Vodafone 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Vodafone Group Plc Annual Report 2006

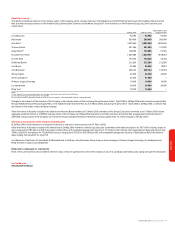

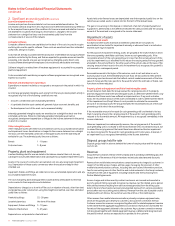

Directors’ Statement of Responsibility

United Kingdom company law requires the directors to prepare financial statements for

each financial year which give a true and fair view of the state of affairs of the Company

and the Group as at the end of the financial year and of the profit or loss of the Group for

that period. In preparing those financial statements, the directors are required to:

•select suitable accounting policies and apply them consistently;

•make judgements and estimates that are reasonable and prudent;

•state whether the Consolidated Financial Statements have been prepared in

accordance with IFRS as adopted for use in the EU;

•for the Company Financial Statements, state whether applicable UK accounting

standards have been followed; and

•prepare the financial statements on a going concern basis unless it is inappropriate to

presume that the Company and the Group will continue in business.

The directors are responsible for keeping proper accounting records which disclose with

reasonable accuracy at any time the financial position of the Company and the Group

and to enable them to ensure that the financial statements comply with the Companies

Act 1985 and Article 4 of the IAS Regulation. They are also responsible for the system of

internal control, for safeguarding the assets of the Company and the Group and, hence,

for taking reasonable steps for the prevention and detection of fraud and other

irregularities.

Disclosure of Information to Auditors

Having made the requisite enquiries, so far as the directors are aware, there is no

relevant audit information (as defined by Section 234ZA of the Companies Act 1985) of

which the Company’s auditors are unaware, and the directors have taken all the

steps they ought to have taken to make themselves aware of any relevant audit

information and to establish that the Company’s auditors are aware of that information.

Going Concern

After reviewing the Group’s and Company’s budget for the next financial year, and other

longer term plans, the directors are satisfied that, at the time of approving the financial

statements, it is appropriate to adopt the going concern basis in preparing the financial

statements.

By Order of the Board

Stephen Scott

Secretary

30 May 2006