Vodafone 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

84 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

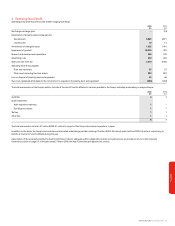

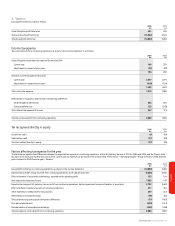

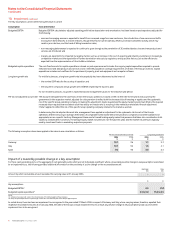

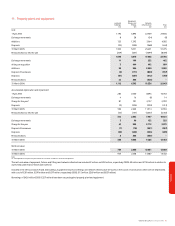

5. Investment income and financing costs 2006 2005

£m £m

Investment income

Available-for-sale investments:

Dividends received 41 19

Loans and receivables 153 201

Fair value adjustments recognised in the income statement:

Derivatives - foreign exchange contracts and interest rate futures 159 74

353 294

Financing costs

Items in hedge relationships:

Other loans 510 472

Interest rate swaps (118) (198)

Dividends on redeemable preference shares 48 –

Fair value hedging instrument 213 231

Fair value of hedged item (186) (213)

Other financial liabilities held at amortised cost:

Bank loans and overdrafts 126 129

Other loans 78 68

Dividends on redeemable preference shares –46

Potential interest charge on settlement of tax issues 329 245

Fair value adjustments recognised in the income statement:

Derivatives - forward starting swaps (48) 25

Equity put rights and similar arrangements(1) 161 67

Finance leases 78

1,120 880

Net financing costs 767 586

Note:

(1) The fair value adjustments for equity put rights and similar arrangements relates to the Group’s arrangements with Telecom Egypt and it’s minority partners in the Group’s other operations in Germany. Further information is provided in “Options

agreements and similar arrangements” on page 42.