will enable us to secure a premium positioning in most of our markets. A simple business model We buy licences that give us rights to spectrum bands and we build networks over which we provide calls, SMS and mobile internet services to customers. Customers pay for the services... -

Page 23

... 2012 we continued our title partnership with the Vodafone McLaren Mercedes Formula One Team to give ongoing global exposure for our brand. Business review 3. Revenue We generate our service revenue through the supply of calls, text messaging, data and other services over our networks. Consumers... -

Page 24

... service - making and receiving calls. Today our customers enjoy a range of services including simple voice calls, text and picture messaging, and data services such as mobile internet browsing, social networking sites, downloading applications ('apps') and sending emails via smartphones. Market... -

Page 25

Vodafone Group Plc Annual Report 2012 23 Business review Performance Governance Enhancing the UK network Over the last 18 months we have been upgrading our network in the UK, and particularly London, to cope with the expected extra demand from the 2012 summer Olympic Games and to deliver a much ... -

Page 26

Vodafone Group Plc Annual Report 2012 24 Strategy (continued) Mobile data: Technology We want to have the best data network and IT systems to provide the platform for our products and services. At the same time we will continue to carefully manage our cost base to deliver profitable data services.... -

Page 27

...and understand, however mobile data can be more difficult to understand - for example setting up your smartphone, email account or accessing internet applications. We are taking a number of steps to improve our service to make it easier for our customers. Our retail stores around the world are being... -

Page 28

... or two revenue market share position. Actions: Our high quality networks combined with low cost devices and innovative services such as mobile payments and mobile health solutions help to support economic development in underdeveloped communities (see below and "Sustainable business" on page 36 for... -

Page 29

...the number of clinics without supplies reduced from 26% to almost zero. The SMS for Life project has since expanded to cover all 5,000 health facilities across Tanzania. Financials Managing scale in India India is our largest market measured by customers with over 150 million phone users. We added... -

Page 30

... higher revenue and lower churn than mobile-only customers. Consistent with our Group strategy of continuing to develop services in Europe and enhance our efficiency and realise scale benefits, in April 2012 we announced a recommended cash offer for Cable & Wireless Worldwide plc, a leading UK fixed... -

Page 31

... Plc Annual Report 2012 29 Business review Performance Enterprise share of service revenue % 2010 2011 2012 22.8 22.9 23.1 Governance Enterprise customers Millions 2010 2011 2012 26.0 28.1 30.3 Millions Vodafone One Net users 2010 2011 2012 0.8 1.4 2.0 Financials Total communications... -

Page 32

... bought through BlackBerry App World are paid for via operator billing. These recently launched services provide a great customer experience and we had over 130,000 active users at the end of the financial year. Apps paid through Vodafone operator billing2 2011 205 2012 1,563 Thousands 2010 2011... -

Page 33

Vodafone Group Plc Annual Report 2012 31 Business review Performance The machine-to-machine market (SIM to SIM communication without human intervention) is expected to grow from â,¬3 billion in 20113 to â,¬6 billion by 20153. +â,¬3bn Governance Financials BMW uses Vodafone's machine-to-machine... -

Page 34

... form of dividends and share buybacks, while still investing around £6 billion a year in our networks and infrastructure. Mobile service revenue market share in key markets March 2012 60% Vodacom1 Germany Italy Our leading performance is based on three core strengths: Our global scale advantage... -

Page 35

...2012 33 Business review Deliver value and efficiency from scale Vodafone is one of the world's largest mobile companies. Our networks support 404 million customers and carry nearly one trillion minutes of calls and 324 billion texts each year. Our scale enables us to secure considerable unit cost... -

Page 36

... and due to growth in emerging markets. We are also continuing to move some transactional and back office activities to our shared services centres in Hungary, Egypt and India. Employment policies and employee relations Our employment policies are developed to reflect local legal, cultural and... -

Page 37

... learn the skills that they need to do their job well based on the 2011 people survey. 2010 2011 2012 13 Financials 15 15 Notes: 1 Represents the average number of employees in our controlled and jointly controlled markets during the year. 2 Based on our controlled markets and our joint venture... -

Page 38

... markets develop their own strategies that address the primary opportunities and risks in their countries whilst supporting the Group's overall vision. Throughout the year, we have kept abreast of the material issues through contact with customers, investors, employees, suppliers and governments... -

Page 39

.... The 2012 data includes India, Ghana, Qatar and South Africa but excludes all other Vodacom markets. Our joint venture in Italy is included in all years. Governance Vodafone sustainability report Our 12th annual sustainability report, which is assured by Ernst & Young LLP using the International... -

Page 40

... awareness and education programme, and build a brand new dedicated maternity hospital in Dar es Salaam. This campaign will help to change the lives of 31,000 women in Tanzania by 2016. Vodafone Egypt Foundation developed and launched a mobile application for its adult literacy campaign. The... -

Page 41

... our network may be successful and disrupt our services or compromise our data. 11. Changes in assumptions underlying the carrying value of certain Group assets could result in impairment. Senior management of Group functions Identify Senior management identify the key risks and develop mitigation... -

