Vodafone 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 61

Board’s Report to Shareholders on Directors’ Remuneration

Dear Shareholder

Since the introduction of the current Executive Remuneration Policy in 2002 (the

“Policy”), the Remuneration Committee has conducted annual reviews to ensure that

the Policy continues to serve the Company and shareholders. Following my appointment

as Chairman of the Committee, we have undertaken a review again this year.

As a result of this year’s review, the Remuneration Committee has concluded that the

existing Policy remains appropriate but wishes to make three minor changes. These are

as follows:

•the deferred bonus scheme will be extended to members of the Executive Committee

based outside of the UK, and the mechanics amended in light of recent US tax

legislation;

•we have considered the weighting of performance shares and options within our long

term incentives, and will place a greater weighting on performance shares for 2006

awards, thus increasing the emphasis on total shareholder return performance; and

•dividends will be accrued on performance shares awarded from 2006 and transferred

as shares on the vesting of awards, to increase the alignment of executive and

shareholder interests.

The key principles of the Policy, which are being maintained, are:

•the expected value of total remuneration will be benchmarked against the relevant

market;

•a high proportion of total remuneration will be delivered through performance related

payments;

•performance measures will be balanced between absolute financial measures and

sector comparative measures to achieve maximum alignment between executive and

shareholder objectives;

•the majority of performance related remuneration will be provided in the form of

equity; and

•share ownership requirements will be applied to executive directors.

The Committee continues to monitor how well incentive awards made in previous years

align with the Company’s performance. The Policy continues to work well and forecast

rewards are commensurate with actual performance. I am confident that the Policy

continues to align executives’ interests with the interests of shareholders, whilst

enabling the Company to engage a high calibre team to successfully lead the Company.

I hope that we receive your support at the AGM on 25 July 2006.

Luc Vandevelde

Chairman of the Remuneration Committee

30 May 2006

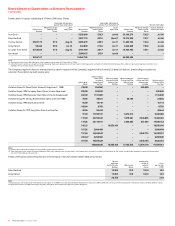

Remuneration Committee

The Remuneration Committee is comprised to exercise independent judgement and

consists only of independent non-executive directors. Luc Vandevelde (Chairman), Sir

John Bond, Dr Michael Boskin and Professor Jürgen Schrempp continue as members.

Philip Yea joined the Committee on 1 January 2006. The Chief Executive and Chairman

are invited to attend meetings of the Remuneration Committee, other than when their

own remuneration is being discussed.

The Remuneration Committee met on five occasions during the year. The Committee

appointed and received advice from Towers Perrin (market data and advice on market

practice and governance) and Kepler Associates (performance analysis and advice on

performance measures and market practice) and received advice from the Group Human

Resources Director and the Group Compensation and Benefits Director. The advisers

also provided advice to the Company on general human resource and compensation

related matters.

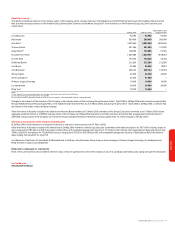

Remuneration Policy

The Policy was approved by shareholders in July 2002. The Policy is set out below:

The overriding objective of the Policy on incentives is to ensure that Vodafone is able

to attract, retain and motivate executives of the highest calibre essential to the

successful leadership and effective management of a global company at the leading

edge of the telecommunications industry. To achieve this objective, Vodafone, from

the context of its UK domicile, takes into account both the UK regulatory framework,

including best practice in corporate governance, shareholder views, political opinion

and the appropriate geographic and nationality basis for determining competitive

remuneration, recognising that this may be subject to change over time as the

business evolves.

The total remuneration will be benchmarked against the relevant market. Vodafone is

one of the largest companies in Europe and is a global business; Vodafone’s policy will

be to provide executive directors with remuneration generally at levels that are

competitive with the largest companies in Europe. A high proportion of the total

remuneration will be awarded through performance related remuneration, with

phased delivery over the short, medium and long term. For executive directors,

approximately 80% of the total expected remuneration will be performance related.

Performance measures will be balanced between absolute financial measures and

sector comparative measures to achieve maximum alignment between executive and

shareholder objectives.

All medium and long term incentives are delivered in the form of Vodafone shares and

options. Executive directors are required to comply with share ownership guidelines.

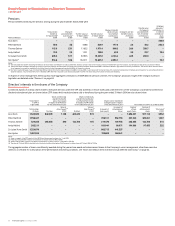

The structure of remuneration for executive directors under the Policy (excluding

pensions) is illustrated below:

The Policy’s key objective is to ensure that there is a strong linkage between pay and

performance. This is achieved by approximately 80% of the total package (excluding

pensions) being delivered through performance-linked short, medium and long term

incentive plans. Therefore, the only guaranteed payment to executive directors is their

base salary.

The Remuneration Committee selects performance measures for incentive plans that

provide the greatest degree of alignment with the Company’s strategic goals and that

are clear and transparent to both directors and shareholders. The performance measures

adopted incentivise both operational performance and share price growth.

Fixed

Base Salary

circa 20% circa 80%

Short/Medium

Term Incentive

Long Term

Incentive

Deferred

Share Bonus

Performance

Shares

Share

Options

Variable

Governance