Vodafone 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 55

The evaluations found the performance of each director to be effective and concluded

that the Board provides the effective leadership and control required for a listed

company. The Nominations and Governance Committee confirmed to the Board that

the contributions made by the directors offering themselves for re-election at the

AGM in July 2006 continued to be effective and the Company should support

their re-election.

Information and professional development

Each member of the Board has immediate access to a dedicated online team room and

can access monthly information including actual financial results, reports from the

executive directors in respect of their areas of responsibility and the Chief Executive’s

report which deals, amongst other things, with investor relations, giving Board members

an opportunity to develop an understanding of the views of major investors. These

matters are discussed at each Board meeting. From time to time, the Board receives

detailed presentations from non-Board members on matters of significance or on new

opportunities for the Group. Financial plans, including budgets and forecasts, are

regularly discussed at Board meetings. The non-executive directors periodically visit

different parts of the Group and are provided with briefings and information to assist

them in performing their duties. The non-executive directors and the Chairman regularly

meet without executives present.

The Board is confident that all its members have the knowledge, ability and experience

to perform the functions required of a director of a listed company. On appointment, all

directors are provided with appropriate training and guidance as to their duties,

responsibilities and liabilities as a director of a public and listed company and also have

the opportunity to discuss organisational, operational and administrative matters with

the Chairman, the Chief Executive and the Company Secretary. When considered

necessary, more formal training is provided.

Matters for the Board

The Board has a formal schedule of matters specifically referred to it for

decision, including:

•the approval of Group commercial strategy;

•Group strategic and long-term plans;

•major capital projects;

•approving annual budgets and operating plans;

•devising and reviewing the Group’s corporate governance structure;

•Group financial structure (including tax and treasury policy);

•approving statutory accounts and shareholder communications;

•Group risk management; and

•material contracts not in the ordinary course of business.

This schedule is reviewed periodically. It was last formally reviewed and updated by the

Nominations and Governance Committee in January 2004 and its proposals were

subsequently approved by the Board. Its currency and continued validity were assessed

as part of the performance evaluations conducted in the 2006 financial year described

earlier in this Report. The agendas for Board meetings are initially developed by the

Chief Executive and the Company Secretary and are finalised by the Chairman. The

directors have access to the advice and services of the Company Secretary and, both as

a group and individually, are entitled to take independent professional advice at the cost

of the Company on matters relating to the proper discharge of their responsibilities.

Executive Management

The executive directors, together with certain other Group functional heads and regional

chief executives, meet 12 times a year as the Executive Committee under the

chairmanship of the Chief Executive. The Executive Committee is responsible for the

day-to-day management of the Group’s businesses, the overall financial performance of

the Group in fulfilment of strategy, plans and budgets and Group capital structure and

funding. It also reviews major acquisitions and disposals.

Committees of the Board

The standing Board Committees are the Audit Committee, the Nominations and

Governance Committee and the Remuneration Committee. The composition and terms

of reference of these committees are published on the Group’s website at

www.vodafone.com. The Secretary to these standing Board Committees is the Company

Secretary or his nominee.

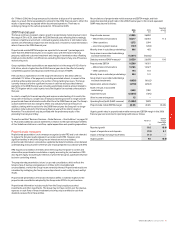

The Audit Committee

The Audit Committee is comprised of financially literate members having the necessary

ability and experience to understand financial statements. Solely for the purpose of

fulfilling the requirements of the Sarbanes-Oxley Act and the Combined Code, the Board

has designated John Buchanan, who is an independent non-executive director, satisfying

the independence requirements of Rule 10A-3 of the US Securities Exchange Act 1934,

as its financial expert on the Audit Committee. Further details of John Buchanan can be

found in “Board of Directors and Group Management”.

Under its terms of reference, the Audit Committee is required, amongst other things, to

oversee the relationship with the external auditors, to review the Company’s preliminary

results announcement, interim results and annual financial statements, to monitor

compliance with statutory and listing requirements for any exchange on which the

Company’s shares are quoted, to review the scope, extent and effectiveness of the

activity of the Group Internal Audit Department, to engage independent advisers as it

determines is necessary and to perform investigations.

The Audit Committee reports to the Board on the quality and acceptability of the

Company’s accounting policies and practices, including without limitation, critical

accounting policies and practices. The Audit Committee also plays an active role in

monitoring the Company’s compliance efforts for section 404 of the Sarbanes-Oxley Act

and receives progress updates at each of its meetings as well as a bi-annual status

presentation from the Programme Management Office.

At least twice a year, the Audit Committee meets separately with the external auditors

and the Group Audit Director without management being present. Further details on the

oversight of the relationships with the external auditors can be found under “Auditors”

and the “Report from the Audit Committee” which are set out on page 57.

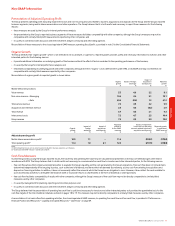

The Nominations and Governance Committee

The Nominations and Governance Committee, which provides a formal and transparent

procedure for the appointment of new directors to the Board, generally engages

external consultants to advise on prospective Board appointees. This year, the

Committee recommended the appointment of three further non-executive directors.

Detailed role profiles were agreed by the Committee before external search consultants

were engaged to prepare a shortlist of potentially suitable candidates. Only after a

rigorous interview process were the appointments recommended to the Board.

The Committee also reviewed the Group’s succession plans, directed the performance

evaluations described earlier in this Annual Report, discussed matters of corporate

governance and assessed the independence of non-executive directors prior to

reporting to the Board.

The Remuneration Committee

The Remuneration Committee is responsible to the Board for the assessment and

recommendation of policy on executive remuneration and packages for individual

executive directors. The Committee has regular private sessions without executive

directors present. Further information on the Committee’s activities is contained in the

“Board’s Report to Shareholders on Directors’ Remuneration”.

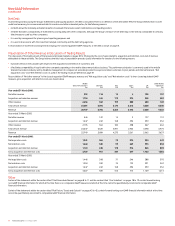

Statement on Internal Control

Introduction

The Board has established procedures that implement in full the Turnbull Guidance,

“Internal Control: Guidance for Directors on the Combined Code”, for the year under

review and to the date of approval of the Annual Report. These procedures, which are

subject to regular review, provide an ongoing process for identifying, evaluating and

managing the significant risks faced by the Group.

Responsibility

The Board has overall responsibility for the system of internal control. A sound system of

internal control is designed to manage rather than eliminate the risk of failure to achieve

business objectives, and can only provide reasonable and not absolute assurance

against material misstatement or loss. The process of managing the risks associated

with social, environmental and ethical impacts is also discussed under “Corporate

Responsibility and Environmental Issues”, on pages 59 to 60.

Control structure

The Board sets the policy on internal control that is implemented by management. This

is achieved through a clearly defined operating structure with lines of responsibility and

delegated authority. The Executive Committee, chaired by the Chief Executive, manages

this on a day-to-day basis.

The Group’s brand essence, which encapsulates the Group’s commitment to integrity

and continuous improvement, in combination with the Group’s Business Principles, sets

the tone of the Group and reflects the control consciousness of management.

Written policies and procedures have been issued which clearly define the limits of

delegated authority and provide a framework for management to deal with areas of

Governance