Vodafone 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 21

Associates

SFR and Cegetel

In December 2003, in order to optimise cash flows between Cegetel Group and its

shareholders, SFR was merged into Cegetel Group and this company was renamed SFR.

The fixed line businesses, Cegetel S.A. and Télécom Développement, previously

controlled by SNCF, were merged to form Cegetel S.A.S. (“Cegetel”), a company in which

SFR had a 65% stake, giving the Group an effective interest of 28.5% at that date. The

Group’s interest in SFR remained at approximately 43.9% as a result of this

reorganisation.

On 11 May 2005, SFR announced an agreement to merge its fixed line business,

Cegetel, with Neuf Telecom, subject to competition and regulatory authority and

employee council approvals which were received, and the transaction completed, on

22 August 2005. Under the agreement, SFR purchased SNCF’s 35% minority interest in

Cegetel, according to a pre-existing contract, and then contributed 100% of the capital

of Cegetel to Neuf Telecom. In return, SFR received a 28% interest in the combined

entity, Neuf Cegetel, together with a 380 million bond to be issued by Neuf Cegetel,

bringing the Group’s effective shareholding in Neuf Cegetel to 12.4%.

Disposals

During the three year period ended on 31 March 2006, the Group has also disposed of

interests in a number of Group companies.

Japan

On 14 November 2003, Vodafone Holdings K.K. completed the disposal of its 100%

interest in Japan Telecom. The Group ceased consolidating the results of Japan Telecom

from 1 October 2003. Receipts resulting from this transaction were ¥257.9 billion (£1.4

billion), comprising ¥178.9 billion (£1.0 billion) of cash, ¥32.5 billion (£0.2 billion) of

transferable redeemable preferred equity and ¥46.5 billion (£0.2 billion) recoverable

withholding tax, which was received during the 2005 financial year. In October 2004, the

preferred equity was sold to the original purchaser for ¥33.9 billion (£0.2 billion).

On 17 March 2006, the Group announced an agreement to sell its 97.7% holding in

Vodafone Japan to SoftBank. The transaction completed on 27 April 2006 for cash

consideration of approximately ¥1.42 trillion (£6.9 billion) including the repayment of

intercompany debt of ¥0.16 trillion (£0.8 billion). In addition, the Group received non-

cash consideration with a fair value of approximately ¥0.23 trillion (£1.1 billion),

comprised of preferred equity and a subordinated loan. SoftBank also assumed debt of

¥0.13 trillion (£0.6 billion).

Sweden

On 5 January 2006, the Group completed the disposal of its 100% interest in Vodafone

Sweden to Telenor Mobile Holding AS (“Telenor”). Net cash proceeds after assumption

of net debt by Telenor were 970 million (£678 million).

Other disposals

During the 2004 financial year, the Group disposed of its interests in its associated

undertakings in Mexico, Grupo Iusacell, and India, RPG Cellular.

On 26 January 2005, the Group completed the disposal of a 16.9% stake in Vodafone

Egypt to Telecom Egypt, reducing the Group’s effective interest to 50.1%.

Business

Regulation

Introduction

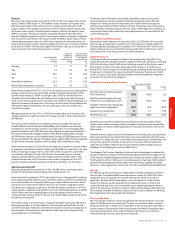

The Group’s operating companies are generally subject to regulation governing the

operation of their business activities. Such regulation typically takes the form of industry

specific law and regulation covering telecommunications services and general

competition (anti-trust) law applicable to all activities. Some regulation implements

commitments made by Governments under the Basic Telecommunications Accord of

the World Trade Organisation to facilitate market entry and establish regulatory

frameworks. The following section describes the regulatory framework and the key

regulatory developments in the EU and selected countries in which the Group has

significant interests. Many of the regulatory developments reported in the following

section involve ongoing proceedings or consideration of potential proceedings that

have not reached a conclusion. Accordingly, the Group is unable to attach a specific level

of financial risk to the Group’s performance from such matters.

