Vodafone 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Vodafone Group Plc Annual Report 2006

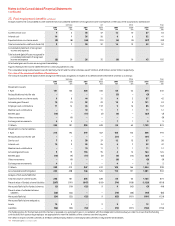

Notes to the Consolidated Financial Statements

continued

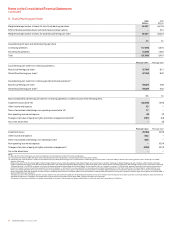

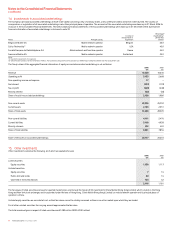

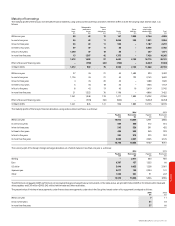

17. Trade and other receivables continued

Included within “Derivative financial instruments” is the following: 2006 2005

£m £m

Fair value through the income statement:

Interest rate swaps 19 –

Foreign exchange swaps 30 42

Option contracts 1–

Other derivatives –1

50 43

Fair value hedges:

Interest rate swaps 260 365

310 408

The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates

prevailing at the year end.

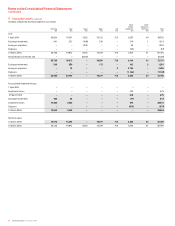

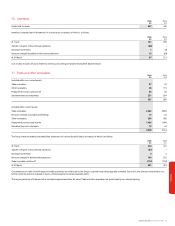

18. Cash and cash equivalents 2006 2005

£m £m

Cash at bank and in hand 948 343

Money market funds 1,841 2,708

Repurchase agreements –206

Commercial paper –512

Cash and cash equivalents as presented in the balance sheet 2,789 3,769

Bank overdrafts (18) (43)

Cash and cash equivalents of discontinued operations (note 29) 161 –

Cash and cash equivalents as presented in the cash flow statement 2,932 3,726

Bank balances and money market funds comprise cash held by the Group on a short-term basis with original maturity of three months or less. The carrying amount of these assets

approximates their fair value.

All commercial paper and repurchase agreements have a maturity of less than three months and the carrying value approximates the fair value.

All repurchase agreements represent fully collateralised bank deposits.

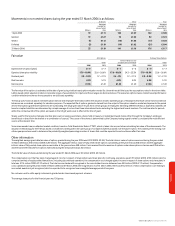

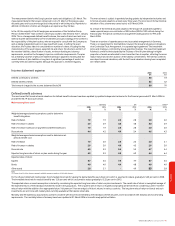

19. Called up share capital 2006 2005

Number £m Number £m

Authorised:

Ordinary shares of US$0.10 each 78,000,000,000 4,875 78,000,000,000 4,875

Ordinary shares allotted, issued and fully paid:

1 April 68,380,866,539 4,286 68,263,933,048 4,280

Allotted during the year 120,466,245 7 116,933,491 6

Cancelled during the year (2,250,000,000) (128) ––

31 March 66,251,332,784 4,165 68,380,866,539 4,286

Note:

(1) At 31 March 2006, the Group held 6,132,757,329 (2005: 3,814,233,598) treasury shares with a nominal value if £353 million (2005: £205 million). The market value of shares held is £7,390 million (2005: £5,359 million).

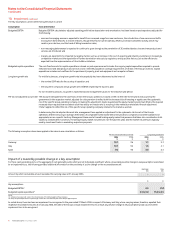

Allotted during the year Nominal

value Net proceeds

Number £m £m

UK share awards and option scheme awards 85,744,935 5 122

US share awards and option scheme awards 34,721,310 2 37

Total for share option schemes and restricted stock awards 120,466,245 7 159

Cancelled during the year

During the year 2,250,000,000 (2005: nil) treasury shares were cancelled in order to comply with Companies Act 1985 requirements in relation to the amount of issued share

capital that can be held in treasury.