Page 42

... costs before income from investments Potential interest credit/(charges) arising on settlement of outstanding tax issues1 Income from investments Foreign exchange2 Equity put rights and similar arrangements3 Interest related to the settlement of tax cases Disposal of SoftBank Mobile Corp. Limited... -

Page 43

... income" on page 40. Financials Europe Germany £m Italy £m Spain £m UK £m Other £m Eliminations £m Europe £m % change £m Organic Year ended 31 March 2012 Revenue Service revenue EBITDA Adjusted operating profit EBITDA margin Year ended 31 March 2011 Revenue Service revenue EBITDA Adjusted... -

Page 44

... from 1 July 2011. Strong data revenue growth of 16.8%* was driven by mobile internet which benefited from a higher penetration of smartphones and an increase in those sold with a data bundle. From Q3, all new consumer contract customers are now on an integrated tariff. Enterprise revenue grew by... -

Page 45

... in active data customers to 12.2 million at 31 March 2012. Vodacom's mobile operations outside South Africa delivered strong service revenue growth of 31.9%*2, driven by customer net additions and the simplification of tariff structures in Mozambique and Tanzania. M-Pesa, our mobile phone based... -

Page 46

...by the competitive market and weakness in brand perception following the network and customer service issues experienced from late 2010 to early 2011 and further accelerated by MTR cuts. On 22 March 2012, Vodafone Hutchison Australia appointed Bill Morrow as its new CEO. In Egypt service revenue was... -

Page 47

Vodafone Group Plc Annual Report 2012 45 2011 financial year compared to the 2010 financial year Group1 Europe £m Africa, Middle East and Asia Pacific £m Non-Controlled Interests and Common Functions2 £m Eliminations £m 2011 £m 2010 £m % change £ Organic3 Business review Revenue Service ... -

Page 48

... impairment charges partially offset by a gain on disposal of the Group's 3.2% interest in China Mobile Limited and the settlement of a tax case. 2011 £m 2010 £m (852) (46) 83 256 95 872 472 880 (1,024) (23) 145 (1) (94) 201 - (796) Profit attributable to equity shareholders Pre-tax adjustments... -

Page 49

... Annual Report 2012 47 Europe Germany £m Italy £m Spain £m UK £m Other £m Eliminations £m Europe £m % change £m Organic Business review Year ended 31 March 2011 Revenue Service revenue EBITDA Adjusted operating profit EBITDA margin Year ended 31 March 2010 Revenue Service revenue EBITDA... -

Page 50

...percentage point benefit from foreign exchange rate movements and the full year impact of the consolidation of Vodacom results from 18 May 2009 partially offset by the impact of the creation of the Vodafone Hutchison Australia ('VHA') joint venture on 9 June 2009. On an organic basis service revenue... -

Page 51

... growth rates for service revenue, revenue, EBITDA and the Group's share of result in Verizon Wireless would have been 6.4%*, 6.6%*, 8.2%* and 10.8%* respectively. 5 Net debt excludes pending credit card receipts. Comparatives are presented on a comparable basis. In South Africa data revenue growth... -

Page 52

... for the year ending 31 March 2013. We expect the Group EBITDA margin to stabilise by March 2014. Our medium term free cash flow guidance is £5.5 billion to £6.5 billion per annum to March 2014. This was based on the prevailing foreign exchange rates in November 2010, including an exchange rate of... -

Page 53

.... Security related reviews are conducted according to our policies and security standards. Security governance and compliance is managed and monitored through software tools that are deployed to all local markets and selected partner markets. Our data centres are managed to international information... -

Page 54

... and long-term growth rates, future technological developments, and the timing and quantum of future capital expenditure. Other factors which may affect revenue and profitability (for example intensifying competition, pricing pressures, regulatory changes and the timing for introducing new products... -

Page 55

... in the United States and generates its earnings in US dollars. Verizon Wireless, which is equity accounted, contributed 42% of the Group's adjusted operating profit for the year ended 31 March 2012. The Group employs a number of mechanisms to manage elements of exchange rate risk at a transaction... -

Page 56

... Plc Annual Report 2012 54 Financial position and resources Consolidated statement of financial position 2012 £m 2011 £m Non-current assets Intangible assets Property, plant and equipment Investments in associates Other non-current assets Current assets Total assets Total equity shareholders... -

Page 57

... of tax payments and the resolution of outstanding tax issues, regulatory rulings, delays in the development of new services and networks, licence and spectrum payments, inability to receive expected revenue from the introduction of new services, reduced dividends from associates and investments or... -

Page 58

... such dividends will not impair the financial condition or prospects of Vodafone Italy including, without limitation, its credit standing. During the 2012 financial year Vodafone Italy paid dividends net of withholding tax totalling â,¬289 million (2011: â,¬325 million) to Verizon Communications Inc... -

Page 59

... the Association of British Insurers guidelines. The movement in treasury shares during the year is shown below: Number Million £m Net debt represented 28.6% of our market capitalisation at 31 March 2012 compared to 32.8% at 31 March 2011. Average net debt at month end accounting dates over the 12... -

Page 60

Vodafone Group Plc Annual Report 2012 58 Financial position and resources (continued) Committed facilities The following table summarises the committed bank facilities available to us at 31 March 2012. Committed bank facilities Amounts drawn 1 July 2010 â,¬4.2 billion syndicated No drawings have ... -

