Vodafone 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 39

pounds sterling or, to holders of ordinary shares with a registered address in a country

which has adopted the euro as its national currency, in euro, unless shareholders wish to

elect to continue to receive dividends in sterling, are participating in the Company’s

Dividend Reinvestment Plan, or have mandated their dividend payment to be paid

directly into a bank or building society account in the United Kingdom. In accordance

with the Company’s Articles of Association, the sterling: euro exchange rate will be

determined by the Company shortly before the payment date.

The Company will pay the ADS Depositary, The Bank of New York, its dividend in US

dollars. The sterling: US dollar exchange rate for this purpose will be determined by the

Company shortly before the payment date. Cash dividends to ADS holders will be paid

by the ADS Depositary in US dollars.

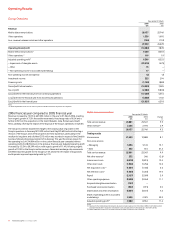

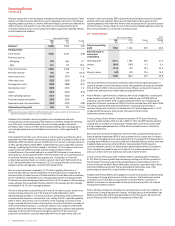

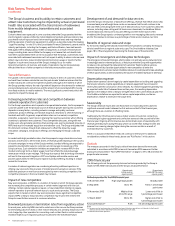

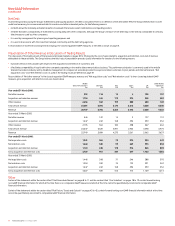

Contractual Obligations

A summary of the Group’s principal contractual financial obligations is shown below.

Further details on the items included can be found in the notes to the Consolidated

Financial Statements.

Payments due by period £m

Contractual obligations(1) Total <1 year 1-3 years 3-5 years >5 years

Borrowings(2) 28,101 4,308 6,175 7,373 10,245

Operating lease commitments(3) 3,644 654 956 742 1,292

Capital commitments(4) 813813–––

Purchase commitments(5) 1,159 855 187 89 28

Telsim asset acquisition agreements 2,600 2,600–––

Total contractual cash obligations(1) 36,317 9,230 7,318 8,204 11,565

Notes:

(1) The above table of contractual obligations excludes commitments in respect of options over interests in Group

businesses held by minority shareholders (see “Option agreements and similar arrangements”) and obligations to pay

dividends to minority shareholders (see “Dividends from associated undertakings and dividends to minority interests”).

Disclosures required by Financial Accounting Standards Board (“FASB”) Interpretation No. 45, “Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others”, are provided in note

31 to the Consolidated Financial Statements. The table also excludes obligations under post employment benefit

schemes, details of which are provided in note 25 to the Consolidated Financial Statements. The table also excludes

contractual obligations relating to the Group’s discontinued operations in Japan, which were disposed of on 27 April 2006.

(2) See note 24 to the Consolidated Financial Statements.

(3) See note 30 to the Consolidated Financial Statements.

(4) Primarily related to network infrastructure.

(5) Predominantly commitments for handsets.

Contingencies

Details of the Group’s contingent liabilities are included in note 31 to the Consolidated

Financial Statements.

A number of Vodafone subsidiaries acquired 3G licences through auctions in 2000 and

2001. An appeal was filed by Vodafone Group Services Limited on behalf of Vodafone

Limited, along with appeals filed by other UK mobile network operators which were

granted a 3G licence, with the VAT and Duties Tribunal on 18 October 2003 for recovery of

VAT on the basis that the amount of the licence fee was inclusive of VAT. The amount

claimed by Vodafone Limited is approximately £888 million. In August 2004, these claims

were referred, jointly, to the ECJ and a hearing took place on 7 February 2006. A decision

by the ECJ is expected within the next 12 to 15 months. The Group has not recognised

any amounts in respect of this matter to date. In addition, the Group has made a claim for

recovery of VAT in relation to 3G licence fees in Portugal, the Netherlands, Germany and

Ireland. The Group may also pursue similar claims in certain other European jurisdictions.

Liquidity and Capital Resources

Cash flows

The major sources of Group liquidity for the 2006 financial year have been cash

generated from operations, dividends from associated undertakings, borrowings through

short term and long term issuances in the capital markets and asset disposals. For the

year ended 31 March 2005, sources of Group liquidity were from cash generated from

operations and dividends from associates. The Group does not use off-balance sheet

special purpose entities as a source of liquidity or for other financing purposes.

