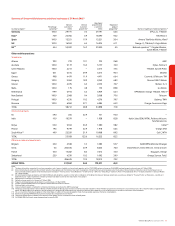

Vodafone 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20 Vodafone Group Plc Annual Report 2006

Business Overview

continued

•The combination of the Group’s US mobile operations with those of Bell Atlantic

Corporation and GTE Corporation to form the Cellco Partnership, which operates

under the name “Verizon Wireless”, on 10 July 2000. The Group owns 45% of Verizon

Wireless and accounts for it as an associated undertaking.

•The acquisition of Airtel Móvil S.A., a mobile network operator in Spain, which became

a subsidiary of the Group in December 2000.

•The acquisition of Eircell Limited, a mobile network operator in Ireland, following a

public offer for shares which closed in May 2001.

•The acquisition of the Group’s operations in Japan. The Group’s initial investment in

Japan resulted from the AirTouch merger and between the date of the merger and

October 2001, the Group increased its effective interest in the Japanese mobile

telecommunications company, J-Phone Co. Ltd to 69.76% through a number of

transactions. The Group also acquired a 66.7% stake in the fixed line operator, Japan

Telecom Co., Ltd (“Japan Telecom”).

By 31 March 2003, the Group controlled mobile operations in 16 countries and held

equity investments in mobile operations in a further 12 countries. The proportionate

mobile customer base was 119.7 million at that date.

Transactions since 31 March 2003

Acquisitions

Subsidiary undertakings

Turkey

On 13 December 2005, the Group announced it had agreed to acquire substantially all

the assets and business of Telsim Mobil Telekomunikasyon (“Telsim”) from the Turkish

Savings Deposit and Investment Fund. The transaction was completed on 24 May 2006,

with cash paid of $4.67 billion (£2.6 billion). Telsim was consolidated as a subsidiary

undertaking from that date.

Czech Republic and Romania

On 31 May 2005, the Company announced that its wholly owned subsidiary, Vodafone

International Holdings B.V., had completed a transaction with Telesystem International

Wireless Inc. of Canada to acquire:

•79.0% of the share capital of MobiFon S.A. (“MobiFon”) in Romania, increasing the

Group’s ownership in MobiFon to approximately 99.1%; and,

•99.9% of the share capital of Oskar Mobil a.s. (“Oskar”) in the Czech Republic

for cash consideration of approximately $3.5 billion (£1.9 billion) which was funded from

the Group’s cash resources. In addition, the Group assumed approximately $1.0 billion

(£0.6 billion) of net debt. The remaining 0.9% of MobiFon was acquired in a separate

transaction in the 2006 financial year.

On 1 February 2006, Oskar was renamed Vodafone Czech Republic.

Egypt

On 16 May 2003, the Group increased its shareholding in Vodafone Egypt from 60.0% to

67.0%. Subsequently, the Group has reduced its effective interest in Vodafone Egypt to

50.1%. Further details are provided in “Performance – Financial Position and Resources –

Option agreements and similar arrangements” on page 42.

Greece

On 1 December 2003, following the purchase of a 9.433% stake in Vodafone Greece

from Intracom S.A., the Group announced a public offer for all remaining shares not held

by the Group. As a result of the offer and subsequent market purchases, the Group

increased its effective interest in Vodafone Greece to 99.4% at 31 March 2004. The total

aggregate cash consideration paid in the 2004 financial year was £815 million.

Vodafone Greece’s shares were delisted from the Athens and London Stock Exchanges

on 15 July 2004 and 20 August 2004 respectively.

Between 24 January 2005 and 31 March 2005, the Group acquired a further 0.4%

interest in Vodafone Greece through private transactions at a price equal to the price

paid in the public offer.

Hungary

On 10 June 2003, the Group increased its stake in Vodafone Hungary to 87.9% by

subscribing for Antenna’s share of an issue of ‘C’ shares.

In the first half of the 2005 financial year, the Group subscribed for HUF 89,301 million

(£248 million) shares in Vodafone Hungary, increasing the Group’s stake to 92.8%. On

24 September 2004, the Group entered into a sale and purchase agreement to acquire

the remaining 7.2% shareholding from Antenna. This transaction completed on

12 January 2005 with the effect that Vodafone Hungary became a wholly owned

subsidiary of the Group.