Page 61

... disclosures about market risk A discussion of our financial risk management objectives and policies and the exposure of the Group to liquidity, market and credit risk is included within note 21 to the consolidated financial statements. Performance Governance Financials Additional information -

Page 62

... Financial Director, Vodafone Limited (the UK operating company) (1999 - 2001); Financial Director for Vodafone's Northern Europe, Middle East and Africa region (2001 - 2002); Chief Financial Officer of the Verizon Wireless partnership (2002 - 2005); Fellow of the Institute of Chartered Accountants... -

Page 63

...; Founder and Managing Director of Change Capital Partners LLP. Skills and experience: Anne's wealth of international business knowledge gained while Chief Executive of an international energy company means she brings valuable insights to the Board. Career history: Chief Executive Officer of AREVA... -

Page 64

... New York and London; Managing Director of UBS Investment Bank and most recently head of its Technology team in Europe (1995 - 2006). Years on Executive Committee: 3 years 3 months Career history: Group Director of External Relationships, Vodafone Group Plc; member of the British Diplomatic Service... -

Page 65

... in local markets, overseen by regional governance teams for Europe and for the Africa, Middle East and Asia Pacific region, as well as in the way we expect our people to behave, with every employee required to comply with our Code of Conduct and encouraged to work in the Vodafone Way (see page 34... -

Page 66

...the management of our capital structure and funding, and key organisational and policy decisions. The members of the Executive Committee and their biographical details are set out on pages 60 to 62 (or at www.vodafone.com/investor). In April every year a Group level strategy review is conducted with... -

Page 67

... the year "deep-dive" presentations have included commercial strategy, technology strategy, spectrum auctions, talent and succession, our enterprise business and our partner markets business. Financials The executive and non-executive directors are equal members of the Board and have collective... -

Page 68

...investment thesis Shareholder engagement Sustainability Delivering transformational products and services Being responsible and ethical wherever we do business Vodafone Foundation Financials Financial results Long range plan/ forecasts Management accounts/ Chief Financial Officer's report Gaining... -

Page 69

... markets where possible) and partner markets, key external advisors and key suppliers. Performance evaluation Performance evaluation of the Board, its committees and individual directors takes place on an annual basis and is conducted within the terms of reference of the Nominations and Governance... -

Page 70

68 Corporate governance (continued) Vodafone Group Plc Annual Report 2012 Nominations and Governance Committee "The Nominations and Governance Committee continues its work of ensuring the Board composition is right and that our governance is effective." In March the Committee reviewed the output ... -

Page 71

... tax liabilities and the appropriateness of deferred tax asset recognition in relation to accumulated tax losses; and a the level of provisioning appropriate for contingent and other liabilities in a number of our markets. Business review Performance Governance Financials Additional information -

Page 72

...are independent of the Company within the meaning of the securities laws administered by the SEC. During the year Deloitte LLP and member firms of Deloitte Touche Tohmatsu Limited charged the Group £8 million (2011: £9 million, 2010: £9 million) for audit and audit related services. The Committee... -

Page 73

... published on our website and announced via the Regulatory News Service. Financial and other information is made available on our website (www.vodafone.com/ investor) which is regularly updated. A summary of our share and control structures is set out in "Shareholder information" on pages 149 to 156... -

Page 74

...required by the Listing Rules and the Code is set out in the "Directors' statement of responsibility" on page 89. Risk management An overview of the Group's framework for identifying and managing risk, both at an operational and strategic level, is set out on page 39. Annual report The directors are... -

Page 75

... (www. vodafone.com/governance). These terms of reference are generally responsive to the relevant NASDAQ rules but may not address all aspects of these rules. Code of conduct Under the NASDAQ rules, US companies must adopt a code of conduct applicable to all directors, officers and employees that... -

Page 76

...page 76) in relation to the dividends and profit for the financial year. As can be seen from the enclosed chart for 2012, in both cases executive pay at Vodafone was very small in comparison. Total cost of executive pay in relation to dividends and adjusted profit attributable to equity shareholders... -

Page 77

... advice on market practice, governance, performance analysis and plan design. pwc also provide a range of services to Vodafone globally including international mobility, tax, technology, finance, operations and compliance. As noted in his biographical details on page 62 of this annual report, Philip... -

Page 78

...financial year, but are based on the three-year performance period ended at 31 March 2012 for the awards shown in the 2012 column, and 31 March 2011 for the awards shown in the 2011 column. The awards listed under 2012 will not vest until 30 June 2012. We valued the award using a closing share price... -

Page 79

...comprises the annual bonus and the long-term incentive opportunity assuming maximum co-investment and no movement in current share price. ï,¢ Fixed (Base salary + Pension) ï,¢ Variable (Bonus + LTI) Governance Financials Fixed Chief Executive Target Maximum Other Executive Directors Target Maximum... -

Page 80

... objectives Supported by 2009 2010 2011 2012 49% 64% 62% 47% 0% 25% 31% 100% Alignment to shareholder interests Share ownership is a key cornerstone of our reward policy and is designed to help maintain commitment over the long-term, and to ensure that the interests of our senior management team... -

