Vodafone 2006 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 141

Online shareholder services

The Company provides a number of shareholder services online at

www.vodafone.com/shareholder, where shareholders may:

•Register to receive electronic shareholder communications. Benefits to shareholders

include faster receipt of communications such as annual reports, with cost and time

savings for the Company. Electronic shareholder communications are also more

environmentally friendly;

•View a live webcast of the AGM of the Company on 25 July 2006. A recording will be

available to review after that date;

•View and/or download the Annual Report and the Annual Review & Summary

Financial Statement 2006;

•Check the current share price;

•Calculate dividend payments; and

•Use interactive tools to calculate the value of shareholdings, look up the historic price

on a particular date and chart Vodafone ordinary share price changes against indices.

Shareholders and other interested parties can also receive Company press releases,

including London Stock Exchange announcements, by registering for Vodafone News via

the Company’s website at www.vodafone.com/news.

Registering for Vodafone News will enable users to:

•be alerted by free SMS as soon as news breaks;

•access the latest news from their mobile; and

•have news automatically e-mailed to them.

Annual General Meeting

The twenty-second AGM of the Company will be held at The Queen Elizabeth II

Conference Centre, Broad Sanctuary, Westminster, London SW1 on 25 July 2006 at

11.00 a.m. or, if later, on conclusion of the Extraordinary General Meeting to be held

immediately before it at 10.45 a.m.

The Notice of Meeting, together with details of the business to be conducted at the

Meeting, is being circulated to shareholders with this Annual Report or the Annual

Review & Summary Financial Statement and can be viewed at the Company’s

website – www.vodafone.com/agm.

The AGM will be transmitted via a live webcast and can be viewed at the Company’s

website – www.vodafone.com/agm – on the day of the meeting and a recording will be

available to review after that date.

To find out more about the AGM and how to view the webcast, visit

www.vodafone.com/agm.

Corporate sponsored nominee service for shareholders

Subject to changes to the Company’s Articles of Association being approved at the

Annual General Meeting on 25 July 2006, the Company intends to establish a Corporate

Nominee Service for Shareholders, which would be operated by the Company’s Registrar.

The service provides a facility for shareholders to remove their shares from the Vodafone

Group Plc share register and hold them, together with other shareholders through a

nominee. There would be no need for a share certificate and, in addition, shareholders’

details will not be held on the main register and so will remain confidential.

Details will be available frollowing the AGM on the Company’s website at

www.vodafone.com/shareholder.

ShareGift

The Company supports ShareGift, the charity share donation scheme (registered charity

number 1052686). Through ShareGift, shareholders who have only a very small number

of shares which might be considered uneconomic to sell are able to donate them to

charity. Donated shares are aggregated and sold by ShareGift, the proceeds being passed

on to a wide range of UK charities. Donating shares to charity gives rise neither to a gain

nor a loss for UK Capital Gains purposes and UK taxpayers may also be able to claim

income tax relief on the value of the donation.

ShareGift transfer forms specifically for the Company’s shareholders are available from

the Company’s Registrars, Computershare Investor Services PLC and, even if the share

certificate has been lost or destroyed, the gift can be completed. The service is generally

free. However, there may be an indemnity charge for a lost or destroyed share certificate

where the value of the shares exceeds £100. Further details about ShareGift can be

obtained from its website at www.ShareGift.org or at 5 Lower Grosvenor Place, London

SW1W 0EJ (telephone: +44 (0) 20 7828 1151).

The Unclaimed Assets Register

The Company participates in the Unclaimed Assets Register, which provides a search

facility for financial assets which may have been forgotten and which donates a

proportion of its public search fees to a group of three UK charities (Age Concern, NSPCC

and Scope). For further information, contact The Unclaimed Assets Register, Garden

Floor, Bain House, 16 Connaught Place, London W2 2ES (telephone: +44 (0) 870 241

1713), or visit its website at www.uar.co.uk.

Share price history

Upon flotation of the Company on 11 October 1988, the ordinary shares were valued at

170 pence each. On 16 September 1991, when the Company was finally demerged, for

UK taxpayers the base cost of Racal Electronics Plc shares was apportioned between the

Company and Racal Electronics Plc for Capital Gains Tax purposes in the ratio of

80.036% and 19.964% respectively. Opening share prices on 16 September 1991 were

332 pence for each Vodafone share and 223 pence for each Racal share.

On 21 July 1994, the Company effected a bonus issue of two new shares for every one

then held and, on 30 September 1999, it effected a bonus issue of four new shares for

every one held at that date. The flotation and demerger share prices, therefore, may be

restated as 11.333 pence and 22.133 pence, respectively.

The share price at 31 March 2006 was 120.50 pence (31 March 2005: 140.50 pence).

The share price on 26 May 2006 was 119.75 pence.

The following tables set out, for the periods indicated, (i) the reported high and low

middle market quotations of ordinary shares on the London Stock Exchange, (ii) the

reported high and low sales prices of ordinary shares on the Frankfurt Stock Exchange,

and (iii) the reported high and low sales prices of ADSs on the NYSE.

The Company’s ordinary shares were traded on the Frankfurt Stock Exchange from 3

April 2000 until 23 March 2004 and, therefore, information has not been provided for

periods outside these dates.

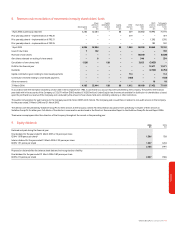

Five year data on an annual basis

London Stock Frankfurt

Exchange Stock Exchange NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

2001/2002 2.29 1.24 3.70 2.00 33.26 17.88

2002/2003 1.31 0.81 2.15 1.26 20.30 12.76

2003/2004 1.50 1.12 2.22 1.59 27.88 18.10

2004/2005 1.49 1.14 – – 28.54 20.83

2005/2006 1.55 1.09 – – 28.04 19.32

Two year data on a quarterly basis

London Stock

Exchange NYSE

Pounds per Dollars

ordinary share per ADS

Financial Year High Low High Low

2004/2005

First Quarter 1.44 1.21 25.90 21.87

Second Quarter 1.34 1.14 24.21 20.83

Third Quarter 1.49 1.32 28.54 24.06

Fourth Quarter 1.46 1.35 27.53 25.60

2005/2006

First Quarter 1.47 1.34 26.87 24.32

Second Quarter 1.55 1.36 28.04 23.90

Third Quarter 1.52 1.23 26.65 21.29

Fourth Quarter 1.33 1.09 23.39 19.32

2006/2007

First Quarter(1) 1.30 1.14 24.23 21.07

Note:

(1) Covering period up to 26 May 2006.

Shareholder information