Vodafone 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

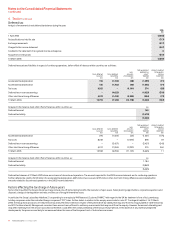

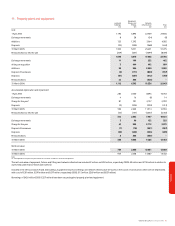

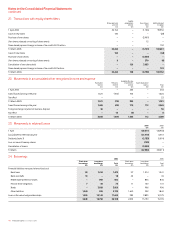

14. Investments in associated undertakings

The Company’s principal associated undertakings all have share capital consisting solely of ordinary shares, unless otherwise stated, and are all indirectly held. The country of

incorporation or registration of all associated undertakings is also their principal place of operation. The accounts of the associated undertakings are drawn up to 31 March 2006 for

inclusion in the Consolidated Financial Statements. The latest statutory financial statements of the associated undertakings were drawn up to 31 December 2005. Summarised

financial information of associated undertakings is disclosed in note 37.

Percentage(1)

Country of shareholding/

incorporation or partnership

Name Principal activity registration interest

Belgacom Mobile S.A. Mobile network operator Belgium 25.0

Cellco Partnership(2) Mobile network operator USA 45.0

Société Française du Radiotéléphone S.A. Mobile network and fixed line operator France 44.0

Swisscom Mobile A.G. Mobile network operator Switzerland 25.0

Notes:

(1) Rounded to nearest tenth of one percent.

(2) Cellco Partnership trades under the name Verizon Wireless. The registered or principal office of the partnership is 180 Washington Valley Road, Bedminster, New Jersey 07921, USA.

The Group’s share of the aggregated financial information of equity accounted associated undertakings is set out below:

2006 2005

£m £m

Revenue 12,480 10,546

Operating profit 3,133 2,668

Non-operating income and expense 17 –

Net interest (227) (197)

Tax on profit (443) (448)

Minority interest (52) (43)

Share of result in associated undertakings 2,428 1,980

Non-current assets 29,055 25,739

Current assets 2,183 2,331

Share of total assets 31,238 28,070

Non-current liabilities 4,141 2,476

Current liabilities 3,468 4,938

Minority interests 432 422

Share of total liabilities 8,041 7,836

Share of net assets in associated undertakings 23,197 20,234

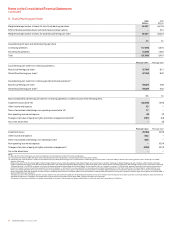

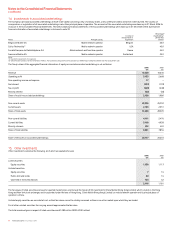

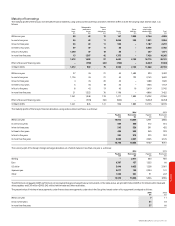

15. Other investments

Other investments comprise the following, all of which are available-for-sale:

2006 2005

£m £m

Listed securities:

Equity securities 1,938 1,117

Unlisted securities:

Equity securities 716

Public debt and bonds 20 16

Cash held in restricted deposits 154 32

2,119 1,181

The fair values of listed securities are based on quoted market prices, and include the Group’s 3.3% investment in China Mobile (Hong Kong) Limited, which is listed on the Hong

Kong and New York stock exchanges and incorporated under the laws of Hong Kong. China Mobile (Hong Kong) Limited is a mobile network operator and its principal place of

operation is China.

Unlisted equity securities are recorded at cost, as their fair values cannot be reliably measured as there is no active market upon which they are traded.

For all other unlisted securities, the carrying amount approximates the fair value.

The total unrealised gain in respect of listed securities was £1,080 million (2005: £330 million).