Vodafone 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

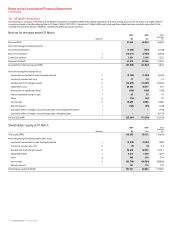

28. Acquisitions continued

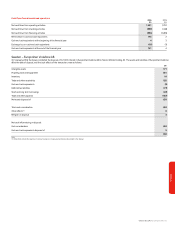

India – Bharti Airtel Limited

On 18 November 2005, the Group acquired a 5.61% direct interest in Bharti Airtel Limited (previously Bharti Tele-Ventures Limited) from Warburg Pincus LLC, and on 22 December

2005 the Group acquired a further 4.39% indirect interest in Bharti Airtel Limited, bringing the Group’s effective shareholding to 10.0%.

Total cash consideration was Rs.67 billion (£858 million).

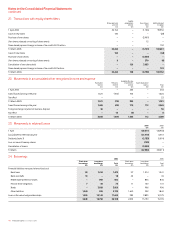

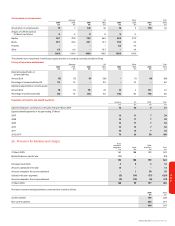

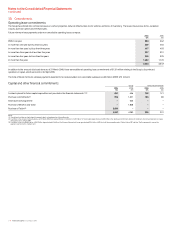

Book Fair value Fair

value adjustments value

£m £m £m

Net assets acquired:

Intangible assets 49 345 394(1)

Property, plant and equipment 142 (1) 141

Inventory 1–1

Trade and other receivables 30 – 30

Cash and cash equivalents 9–9

Deferred tax liabilities (2) (126) (128)

Short and long-term borrowings (56) – (56)

Current tax liabilities – (2) (2)

Trade and other payables (73) (1) (74)

100 215 315

Goodwill 543

Total cash consideration (including £1 million of directly attributable costs) 858

Net cash outflow arising on acquisition:

Cash consideration 858

Cash and cash equivalents acquired (9)

849

Note:

(1) Intangible assets consist of licences and spectrum fees of £343 million and other intangibles of £51 million.

The goodwill is attributable to the profitability of the acquired business and the synergies expected to arise within those businesses after the Group's acquisition of the shares in

Bharti Airtel Limited.

Results of the acquired entity have been proportionately consolidated in the income statement from the dates of acquisition.

From the date of acquisition, the entity contributed a loss of £8 million to the net loss of the Group.