European Union

Although most Member States of the EU (“Member States”) have now implemented the

EU Regulatory Framework for the communications sector (“the EU Framework”), which

was adopted in 2002, there remain both ongoing and new infringement proceedings

against a number of Member States for late or inadequate implementation.

The EU Framework consists of four principal Directives outlining matters such as the

objectives to be pursued by national regulatory authorities (“NRAs”), the way in which

telecommunications operators are to be licensed, measures to be taken to protect

consumers and ensure universal provision of certain telecommunications services and

the terms and basis upon which operators interconnect and provide access to each

other.

The EU Framework introduces a number of important changes to the previous

framework. It is intended to align the techniques for defining where sector specific

regulation may be applied and the threshold for when such regulation can be applied

with those already employed in EU competition law. It is also intended to ensure greater

consistency of approach amongst NRAs within the Member States. All NRAs are required

to take utmost account of the list of markets which are specified by the European

Commission (the “Commission”) in a Recommendation when deciding which markets to

investigate. The first such Recommendation was published by the Commission in

February 2003 and includes markets at a wholesale level, for ‘voice call termination on

individual mobile networks’ (the “call termination market”), the ‘wholesale national

market for international roaming’ (the “roaming market”) and the wholesale market for

‘access and call origination’ (the “access market”) on public mobile networks (together

the “relevant markets”). NRAs may, with the Commission’s consent, also propose

markets not included in the Recommendation. The Commission will periodically review

the Recommendation and the Commission has said it expects to complete the first such

review by the end of 2006. This review may lead to an increase or a decrease in the

number and scope of markets subject to sector specific regulation. Changes to the

Recommendation are expected to become effective at the conclusion of the review,

while any changes to the framework would become effective following their

transposition into national law, from approximately 2010 onwards. So far, the

Commission has signalled that only minor changes to the regulatory framework will be

considered. Whether the reviewed regulatory framework will increase or decrease the

regulatory burden on the Group will depend on the changes being adopted by the

EU, the manner in which revised directives are subsequently implemented in

Member States and how the revised regulatory framework will be applied by the

respective NRAs.

Regulation, under the EU Framework, can only be applied to undertakings with

significant market power (“SMP”) (either individually or collectively) in the relevant

markets, subject to the Commission’s consent. SMP under the EU Framework accords

with the concept of “dominance” under existing EU competition law. This generally

implies a market share of at least 40%, although other factors may also be taken into

consideration. The SMP threshold under the previous framework required only a 25%

share of the relevant market. The Commission published SMP Guidelines in July 2002,

which set out principles for use by NRAs in the analysis of markets to determine if

undertakings have SMP under the EU Framework.

Spectrum

In September 2005, the Commission published proposals for spectrum reform across

the EU, including proposals to allow holders of spectrum greater flexibility on the use to

which it is put, to allow holders to trade spectrum within a spectrum market and to

improve harmonisation of certain bands. The Commission has proposed that these

reforms be enacted by 2010 and has commenced a number of actions to pursue its

proposals, principally through the work of the Radio Spectrum Policy Group, a spectrum

policy working group comprising the Commission and Member States.

Data retention

In 2005, the European Parliament passed a new Directive on the retention of electronic

communications data for law enforcement purposes. Member States must now proceed

with national implementation. The Directive sets out the data that network operators

and service providers must store and, if requested, make available to law enforcement

authorities for the purpose of the prevention, investigation, detection and prosecution of

serious criminal offences. The initial investment and recurring annual operating costs to

the Group of this data retention requirement may be material. It depends on how it is

implemented nationally and the extent to which the total of such costs are

compensated.

International Roaming

In February 2006, the Commission announced that it is proposing to enact new

legislation by way of a regulation under Article 95 of the EU Treaty (which would have

immediate effect) to reduce what it considers to be excessive prices charged by mobile

network operators for international roaming services. The Commission has concluded its

consultation on proposals for a regulation which will include both retail price regulation

aimed at ensuring that the costs of calls when roaming are no more than equivalent

domestic calls and the regulation of wholesale prices charged between mobile