Japan

During the 2004 financial year, the Group sold its interest in Japan Telecom, as described

under “Disposals”. In addition, J-Phone Co., Ltd was renamed Vodafone K.K. on 1 October

2003 and Japan Telecom Holdings Co., Ltd. was renamed Vodafone Holdings K.K. on

10 December 2003.

On 25 May 2004, the Group’s wholly owned subsidiary, Vodafone International Holdings

B.V., announced offers for the shares not held by the Group in Vodafone Holdings K.K.

and Vodafone K.K. As a result of these offers, the Group increased its effective

shareholding in Vodafone K.K. to 98.2% and its stake in Vodafone Holdings K.K. to 96.1%

for a total consideration of £2.4 billion. On 1 October 2004, the merger of Vodafone K.K.

and Vodafone Holdings K.K. was completed and the Group held a 97.7% stake in the

merged company, which was renamed Vodafone K.K. Subsequently, on 1 August 2005,

shares in Vodafone K.K. were delisted from the Tokyo Stock Exchange.

Vodafone K.K was subsequently sold on 27 April 2006. Further details are provided in the

section on “Disposals” below.

Malta

On 1 August 2003, the Group increased its shareholding in Vodafone Malta from 80% to

100% by purchasing Maltacom Plc’s 20% interest in Vodafone Malta for cash

consideration of 30 million.

The Netherlands

During the 2004 financial year, the Group increased its effective interest in Vodafone

Netherlands to 99.9% as a result of private transactions. The Group has exercised its

rights under Dutch law and initiated compulsory acquisition procedures in order to

acquire the remaining shares. Following these procedures, Vodafone Netherlands will

become a wholly owned subsidiary of the Group. Vodafone Netherlands’ shares have

been de-listed from the Euronext Amsterdam Stock Exchange.

Portugal

Having achieved an effective interest of greater than 90% at the start of the 2004

financial year, the Group implemented compulsory acquisition procedures to acquire

the remaining shares, which became effective on 21 May 2003, for a further

consideration of £74 million. As a result, Vodafone Portugal became a wholly owned

subsidiary of the Group.

Sweden

Under compulsory acquisition procedures, on 15 March 2004, Vodafone Holdings

Sweden AB obtained advanced access to an aggregate of 2,377,774 shares in Vodafone

Sweden, giving the Group ownership of, and title, to these shares.

On 31 March 2004, the Group increased its effective interest in Vodafone Sweden to

100% by the purchase of 1,320,000 shares which were held in treasury by Vodafone

Sweden.

Vodafone Sweden was subsequently sold on 5 January 2006. Further details are given

on page 115.

UK

On 22 September 2003, the Group acquired 100% of Singlepoint (4U) Limited for a

consideration of £417 million. In addition, as a result of a recommended cash offer

announced on 5 August 2003, the Group acquired 98.92% of Project Telecom plc, after

the offer was declared unconditional on 19 September 2003, and subsequently

acquired the remaining 1.08% in November 2003, for a total consideration of £164

million. These businesses have been integrated into the Group’s UK operations.

Joint ventures

India

On 18 November 2005, the Group acquired a 5.61% direct interest in Bharti from Warburg

Pincus LLC and, on 22 December 2005, the Group acquired a further 4.39% effective

shareholding in Bharti by subscribing for convertible debentures in Bharti Enterprises

Private Limited, bringing the Group’s effective shareholding in Bharti to 10.0%. Bharti is a

national mobile operator in India which also provides fixed-line services. The total

consideration paid for these transactions was Rs. 67 billion (£858 million).

South Africa

On 26 January 2006, the Group announced that its offer to acquire a 100% interest in

VenFin Limited (“VenFin”) had become wholly unconditional. VenFin’s principal asset was

a 15% stake in Vodacom Group (Pty) Limited (“Vodacom”) and VenFin has disposed of

substantially all of its assets other than its stake in Vodacom for a cash consideration of

R5 billion (£0.5 billion) to a new company owned by certain of the former shareholders

in VenFin. At 31 March 2006, the Group held an effective economic interest in VenFin of

98.7% and an effective voting interest of 99.3%. On 20 April 2006, the Group completed

the compulsory acquisition of the remaining minority shareholdings in VenFin, from

which date the Group holds 100% of the issued share capital of VenFin. As a result the

Group holds 50% of the share capital of Vodacom.