Page 81

... Governance Global Long-Term a To motivate and incentivise delivery of sustained performance over the Incentive Plan long-term. ('GLTI') base awards a Award levels and the framework for determining vesting are reviewed annually to ensure they continue to support our strategy. a Long-term incentive... -

Page 82

... income dividends; a the impact of any mergers, acquisitions and disposals; a certain material one-off tax settlements; and a foreign exchange rate movements over the performance period. The cumulative adjusted free cash flow target and range for awards in the 2013, 2012, 2011 and 2010 financial... -

Page 83

Vodafone Group Plc Annual Report 2012 81 Estimates of total future potential remuneration from 2013 pay packages The tables below provide estimates of the potential future remuneration for each of the executive directors based on the remuneration opportunity granted in the 2013 financial year. ... -

Page 84

... HM Revenue & Customs ('HMRC') approved scheme open to all staff permanently employed by a Vodafone Company in the UK as of the eligibility date. Options under the plan are granted at up to a 20% discount to market value. Executive directors' participation is included in the option table on page 85... -

Page 85

...in service. They also have an entitlement under a long-term disability plan from which two-thirds of base salary, up to a maximum benefit determined by the insurer, would be provided until normal retirement date. Pension benefits earned by the director in the year ended 31 March 2012 were: Change in... -

Page 86

Vodafone Group Plc Annual Report 2012 84 Directors' remuneration (continued) Directors' interests in the shares of the Company - long-term incentives Performance shares GLTI conditional share awards granted to executive directors for the relevant financial years are shown below. It is important to... -

Page 87

Vodafone Group Plc Annual Report 2012 85 Share options No share options have been granted to directors during the year. The following information summarises the executive directors' options under the Vodafone Group 2008 Sharesave Plan ('SAYE'), the Vodafone Group Plc 1999 Long-Term Stock Incentive... -

Page 88

... and Governance Committee" on page 68. The terms and conditions of appointment of non-executive directors are available for inspection at the Company's registered office during normal business hours and at the AGM (for 15 minutes prior to the meeting and during the meeting). Date of letter... -

Page 89

... Company, which includes interests in the Vodafone Share Incentive Plan, but which excludes interests in the Vodafone Group share option schemes, and the Vodafone Group short-term or long-term incentives, are shown below: 21 May 2012 31 March 2012 1 April 2011 or date of appointment Business review... -

Page 90

...139 30. Directors and key management compensation 140 31. Related party transactions 141 32. Employees 141 33. Subsequent events 142 Audit report on the Company financial statements 143 Company financial statements of Vodafone Group Plc 144 Notes to the Company financial statements: 144 1. Basis of... -

Page 91

... registered public accounting firm who also audit the Group's consolidated financial statements. Their audit report on internal control over financial reporting is on page 90. By Order of the Board Business review Performance Governance Directors' responsibility statement The Board confirms... -

Page 92

Vodafone Group Plc Annual Report 2012 90 Audit report on internal controls Report of independent registered public accounting firm to the members of Vodafone Group Plc We have audited the internal control over financial reporting of Vodafone Group Plc and subsidiaries and applicable joint ventures ... -

Page 93

... of: a the nominal GDP rates for the country of operation; and a the compound annual growth rate in EBITDA in years nine to ten of the management plan. Governance Taxation The Group's tax charge on ordinary activities is the sum of the total current and deferred tax charges. The calculation of the... -

Page 94

Vodafone Group Plc Annual Report 2012 92 Critical accounting estimates (continued) Recognition therefore involves judgement regarding the future financial performance of the particular legal entity or tax group in which the deferred tax asset has been recognised. Historical differences between ... -

Page 95

... the listing rules we are required to review: a the directors' statement contained within the directors' report in relation to going concern; a the part of the Corporate Governance Statement relating to the Company's compliance with the nine provisions of the UK Corporate Governance Code specified... -

Page 96

... ended 31 March 2012 £m 2011 £m 2010 £m (Losses)/gains on revaluation of available-for-sale investments, net of tax Foreign exchange translation differences, net of tax Net actuarial (losses)/gains on defined benefit pension schemes, net of tax Revaluation gain Foreign exchange gains transferred... -

Page 97

... Plc Annual Report 2012 95 Consolidated statement of financial position at 31 March Business review 2012 Note £m 2011 £m Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associates Other investments Deferred tax assets Post employment benefits... -

Page 98

Vodafone Group Plc Annual Report 2012 96 Consolidated statement of changes in equity for the years ended 31 March Equity Additional Share capital £m paid-in capital1 £m Treasury shares £m Retained losses £m Currency reserve £m Pensions reserve £m Other comprehensive income Investment ... -

Page 99

Vodafone Group Plc Annual Report 2012 97 Consolidated statement of cash flows for the years ended 31 March Business review 2012 Note £m 2011 £m 2010 £m Net cash flow from operating activities Cash flows from investing activities Purchase of interests in subsidiaries and joint ventures, net of ... -

Page 100

...historical cost basis except for certain financial and equity instruments that have been measured at fair value. New accounting pronouncements adopted On 1 April 2011 the Group adopted new accounting policies to comply with: a "Improvements to IFRS" issued in May 2010. a Amendments to IAS 24 "State... -

