Vodafone 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

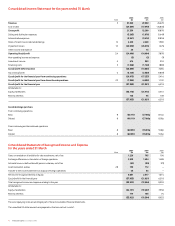

Vodafone Group Plc Annual Report 2006 67

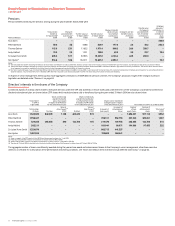

Long term incentives

Performance shares

Conditional awards of ordinary shares made to executive directors under the Vodafone Group Long Term Incentive Plan and Vodafone Group Plc 1999 Long Term Stock Incentive Plan,

and dividends on those shares paid under the terms of the Company’s scrip dividend scheme and dividend reinvestment plan, are shown below. Long Term Incentive shares that vested

and were sold or transferred during the year ended 31 March 2006 are also shown below:

Shares sold or

Shares Shares forfeited in transferred in

Total interest in added during the respect of awards respect of awards

Long Term Incentives 2006 financial year for the 2003, for the 2003,

at 1 April 2005 or Shares conditionally awarded through dividend 2004 and 2005 2004 and 2005 Total interest in long term

date of appointment(1) during the 2006 financial year reinvestment financial years financial years incentives at 31 March 2006

Value at

date of award(2) Number Total value(4)

Number Number £’000 Number Number(3) Number(3) of shares £’000

Arun Sarin 3,861,669 1,717,120 2,494–––5,578,789 6,722

Peter Bamford 2,934,630 876,532 1,273 15,609 592,145 492,367 2,742,259 3,304

Thomas Geitner 2,429,377 811,127 1,178 11,949 453,321 376,934 2,422,198 2,919

Andy Halford 514,616 539,975 784 3,110 118,013 98,126 841,562 1,014

Sir Julian Horn-Smith 3,717,872 1,117,080 1,623 20,387 773,413 643,092 3,438,834 4,144

Ken Hydon 2,948, 684 – – 15,609 592,145 788,719 – –

Notes:

(1) Restricted share awards under the Vodafone Group Long Term Incentive Plan and Vodafone Group Plc 1999 Long Term Stock Incentive Plan.

(2) The value of awards under the Vodafone Group Plc 1999 Long Term Incentive Plan is based on the price of the Company’s ordinary shares on 26 July 2005 of 145.25p.

(3) Shares in respect of awards for the 2003 financial year were sold or transferred on 1 July 2005 and 19 August 2005. The closing middle market price of the Company’s ordinary shares on 1 July 2005, the date of vesting, was 136.25p.

(4) The value at 31 March 2006 is calculated using the closing middle market price of the Company’s ordinary shares at 31 March 2006 of 120.5p.

(5) All employees, including Executive Directors with the exception of those retiring in the 2006 financial year, received an award of 320 shares on 1 July 2005, under the Global All Employee Share Plan. The awards vest after two years and are not subject

to performance conditions.

The aggregate number of shares conditionally awarded during the year to the Company‘s senior management is 3,192,815 shares. For a description of the performance and vesting

conditions see “Long term incentives” on pages 62 to 63. In some cases local performance conditions attach to the awards.

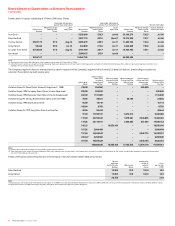

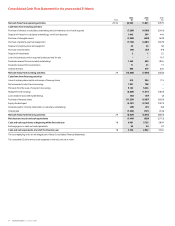

Share options

The following information summarises the directors’ options under the Vodafone Group Plc Savings Related Share Option Scheme, the Vodafone Group 1998 Sharesave Scheme, the

Vodafone Group Plc Executive Share Option Scheme and the Vodafone Group 1998 Company Share Option Scheme, all of which are HM Revenue and Customs approved schemes. The

table also summarises the directors’ options under the Vodafone Group Plc Share Option Scheme, the Vodafone Group 1998 Executive Share Option Scheme, the AirTouch

Communications, Inc. 1993 Long Term Stock Incentive Plan and the Vodafone Group Plc 1999 Long Term Stock Incentive Plan, which are not HM Revenue and Customs approved. No

other directors have options under any of these schemes. Only under the Vodafone Group 1998 Sharesave Scheme may shares be offered at a discount in future grants of options. For a

description of the performance and vesting conditions see “Long term incentives” on pages 62 to 63.

Options held at

1 April 2005 Options granted Options exercised Options lapsed Weighted average

or date of during the 2006 during the 2006 during the 2006 Options held at exercise price at Earliest date

appointment(1) financial year financial year financial year 31 March 2006 31 March 2006 from which Latest

Number Number Number Number Number Pence exercisable expiry date

Arun Sarin(2)(3) 20,704,987 5,711,292 – – 26,416,279 152.5 Jun 2000 Jul 2015

Peter Bamford 19,073,022 2,915,424 4,350,652 2,053,776 15,584,018 148.5 Jul 2002 Mar 2007

Thomas Geitner 17,334,854 2,697,882 – 1,635,776 18,396,960 140.5 Jul 2003 Jul 2015

Andy Halford 921,485 1,796,003 13,395 – 2,704,093 147.6 Jul 2002 Jul 2015

Sir Julian Horn-Smith 23,332,869 3,715,505 – 1,847,776 25,200,598 134.9 Jul 2002 Jul 2015

Ken Hydon 18,717,166 – 8,338,371 7,280,782 3,098,013 213.9 Jul 2002 Jul 2006

100,084,383 16,836,106 12,702,418 12,818,110 91,399,961

Notes:

(1) The weighted average exercise price of options over shares in the Company granted during the year and listed above is 145.25 pence. The earliest date from which they are exercisable is July 2008 and the latest expiry date is 25 July 2015. For a

description of the performance and vesting conditions see “Long term incentives” on pages 62 to 63.

(2) Some of the options held by Arun Sarin are held in the form of ADSs, each representing ten ordinary shares of the Company, which are traded on the New York Stock Exchange. The number of ADSs over which Arun Sarin holds options is 625,000.

(3) The terms of the share options granted over 6,250,000 shares in 1999 to Arun Sarin allow exercise until the earlier of the date on which he ceases to be a director of the Company and the seventh anniversary of the respective dates of grant.

(4) In accordance with the terms of the plan rules, options granted to Ken Hydon became exercisable on retirement, being pro-rated for both time and performance.

The aggregate number of options granted during the year to the Company’s senior management, other than executive directors, is 10,454,900. The weighted average exercise price of

the options granted to senior management during the year is 145.24 pence. The earliest date from which they are exercisable is July 2008 and the latest expiry date is 25 July 2015.

Governance