The Group’s key sources of liquidity for the foreseeable future are likely to be cash

generated from operations and borrowings through long term and short term issuances

in the capital markets, as well as committed bank facilities. Additionally, the Group has a

put option in relation to its interest in Verizon Wireless which, if exercised, could provide

a material cash inflow. Please see “Option agreements and similar arrangements” at the

end of this section.

The Group’s liquidity and working capital may be affected by a material decrease in cash

flow due to factors such as reduced operating cash flow resulting from further possible

business disposals, increased competition, litigation, timing of tax payments and the

resolution of outstanding tax issues, regulatory rulings, delays in development of new

services and networks, inability to receive expected revenue from the introduction of

new services, reduced dividends from associates and investments or dividend payments

to minority shareholders. Please see the section titled “Risk Factors, Trends and

Outlook”, on pages 43 to 45. The Group anticipates a significant increase in cash tax

payments and associated interest payments over the next three years due to the

resolution of long standing tax issues. The Group is also party to a number of

agreements that may result in a cash outflow in future periods. These agreements are

discussed further in “Option agreements and similar arrangements” at the end of this

section.

Wherever possible, surplus funds in the Group (except in Albania, Romania and Egypt)

are transferred to the centralised treasury department through repayment of

borrowings, deposits and dividends. These are then on-lent or contributed as equity to

fund Group operations, used to retire external debt or invested externally.