Page 101

... measurement basis for asset returns. The amendments also include a revised definition of short- and long-term benefits to employees and revised criteria for the recognition of termination benefits. Business review Performance Governance Basis of consolidation The consolidated financial statements... -

Page 102

Vodafone Group Plc Annual Report 2012 100 Notes to the consolidated financial statements (continued) 2. Significant accounting policies (continued) Interests in joint ventures A joint venture is a contractual arrangement whereby the Group and other parties undertake an economic activity that is ... -

Page 103

Vodafone Group Plc Annual Report 2012 101 Software integral to a related item of hardware equipment is accounted for as property, plant and equipment. Costs associated with maintaining computer software programs are recognised as an expense when they are incurred. Internally developed software is ... -

Page 104

Vodafone Group Plc Annual Report 2012 102 Notes to the consolidated financial statements (continued) 2. Significant accounting policies (continued) Property, plant and equipment and finite lived intangible assets At each reporting period date, the Group reviews the carrying amounts of its property... -

Page 105

... fair value gain or loss and are included in equity. For the purpose of presenting consolidated financial statements, the assets and liabilities of entities with a functional currency other than sterling are expressed in sterling using exchange rates prevailing at the reporting period date. Income... -

Page 106

Vodafone Group Plc Annual Report 2012 104 Notes to the consolidated financial statements (continued) 2. Significant accounting policies (continued) The carrying amount of deferred tax assets is reviewed at each reporting period date and adjusted to reflect changes in probability that sufficient ... -

Page 107

...at the reporting date and are discounted to present value where the effect is material. Financials Share-based payments The Group issues equity-settled share-based payments to certain employees. Equity-settled share-based payments are measured at fair value (excluding the effect of non-market-based... -

Page 108

... group of related services and products being the supply of communications services and products. Segment information is provided on the basis of geographic areas, being the basis on which the Group manages its worldwide interests. Revenue is attributed to a country or region based on the location... -

Page 109

Vodafone Group Plc Annual Report 2012 107 A reconciliation of EBITDA to operating profit is shown below. For a reconciliation of operating profit to profit before taxation, see the consolidated income statement on page 94. 2012 £m 2011 £m 2010 £m Business review EBITDA Depreciation, ... -

Page 110

Vodafone Group Plc Annual Report 2012 108 Notes to the consolidated financial statements (continued) 4. Operating profit Operating profit has been arrived at after charging/(crediting): 2012 £m 2011 £m 2010 £m Net foreign exchange losses/(gains) Depreciation of property, plant and equipment (... -

Page 111

Vodafone Group Plc Annual Report 2012 109 5. Investment income and financing costs 2012 £m 2011 £m 2010 £m Business review Investment income: Available-for-sale investments: Dividends received Loans and receivables at amortised cost Gain on settlement of loans and receivables1 Fair value ... -

Page 112

Vodafone Group Plc Annual Report 2012 110 Notes to the consolidated financial statements (continued) 6. Taxation (continued) Tax (credited)/charged directly to other comprehensive income 2012 £m 2011 £m 2010 £m Current tax credit Deferred tax (credit)/charge Total tax (credited)/charged ... -

Page 113

Vodafone Group Plc Annual Report 2012 111 Deferred tax assets and liabilities, before offset of balances within countries, are as follows: Amount (charged)/ credited in income statement £m Gross deferred tax asset £m Gross deferred tax liability £m Less amounts unrecognised £m Net recognised ... -

Page 114

... UK tax authorities in respect of the CFC tax case in the prior year. The Group holds provisions in respect of deferred taxation that would arise if temporary differences on investments in subsidiaries, associates and interests in joint ventures were to be realised after the year end reporting date... -

Page 115

Vodafone Group Plc Annual Report 2012 113 9. Intangible assets Licences and Goodwill £m spectrum £m Computer software £m Other £m Total £m Business review Cost: 1 April 2010 Exchange movements Arising on acquisition Additions Disposals Other 31 March 2011 Exchange movements Arising on ... -

Page 116

... calculation in the year ended 31 March 2011 were as follows: Pre-tax adjusted discount rate Italy Spain Greece Ireland Portugal 11.9% 11.5% 14.0% 14.5% 14.0% During the year ended 31 March 2011 the goodwill in relation to the Group's investments in Italy, Spain, Greece, Ireland and Portugal was... -

Page 117

... rate Business review India Turkey 13.8% 17.6% During the year ended 31 March 2010 the goodwill in relation to the Group's operations in India was impaired by £2,300 million primarily due to intense price competition following the entry of a number of new operators into the market. The pre-tax... -

Page 118

... the recoverable amount India pps Romania pps Pre-tax adjusted discount rate Long-term growth rate Budgeted EBITDA1 Budgeted capital expenditure2 Notes: 1 Budgeted EBITDA is expressed as the compound annual growth rates in the initial five years for all cash generating units of the plans used for... -

Page 119

... Cost: 1 April 2010 Exchange movements Additions Disposals Reclassifications 31 March 2011 Exchange movements Arising on acquisition Additions Disposals Disposals of subsidiaries and joint ventures Other 31 March 2012 Accumulated depreciation and impairment: 1 April 2010 Exchange movements Charge... -

