Vodafone 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 109

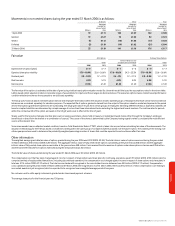

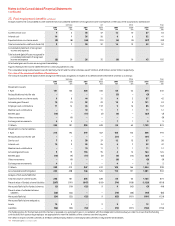

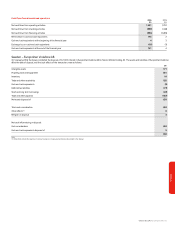

Actual return on scheme assets Germany UK Other Total

2006 2005 2006 2005 2006 2005 2006 2005

£m £m £m £m £m £m £m £m

Actual return on scheme assets 19 7143 54 16 5178 66

Analysis of scheme assets at

31 March is as follows: %%%%%%

Equities 34.1 29.8 79.9 66.6 85.0 81.0

Bonds 59.1 63.6 20.1 16.7 10.0 9.7

Property ––––5.0 4.7

Other 6.8 6.6 –16.7 –4.6

100.0 100.0 100.0 100.0 100.0 100.0

The scheme has no investments in the Group’s equity securities or in property currently used by the Group.

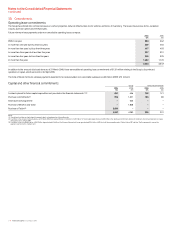

History of experience adjustments Germany UK Other Total

2006 2005 2006 2005 2006 2005 2006 2005

£m £m £m £m £m £m £m £m

Experience adjustments on

scheme liabilities:

Amount (£m) (3) (3) (1) (56) –(1) (4) (60)

Percentage of scheme liabilities (%) 1% 1% –9% –1% –6%

Experience adjustments on scheme assets:

Amount (£m) 10 (1) 99 23 12 2121 24

Percentage of scheme assets (%) 5% 1% 12% 4% 14% 3% 11% 3%

Expected contributions and benefit payments Germany UK Other Total

£m £m £m £m

Expected employer’s contributions in the year ending 31 March 2007 16 36 9 61

Expected benefit payments in the year ending 31 March:

2007 16 11 7 34

2008 15 11 7 33

2009 15 11 7 33

2010 15 12 7 34

2011 15 12 7 34

2012-2017 76 66 38 180

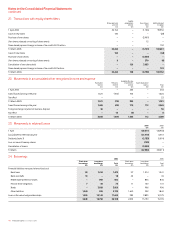

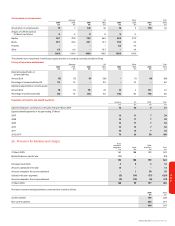

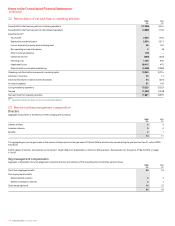

26. Provisions for liabilities and charges Asset

retirement Other

obligations Legal provisions Total

£m £m £m £m

31 March 2005 160 188 199 547

Reclassification as held for sale (25) – – (25)

135 188 199 522

Exchange movements 43310

Amounts capitalised in the year 14––14

Amounts charged to the income statement – 1 38 39

Utilised in the year - payments (3) (74) (77) (154)

Amounts released to the income statement (2) (19) (6) (27)

31 March 2006 148 99 157 404

Provisions have been analysed between current and non-current as follows:

2006 2005

£m £m

Current liabilities 139 228

Non-current liabilities 265 319

404 547

Financials