Vodafone 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Vodafone Group Plc Annual Report 2006

Operating Results

continued

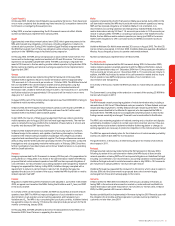

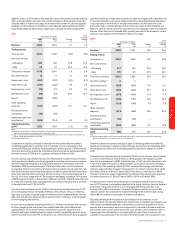

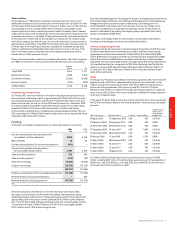

(Loss)/profit for the financial year from discontinued operations

Years ended 31 March

2006 2005 Change

£m £m %

Revenue(1) 7,268 7,396 (1.7)

Adjusted operating profit 455 664

Impairment loss (4,900) –

Operating (loss)/profit (4,445) 664

Non-operating income and expense −

−13

Net financing costs (3) (11)

(Loss)/profit before taxation (4,448) 666

Tax on (loss)/profit(1) (140) 436

(Loss)/profit for the financial year (4,588) 1,102

Note:

(1) Included a deferred tax credit of £599 million in the year to 31 March 2005 in respect of losses in Vodafone Holdings K.K.

which became eligible for offset against profits of Vodafone K.K. following the merger of the two entities on 1 October

2004.

On 17 March 2006, the Group announced that an agreement had been reached to sell

its 97.7% interest in Vodafone Japan to SoftBank. This resulted in the Group’s operations

in Japan being classified as an asset held for sale and being presented as a discontinued

operation. The disposal was completed on 27 April 2006.

Following the announcement on 17 March 2006, the Group recognised an impairment

loss of £4,900 million in respect of Vodafone Japan. The recoverable amount of

Vodafone Japan was the fair value less costs to sell.

On completion of the disposal of Vodafone Japan in April 2006, a loss on disposal was

recognised as the difference between the final sale proceeds less costs to sell and the

carrying value at the date of disposal. The loss on disposal includes, among other items,

the cumulative exchange differences in respect of Vodafone Japan previously

recognised in equity from 1 April 2004 through to completion.

Review of Operations

Please refer to the Summary of Key Performance Indicators for Principal Markets on

page 37 and note 3 to the Consolidated Financial Statements.

Mobile businesses

Vodafone operating companies are licensed on an arm’s length basis to use the

Vodafone brand and related trademarks. These arrangements have been reviewed

and the charges for the use of the Vodafone brand and related trademarks were revised

with effect from 1 April 2005 to reflect the positioning of the brand in the

current markets. There is no material impact on the Group’s overall operating profit. The

impact of the change is to reduce individual operating company profitability with a

corresponding increase in the profit attributable to the common functions segment,

which forms part of the mobile telecommunications business.

In April 2006, the Group announced changes to the organisational structure of its

operations, effective from 1 May 2006. The following results are presented in

accordance with the organisation structure in place for the year to 31 March 2006.