Page 120

... Company Limited Vodafone New Zealand Limited Vodafone Qatar Q.S.C.7 Vodafone Group Services Limited9 Vodafone Marketing S.a.r.l. Vodafone Holding GmbH Vodafone Holdings Europe S.L.U. Vodafone Europe B.V. Vodafone International Holdings B.V. Vodafone Investments Luxembourg S.a.r.l. Vodafone... -

Page 121

Vodafone Group Plc Annual Report 2012 119 13. Investments in joint ventures Principal joint ventures At 31 March 2012 the Company had the following joint ventures carrying on businesses which affect the profits and assets of the Group. Unless otherwise stated the Company's principal joint ventures... -

Page 122

... 2012 the fair value of Safaricom Limited was KES 51 billion (£386 million) based on the closing quoted share price on the Nairobi Stock Exchange. The Group's share of the aggregated financial information of equity accounted associates is set out below. 2012 £m 2011 £m 2010 £m Share of revenue... -

Page 123

... resale Inventory is reported net of allowances for obsolescence, an analysis of which is as follows: 2012 £m 486 537 2011 £m 2010 £m 1 April Exchange movements Amounts (credited)/charged to the income statement 31 March 117 (8) - 109 120 (1) (2) 117 111 5 4 120 Governance Cost of sales... -

Page 124

... and shares to its directors and employees. The maximum aggregate number of ordinary shares which may be issued in respect of share options or share plans will not (without shareholder approval) exceed: a 10% of the ordinary share capital of the Company in issue immediately prior to the date of... -

Page 125

...Plc Annual Report 2012 123 Share options Vodafone Group executive plans No share options have been granted to any directors or employees under the Company's discretionary share option plans in the year ended 31 March 2012. There are options outstanding under the Vodafone Group 1999 Long-Term Stock... -

Page 126

Vodafone Group Plc Annual Report 2012 124 Notes to the consolidated financial statements (continued) 20. Share-based payments (continued) Fair value of options granted Ordinary share options 2012 2011 2010 Expected life of option (years) Expected share price volatility Dividend yield Risk free ... -

Page 127

... Officer, Group General Counsel and Company Secretary, Group Treasury Director and Director of Financial Reporting meets at least annually to review treasury activities and its members receive management information relating to treasury activities on a quarterly basis. The Group's accounting... -

Page 128

Vodafone Group Plc Annual Report 2012 126 Notes to the consolidated financial statements (continued) 21. Capital and financial risk management (continued) The following table presents ageing of receivables that are past due and provisions for doubtful receivables that have been established. 2012 ... -

Page 129

... Group Plc Annual Report 2012 127 Foreign exchange management As Vodafone's primary listing is on the London Stock Exchange its share price is quoted in sterling. Since the sterling share price represents the value of its future multi-currency cash flows, principally in euro, US dollars, South... -

Page 130

...(2011: £3,190 million) in relation to the options disclosed in note 12. Bank loans include INR 273 billion of loans held by Vodafone India Limited ('VIL') and its subsidiaries (the 'VIL Group'). The VIL Group has a number of security arrangements supporting certain licences secured under the terms... -

Page 131

Vodafone Group Plc Annual Report 2012 129 The fair value and carrying value of the Group's long-term borrowings is as follows: Sterling equivalent nominal value 2012 £m 2011 £m 2012 £m Fair value 2011 £m 2012 £m Carrying value 2011 £m Business review Financial liabilities measured at ... -

Page 132

...14,326 10,198 2,832 387 23 832 14,272 Payables and receivables are stated separately in the table above as settlement is on a gross basis. The £39 million net receivable (2011: £54 million net payable) in relation to foreign exchange financial instruments in the table above is split £89 million... -

Page 133

... indirect interests in Vodafone India. The figures shown in the tables above take into account interest rate swaps used to manage the interest rate profile of financial liabilities. Interest on floating rate borrowings is generally based on national LIBOR equivalents or government bond rates in the... -

Page 134

...Redeemable preference shares Redeemable preference shares comprise class D and E preferred shares issued by Vodafone Americas, Inc. An annual dividend of US$51.43 per class D and E preferred share is payable quarterly in arrears. The dividend for the year amounted to £56 million (2011: £58 million... -

Page 135

...South Africa, Spain, the United Kingdom and the United States. The Group's principal defined benefit pension scheme in the United Kingdom was closed to new entrants from 1 January 2006 and closed to future accrual for existing members on 31 March 2010. Business review Income statement expense 2012... -

Page 136

... of financial position arising from the Group's obligations in respect of its defined benefit schemes is as follows: 2012 £m 2011 £m 2010 £m Movement in pension assets: 1 April Exchange rate movements Expected return on pension assets Actuarial (losses)/gains Employer cash contributions Member... -

Page 137

Vodafone Group Plc Annual Report 2012 135 History of experience adjustments 2012 £m 2011 £m 2010 £m 2009 £m 2008 £m Business review Experience adjustments on pension liabilities: Amount Percentage of pension liabilities Experience adjustments on pension assets: Amount Percentage of pension ... -

Page 138

Vodafone Group Plc Annual Report 2012 136 Notes to the consolidated financial statements (continued) 25. Trade and other payables 2012 £m 2011 £m Included within non-current liabilities: Other payables Accruals and deferred income Derivative financial instruments Included within current ... -

