Vodafone 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 107

Financials

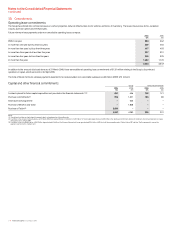

The measurement date for the Group’s pension assets and obligations is 31 March. The

measurement date for the Group’s net periodic cost is 31 March of the previous year.

Actuarial gains and losses are recognised in the period in which they arise. Payments to

defined contribution schemes are charged as an expense as they fall due.

In the UK, the majority of the UK employees are members of the Vodafone Group

Pension Scheme (the “main scheme”), which was closed to new entrants from 1 January

2006. This is a tax approved defined benefit scheme, the assets of which are held in an

external trustee-administered fund. The investment policy and strategy of the scheme is

the responsibility of the plan trustees, who are required to consult with the Company as

well as taking independent advice on key investment issues. In setting the asset

allocation, the Trustees take into consideration a number of criteria, including the key

characteristics of the asset classes, expected risk and return, the structure and term of

the member liabilities, diversification of assets, minimum funding and solvency

requirements, as well as the Company’s input on contribution requirements. The plan

has a relatively low level of pensioner liabilities already in payment, meaning that the

overall duration of plan liabilities is long term. A significant percentage of assets has

currently been allocated to equities although this approach is reviewed regularly.

The main scheme is subject to quarterly funding updates by independent actuaries and

to formal actuarial valuations at least every three years. The most recent formal triennial

valuation of this scheme was carried out as at 31 March 2004.

As a result of the triennial actuarial valuation, the Group’s UK subsidiaries agreed to

make a special lump sum contribution of £30 million (2005: £100 million) during the

financial year. The special contributions brought the funding position to 99% at 31

March 2006.

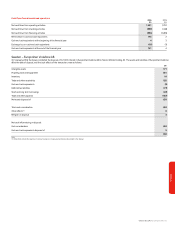

There are a number of separate pension and associated arrangements in Germany.

There is no requirement to fund liabilities, however the Group funds pension obligations

via a Contractual Trust Arrangement, in a separate legal agreement. The investment

policy and strategy is controlled by Group appointed trustees. The investment approach

followed is similar to that adopted by the Trustees of the UK plan although a higher

proportion of assets are allocated to bond securities than to equities, reflecting the more

mature nature and shorter duration of the liability commitments. The German schemes

are subject to annual valuations, with the last formal valuations having been completed

at 31 March 2006.

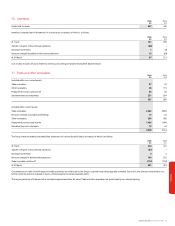

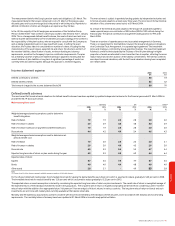

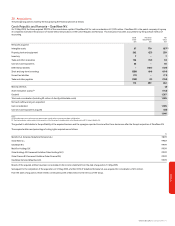

Income statement expense 2006 2005

£m £m

Defined contributions schemes 28 18

Defined benefit schemes 52 52

Total amount charged to the income statement (note 34) 80 70

Defined benefit schemes

The most recent full formal actuarial valuations for defined benefit schemes have been updated by qualified independent actuaries for the financial year ended 31 March 2006 to

provide the IAS 19 disclosures below.

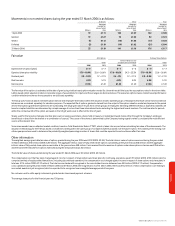

Major assumptions used Germany UK Other(1)

2006 2005 2006 2005 2006 2005

%%%%%%

Weighted average actuarial assumptions used to determine

benefit obligations:

Rate of inflation 1.9 1.9 2.8 2.8 2.0 2.0

Rate of increase in salaries 2.9 2.9 4.8 4.8 3.0 2.9

Rate of increase in pensions in payment and deferred pensions 1.9 1.9 2.8 2.8 2.0 2.0

Discount rate 4.4 4.5 4.9 5.4 4.6 4.3

Weighted average actuarial assumptions used to determine net

periodic benefit cost:

Rate of inflation 1.9 2.0 2.8 2.5 2.0 2.1

Rate of increase in salaries 2.9 3.0 4.8 4.5 2.9 3.0

Discount rate 4.5 5.3 5.4 5.5 4.7 4.4

Expected long term rate of return on plan assets during the year 4.9 5.3 6.8 6.9 6.4 6.4

Expected rates of return:

Equities 6.7 6.6 7.4 7.7 6.7 6.6

Bonds 4.0 4.0 4.4 4.8 4.0 4.0

Other assets 2.8 2.1 -4.9 5

5..332.8

Note:

(1) Figures shown for other schemes represent weighted average assumptions of individual schemes.

For the US post retirement medical plan, the immediate trend rate for valuing the dental benefits was 6.5 per cent, which is assumed to reduce gradually to 5.25 per cent in 2008.

The immediate trend rate for medical benefits was 12.0 per cent, which is assumed to reduce gradually to 5.25 per cent in 2013.

The expected return on assets assumption is derived by considering the expected long term rates of return on plan investments. The overall rate of return is a weighted average of

the expected returns of the individual investments made in the group plans. The long term rate of return on equities and property are derived from considering current “risk free”

rates of return with the addition of an appropriate future “risk premium” from an analysis of historic returns in various countries. The long term rates of return on bonds and cash

investments are set in line with market yields currently available at the balance sheet date.

Mortality and life expectancy assumptions used are consistent with those recommended by the individual scheme actuaries, and in accordance with statutory and local funding

requirements. The mortality tables in Germany have been updated at 31 March 2006 in line with newly published tables.