Vodafone 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 105

Financials

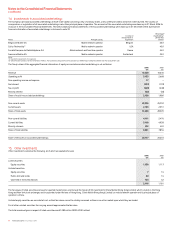

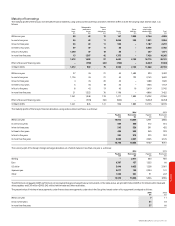

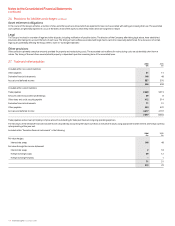

Interest rate and currency of borrowings Fixed rate borrowings

Weighted

average

Floating Fixed Weighted time for

Total rate rate average which rate is

borrowings borrowings borrowings interest rate fixed

Currency £m £m £m % Years

Sterling 1,5111,511–––

Euro 6,941 5,996 945 5.1 10.8

US dollar 8,9058,905–––

Japanese yen 1,2961,296–––

Other 1,5451,545–––

31 March 2006 20,198 19,253 945 5.1 10.8

Sterling 1,123 1,123–––

Euro 6,216 5,238 978 5.0 11.6

US dollar 5,107 5,107–––

Japanese yen 2,061 2,061–––

Other 686686–––

31 March 2005 15,193 14,215 978 5.0 11.6

Interest on floating rate borrowings is based on national LIBOR equivalents or government bond rates in the relevant currencies.

The figures shown in the tables above take into account interest rate swaps used to manage the interest rate profile of financial liabilities.

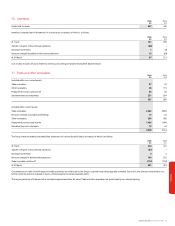

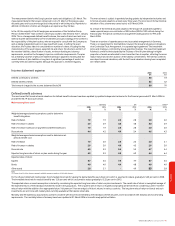

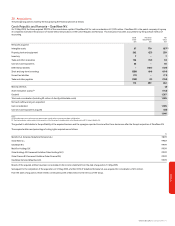

At 31 March 2006, the Group had entered into foreign exchange contracts to decrease its sterling and US dollar borrowings above by amounts equal to £2,971 million (2005: £570

million) and £6,009 million (2005: £2,703 million) respectively and to increase its euro, Japanese yen and other currency borrowings above by amounts equal to £6,230 million

(2005: £1,487 million), £1,827 million (2005: £1,913 million) and £962 million (2005: £156 million decrease to other borrowings) respectively.

Further protection from euro and Japanese yen interest rate movements on debt is provided by interest rate swaps. At 31 March 2006 the Group had euro and Japanese yen

denominated interest rate swaps for amounts equal to £1,536 million and £3,720 million respectively. The effective rates, which have been fixed, are 3.54% and 0.36% respectively.

In addition the Group has entered into euro denominated forward starting interest rate swaps for amounts equal to £698 million, £2,793 million and £698 million, which cover the

periods June 2007 to June 2008, June 2008 to June 2009 and September 2008 to September 2009 respectively. The effective rates, which have been fixed, range from 2.62% per

annum to 3.02% per annum.

Borrowing facilities

At 31 March 2006, the Group’s most significant committed borrowing facilities

comprised two bank facilities of $5,925 million (£3,407 million) and $5,025 million

(£2,890 million) expiring between two and five years and in more than five years,

respectively (2005: two bank facilities of $5,525 million (£2,926 million) and $4,853

million (£2,570 million)), and a ¥259 billion (£1,265 million, 2005: ¥225 billion (£1,112

million)) term credit facility, which expires between two and five years. The bank facilities

remained undrawn throughout the year and the ¥259 billion term credit facility was fully

drawn down on 21 December 2005.

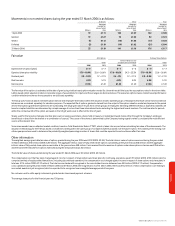

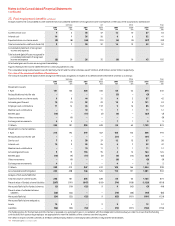

Under the terms and conditions of the $5,925 million and $5,025 million bank facilities,

lenders have the right, but not the obligation, to cancel their commitment 30 days from

the date of notification of a change of control of the Company and have outstanding

advances repaid on the last day of the current interest period. The facility agreement

provides for certain structural changes that do not affect the obligations of the

Company to be specifically excluded from the definition of a change of control. This is in

addition to the rights of lenders to cancel their commitment if the Company has

committed an event of default. Substantially the same terms and conditions apply in the

case of Vodafone Finance K.K.’s ¥259 billion term credit facility, although the change of

control provision is applicable to any guarantor of borrowings under the term credit

facility. As of 31 March 2006, the Company was the sole guarantor of the ¥259 billion

term credit facility.

In addition to the above, certain of the Group’s subsidiaries had committed facilities at

31 March 2006 of £271 million (2005: £168 million) in aggregate, of which £65 million

(2005: £77 million) was undrawn. Of the total committed facilities, £121 million (2005:

£28 million) expires in less than one year, £109 million (2005: £100 million) expires

between two and five years, and £41 million (2005: £40) expires in more than five years.

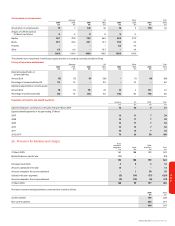

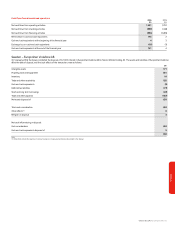

Redeemable preference shares

Redeemable preference shares comprise class D and E preferred shares issued by

Vodafone Americas, Inc. An annual dividend of $51.43 per class D and E preferred share

is payable quarterly in arrears. The dividend for the year amounted to £48 million (2005:

£46 million). The aggregate redemption value of the class D and E preferred shares is

$1.65 billion. The holders of the preferred shares are entitled to vote on the election of

directors and upon each other matter coming before any meeting of the shareholders

on which the holders of ordinary shares are entitled to vote. Holders are entitled to vote

on the basis of twelve votes for each share of class D or E preferred stock held. The

maturity date of the 825,000 class D preferred shares is 6 April 2020. The 825,000 class

E preferred shares have a maturity date of 1 April 2020. The class D and E preferred

shares have a redemption price of $1,000 per share plus all accrued and unpaid

dividends.