Page 139

... subleases is £252 million (2011: £240 million). Capital commitments Company and subsidiaries 2012 £m 2011 £m 2012 £m Share of joint ventures 2011 £m 2012 £m Group 2011 £m Contracts placed for future capital expenditure not provided in the financial statements1 1,735 1,786 283... -

Page 140

... replacement security asset is listed on an internationally recognised stock exchange in certain core jurisdictions, the Trustee may decide to agree a lower ratio than 133%. Legal proceedings The Company and its subsidiaries are currently, and may be from time to time, involved in a number of... -

Page 141

..." on pages 74 to 87. Key management compensation Aggregate compensation for key management, being the directors and members of the Executive Committee, was as follows: 2012 £m 2011 £m 2010 £m Financials Short-term employee benefits Post employment benefits - defined contribution schemes Share... -

Page 142

Vodafone Group Plc Annual Report 2012 140 Notes to the consolidated financial statements (continued) 31. Related party transactions The Group's related parties are its joint ventures (see note 13), associates (see note 14), pension schemes, directors and Executive Committee members. Group ... -

Page 143

... is shown below. 2012 Employees 2011 Employees 2010 Employees Business review By activity: Operations Selling and distribution Customer care and administration By segment: Germany Italy Spain UK Other Europe Europe India Vodacom Other Africa, Middle East and Asia Pacific Africa, Middle East and... -

Page 144

... parent company financial statements of Vodafone Group Plc for the year ended 31 March 2012 which comprise the balance sheet and the related notes 1 to 11. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards (United... -

Page 145

Vodafone Group Plc Annual Report 2012 143 Company financial statements of Vodafone Group Plc at 31 March Note 2012 £m 2011 £m Business review Fixed assets Shares in Group undertakings Current assets Debtors: amounts falling due after more than one year Debtors: amounts falling due within one ... -

Page 146

.... Deferred tax assets and liabilities are not discounted. 2. Significant accounting policies The Company's significant accounting policies are described below. Accounting convention The Company financial statements are prepared under the historical cost convention and in accordance with applicable... -

Page 147

...the Group's risk management strategy. Derivative financial instruments are initially measured at fair value on the contract date and are subsequently remeasured to fair value at each reporting date. The Company designates certain derivatives as hedges of the change of fair value of recognised assets... -

Page 148

Vodafone Group Plc Annual Report 2012 146 Notes to the Company financial statements (continued) 4. Debtors 2012 £m 2011 £m Amounts falling due within one year: Amounts owed by subsidiaries Taxation recoverable Other debtors Amounts falling due after more than one year: Deferred taxation Other ... -

Page 149

Vodafone Group Plc Annual Report 2012 147 8. Share-based payments The Company currently uses a number of equity-settled share plans to grant options and shares to the directors and employees of its subsidiaries. At 31 March 2012 the Company had 84 million ordinary share options outstanding (2011: ... -

Page 150

Vodafone Group Plc Annual Report 2012 148 Notes to the Company financial statements (continued) 10. Equity dividends 2012 £m 2011 £m Declared during the financial year: Final dividend for the year ended 31 March 2011: 6.05 pence per share (2010: 5.65 pence per share) Interim dividend for the ... -

Page 151

Vodafone Group Plc Annual Report 2012 149 Shareholder information Investor calendar Ex-dividend date for final dividend Record date for final dividend Interim management statement 30 June 2012 Annual general meeting Final dividend payment Half-year financial results Ex-dividend date for interim ... -

Page 152

... on the New York Stock Exchange ('NYSE')/NASDAQ. The Company transferred its ADS listing from the NYSE to NASDAQ on 29 October 2009. Quarter High Year ended 31 March High London Stock Exchange Pounds per ordinary share Low High NYSE/NASDAQ Dollars per ADS Low 2008 2009 2010 2011 2012 1.98 1.70... -

Page 153

... The Company is registered in England and Wales under the name Vodafone Group Public Limited Company with the registration number 1833679. Additional information Markets Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange and in the form of ADSs on NASDAQ. The Company had... -

Page 154

...or more of any class of the Company's equity share capital or the voting rights available to its shareholders, (v) relating to the arrangement of any employee benefit in which the director will share equally with other employees and (vi) relating to any insurance that the Company purchases or renews... -

Page 155

... vote any shares held under the Vodafone Group Share Incentive Plan and "My ShareBank" (a vested nominee share account) through the respective plan's trustees. Holders of the Company's 7% cumulative fixed rate shares are only entitled to vote on any resolution to vary or abrogate the rights attached... -

Page 156

... are available on the SEC's website (www.sec.gov). Shareholders can also obtain copies of the Company's articles of association from our website at www.vodafone.com/governance or from the Company's registered office. Material contracts At the date of this annual report the Group is not party to any... -

Page 157

... Group Plc Annual Report 2012 155 Taxation of dividends UK taxation Under current UK tax law no withholding tax will be deducted from the dividends we pay. Shareholders who are within the charge to UK corporation tax will be subject to corporation tax on the dividends we pay unless the dividends... -