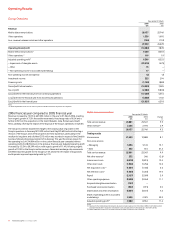

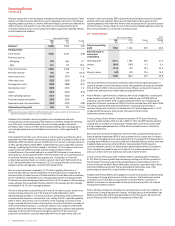

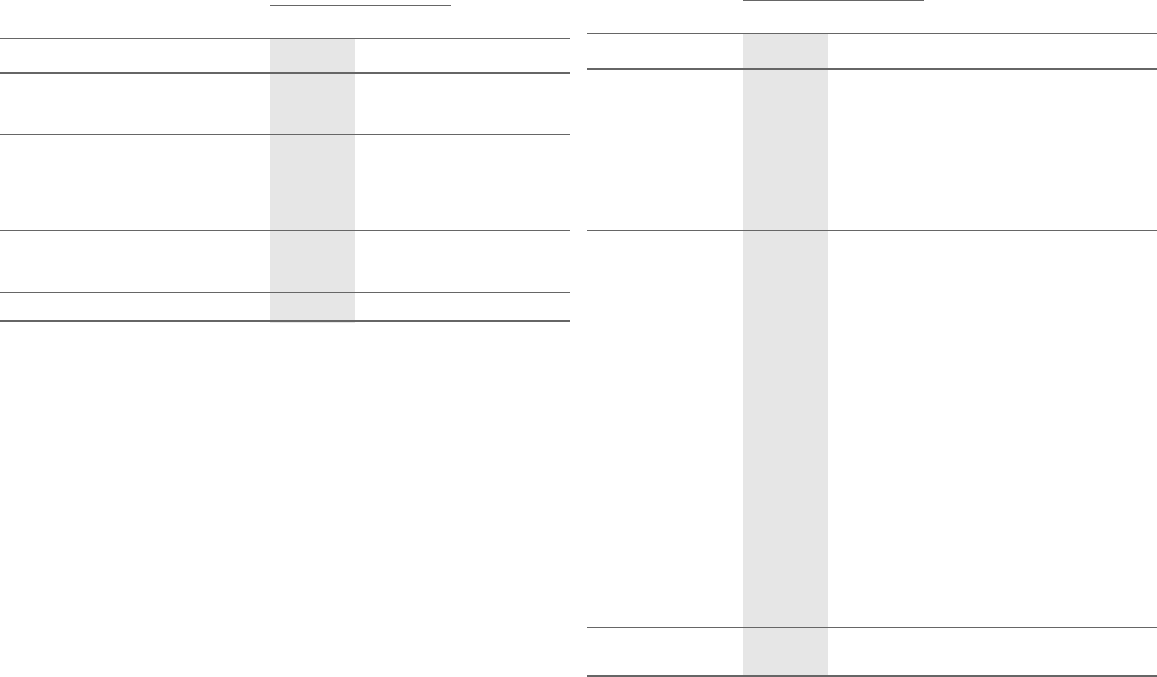

Germany

Local

Years ended 31 March currency

2006 2005 Change change

£m £m % %

Revenue(1) 5,754 5,684 1.2 1.2

Trading results

Voice services 4,304 4,358 (1.2) (1.3)

Non-voice services

– Messaging 836 800 4.5 4.6

– Data 254 162 56.8 56.8

Total service revenue 5,394 5,320 1.4 1.4

Net other revenue(1) 114 122 (6.6) (6.9)

Interconnect costs (732) (734) (0.3) (0.3)

Other direct costs (281) (314) (10.5) (10.3)

Net acquisition costs(1) (366) (348) 5.2 5.2

Net retention costs(1) (349) (330) 5.8 5.6

Payroll (412) (425) (3.1) (3.0)

Other operating

expenses (665) (646) 2.9 3.1

Purchased licence

amortisation (342) (342) – –

Depreciation and other

amortisation(2) (865) (830) 4.2 4.3

Adjusted operating

profit(2) 1,496 1,473 1.6 1.3

Notes:

(1) Revenue includes revenue of £246 million (2005: £242 million) which has been excluded from other revenue and

deducted from acquisition and retention costs in the trading results.

(2) Before impairment losses

The German market has seen recent intensification in price competition, principally from

new market entrants, together with high levels of penetration and further reductions in

termination rates. Despite this, Vodafone has continued to lead the market in the

number of 3G customers, and has launched innovative products such as mobile TV and

Vodafone Zuhause, which allows users to replace fixed line networks installed in their

homes. In addition, Vodafone launched HSDPA technology in March 2006.

Total revenue increased by 1.2% as the benefits of a larger customer base and an

increase in non-voice service revenue were partly offset by reduced voice pricing, in

response to aggressive competition, and a further termination rate cut in December

2005 from 13.2 to 11.0 eurocents per minute. The average customer base grew by 8.4%

due to the attractiveness of promotions, including an offer which allowed prepaid

customers to pay a fixed charge for calls to fixed lines and other Vodafone customers,

which was taken up by more than one and a quarter million customers, and new

products such as Vodafone Zuhause, which had 448,000 registered customers at

31 March 2006. New prepaid tariffs, including a low priced internet only offer, and

ongoing promotional activity, particularly in the last four months of the year, contributed

to total voice usage increasing by 13.7%. Excluding the termination rate cut in

December 2005, service revenue growth would have been 3.1% in local currency. A

further cut in termination rates is currently expected by the end of 2006.

Non-voice service revenue increased by 13.4% in local currency, driven primarily by strong

growth of 56.8% in non-messaging data revenue. Vodafone maintained its leadership in

the 3G market, demonstrated by Vodafone live! with 3G customers generating over 3.1

million full track music downloads in the current financial year for Vodafone, more than

any other mobile network operator in Germany. The number of active Vodafone live!

devices continued to increase, with 28.3% growth in the year. In the business segment,

there were 241,000 Vodafone Mobile Connect 3G/GPRS data cards and 226,000 wireless

push e-mail enabled devices registered on the network at 31 March 2006. Messaging

revenue increased 4.6%, in local currency, mainly as a result of promotional activities.

Overall cost efficiencies, counteracted by investments in customer acquisition and

retention and an increase in Group charges for the use of the brand and related

trademarks, which represented 1.1% of service revenue, lead to an increase in adjusted

operating profit of 1.3% in local currency to £1,496 million. Growth in 3G customers and

increased gross additions, partially offset by a rise in the proportion of low subsidy prepaid