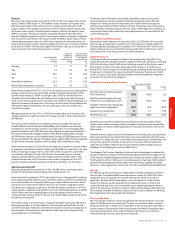

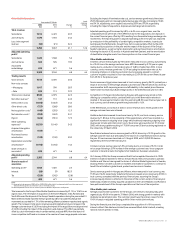

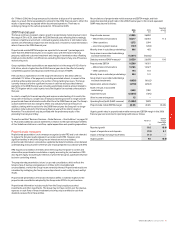

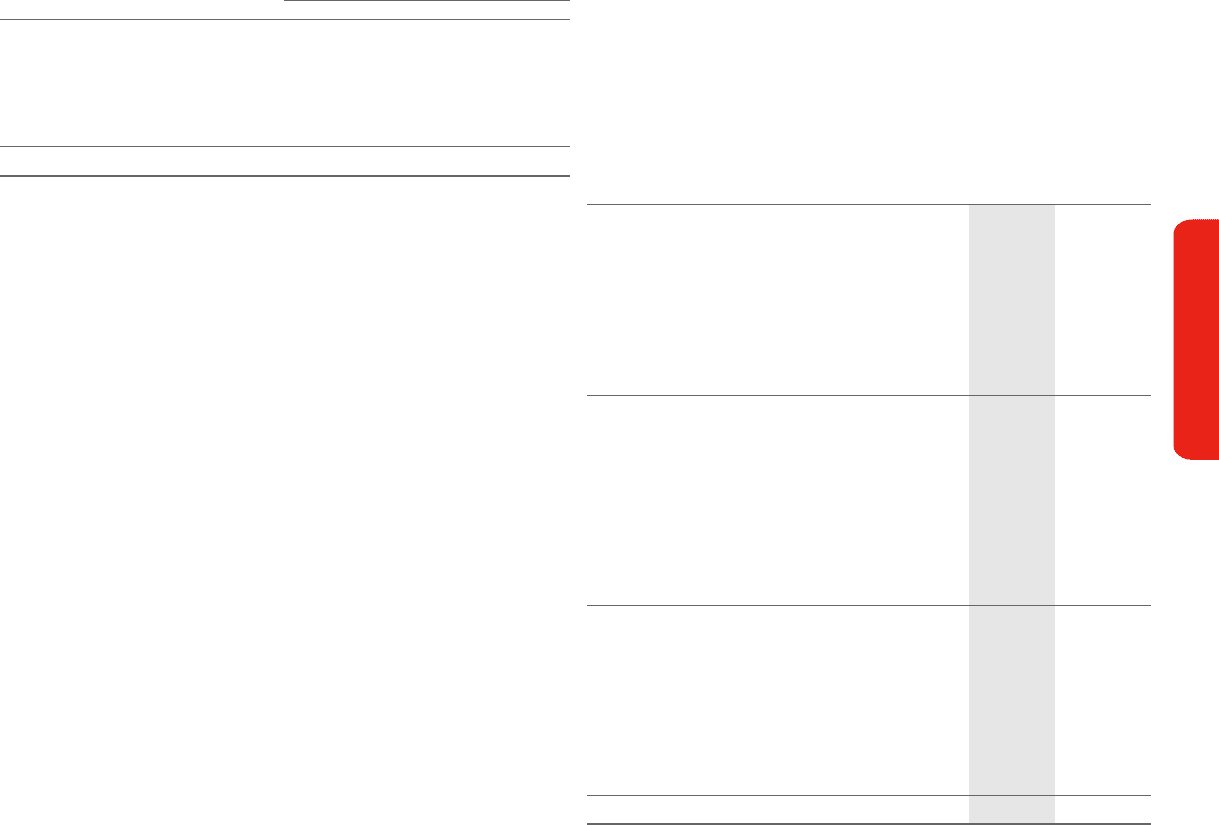

Decrease in cash in the year

During the 2006 financial year, the Group increased its net cash inflow from operating

activities by 7.9% to £11,841 million, including a 10.3% increase to £10,190 million from

continuing operations. The Group generated £6,418 million of free cash flow from

continuing operations, a reduction of 2.6% on the previous financial year, and an

additional £701 million from discontinued operations. Free cash flow from continuing

operations decreased from the prior financial year due to a reduction in the dividends

received from associated undertakings, principally Verizon Wireless, and an increase in

capital expenditure which more than offset the increase in the net cash inflow from

operating activities.

The Group holds its cash and liquid investments in accordance with the counterparty

and settlement risk limits of the Board approved treasury policy. The main forms of

liquid investments at 31 March 2006 were money market funds and bank deposits.

2006 2005

£m £m

Net cash flows from operating activities 11,841 10,979

– Continuing operations 10,190 9,240

– Discontinued operations 1,651 1,739

Taxation 1,682 1,578

Purchase of intangible fixed assets (690) (699)

Purchase of property, plant and equipment (4,481) (4,279)

Disposal of property, plant and equipment 26 68

Operating free cash flow 8,378 7,647

Taxation (1,682) (1,578)

Dividends from associated undertakings 835 1,896

Dividends paid to minority shareholders in

subsidiary undertakings (51) (32)

Dividends from investments 41 19

Interest received 319 339

Interest paid (721) (744)

Free cash flow 7,119 7,547

– Continuing operations 6,418 6,592

– Discontinued operations 701 955

Net cash outflow from acquisitions and disposals (3,587) (2,017)

Other cash flows from investing activities (56) 113

Equity dividends paid (2,749) (1,991)

Other cash flows from financing activities (1,555) (5,764)

Decrease in cash in the year (828) (2,112)

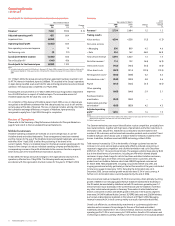

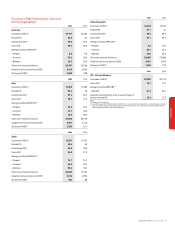

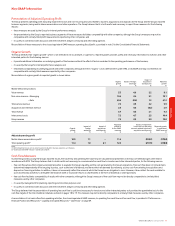

Capital expenditure

During the 2006 financial year, £4,481 million was spent on property, plant and

equipment, an increase of 4.7% from the previous financial year. From continuing

operations, the amount spent increased to £3,634 million.

The cash outflow in intangible assets reduced from £699 million in the previous

financial year to £690 million in the current financial year, with the largest element

being expenditure on computer software.

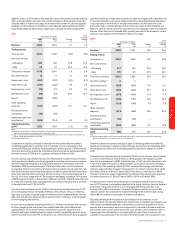

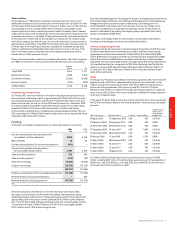

Dividends from associated undertakings and investments and dividends to

minority shareholders

Dividends from the Group’s associated undertakings and investments are generally paid

at the discretion of the board of directors or shareholders of the individual operating

Performance