Page 158

...Annual Report 2012 156 Shareholder information (continued) Additional tax considerations UK inheritance tax An individual who is domiciled in the United States (for the purposes of the Estate Tax Convention) and is not a UK national will not be subject to UK inheritance tax in respect of our shares... -

Page 159

Vodafone Group Plc Annual Report 2012 157 History and development The Company was incorporated under English law in 1984 as Racal Strategic Radio Limited (registered number 1833679). After various name changes, 20% of Racal Telecom Plc share capital was offered to the public in October 1988. The ... -

Page 160

... 31 March 2012 foreign exchange rates. Europe region Germany Our current MTR was reduced in December 2010 to 3.36 eurocents per minute, effective until 30 November 2012. In December 2011 the national regulator enquired about the demand for 900/1800 MHz spectrum beyond 2016 when current licences... -

Page 161

...new end-user tax on both mobile and fixed phone traffic of HUF 2.0 per minute and per SMS/MMS. The new tax would generate tax revenue of HUF 52 billion (£147.3 million) a year, which is close to 10% of the relevant service revenue of the whole market, and would be in force from 1 July 2012. Ireland... -

Page 162

... a claim by Telecom Egypt against Vodafone Egypt relating to historic termination charges. New Zealand Vodafone and Telecom New Zealand have been selected to share a NZ$285 million (£146 million) government grant to roll-out and operate an open access fibre and wireless network in rural areas. The... -

Page 163

... MHz expiry date 2.1 GHz expiry date 2.6 GHz expiry date Business review Europe Germany Italy Spain UK Albania Czech Republic Greece Hungary Ireland Malta Netherlands Portugal Romania Turkey Africa, Middle East and Asia Pacific India6 Vodacom: South Africa Egypt Ghana New Zealand Qatar December... -

Page 164

... internal performance reporting; a these measures are used in setting director and management remuneration; and a they are useful in connection with discussion with the investment analyst community and debt rating agencies. Reconciliations of adjusted operating profit and adjusted earnings per share... -

Page 165

...exchange pps Reported change % Business review 31 March 2012 Group Service revenue Revenue Service revenue for the quarter ended 31 March 2012 Voice revenue Messaging revenue Data revenue Fixed line revenue Emerging markets service revenue Enterprise revenue Enterprise data revenue Vodafone Global... -

Page 166

...Asia Pacific South Africa - data revenue3 Egypt - service revenue Ghana - service revenue Indus Towers - contribution to India service revenue growth Percentage point reduction in EBITDA margin Verizon Wireless2 Revenue Service revenue EBITDA Group's share of result of Verizon Wireless 31 March 2010... -

Page 167

... 2012 Form 20-F. Item Form 20-F caption Location in this document Page Business review 1 2 3 Identity of directors, senior management and advisers Offer statistics and expected timetable Key information 3A Selected financial data Not applicable Not applicable Selected financial data Shareholder... -

Page 168

Vodafone Group Plc Annual Report 2012 166 Form 20-F cross reference guide (continued) Item Form 20-F caption Location in this document Page 6 Directors, senior management and employees 6A Directors and senior management 6B Compensation 6C Board practices 6D Employees 6E Share ownership 7 Board ... -

Page 169

Vodafone Group Plc Annual Report 2012 167 Item Form 20-F caption Location in this document Page Business review 16 16A Audit Committee financial expert 16B Code of ethics 16C Principal accountant fees and services 16D Exemptions from the listing standards for audit committees 16E Purchase of... -

Page 170

... communications strategy, including data revenue growth, and its expectations with respect to long-term shareholder value growth; a mobile penetration and coverage rates, mobile termination rate cuts, the Group's ability to acquire spectrum, expected growth prospects in the Europe, Africa, Middle... -

Page 171

... than anticipated prices of new mobile handsets; a changes in the costs to the Group of, or the rates the Group may charge for, terminations and roaming minutes; a the Group's ability to realise expected benefits from acquisitions, partnerships, joint ventures, franchises, brand licences, platform... -

Page 172

... of the India tax case. Financial Services Authority. A downward revaluation of an asset. A charge paid by Vodafone to other fixed line or mobile operators when a Vodafone customer calls a customer connected to a different network. Information and communications technology. Internet protocol ('IP... -

Page 173

... and outgoing network usage by non-Vodafone customers and interconnect charges for incoming calls. A smartphone is a mobile phone offering advanced capabilities including access to email and the internet. The number of smartphone devices divided by the number of registered SIMs, excluding data only... -

Page 174

... 2011 2010 2009 2008 Consolidated income statement data (£m) Revenue Operating profit Profit before taxation Profit for the financial year Consolidated statement of financial position data (£m) Total assets Total equity Total equity shareholders' funds Earnings per share1 Weighted average number... -

Page 175

... product and company names mentioned herein may be the trade marks of their respective owners. The content of our website (www.vodafone.com) should not be considered to form part of this annual report or our annual report on Form 20-F. © Vodafone Group 2012 Financials Additional information Text... -

Page 176

...: [email protected] Website: www.vodafone.com/investor Media Relations Telephone: +44 (0) 1635 664444 Email: [email protected] Website: www.vodafone.com/media Sustainability Email: [email protected] Website: www.vodafone.com/sustainability Access our online Annual Report at...