Vodafone 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 11

Strategy

We have a significant opportunity to deliver

value to both our customers and shareholders.

£9 billion

Special distribution

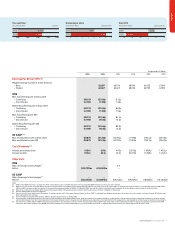

Capital expenditure on fixed assets is expected to be in the range of £4.2 billion to

£4.6 billion, higher than last year due to the investment needs for recent acquisitions

and the wider rollout of HSDPA. Free cash flow is anticipated to be in the range of

£4.0 billion to £4.5 billion. Higher tax payments, including around £1.2 billion, with interest

costs, from settling some long standing disputes, increased capital expenditure and

higher financing costs from our increased borrowing, are expected to offset continued

growth in underlying operating cash flows.

Executing our strategy

We have a good track record of delivering against our plans and demonstrating

outperformance against the majority of our principal competitors. However, our

environment is changing and we need to adapt to ensure we continue to meet our

customer needs and deliver superior returns to shareholders.

We have established clear strategic objectives: cost reduction and revenue stimulation

in Europe; innovating and delivering total communications solutions; delivering

strong growth in emerging markets; actively managing our portfolio to maximise

returns; and aligning our financial policies to our strategy. We have reorganised the

business as we begin to deliver against these objectives.

Vodafone is well placed to execute on this strategy. Our scale makes us the clear partner

of choice for others and we have a track record for innovation. We have a strong brand

and an unrivalled customer reach. As customer demands evolve and technology

converges, we remain focused on the core benefits of mobility and personalisation

as we seek to deliver total communications solutions. We have a significant opportunity

to deliver value to both our customers and shareholders.

On a final note, on behalf of the Board, I would like to express sincere thanks to Ian

MacLaurin, who is retiring as Chairman, for his service and support to the Company

since 1997. We wish him continued success.

Arun Sarin

Chief Executive

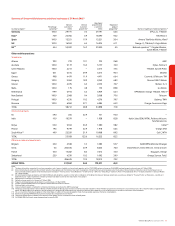

02468

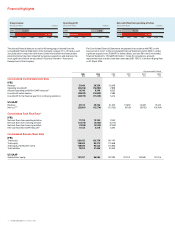

Dividends (pence)

2005

2006

4.07

6.07

+49%

02468

Share purchases (£bn)

2005

2006

4.0

6.5

+£2.5bn

Financial implications

Our One Vodafone programme, which primarily has been focused on our mature

mobile markets in Europe, delivers efficiencies in operating costs, being payroll and

other operating expenses, and in capital expenditures. We have previously targeted

keeping these total costs broadly stable between the 2004 and 2008 financial years,

with operating costs expected to rise at a lower rate than revenue. Through our new

strategic objectives, we now expect underlying operating costs alone to be broadly

stable between the 2006 and 2008 financial years for the total of our European

operations and central costs.

On the same basis, we continue to target expenditures on fixed assets to be 10% of

revenue for the 2008 financial year. We also continue to expect at least 1% additional

revenue market share between the 2005 and 2008 financial years, measured against

our established principal competitors in Germany, Italy, Spain and the UK.

Our strategic changes also have implications on returns to shareholders and our capital

structure. We have previously indicated an intention to pay out approximately 50% of

adjusted earnings per share for the 2007 financial year onwards. We now consider it

appropriate to target a 60% payout ratio, with effect for the full 2006 financial year, with

a view to growing the dividend per share in line with underlying earnings per share

thereafter. Dividends per share have, therefore, increased by 49% to 6.07 pence for

the year.

As we enter a new phase in our development, we believe that the most appropriate

capital structure, which meets the needs of both the business and shareholders, is one

that reflects a higher level of gearing. The incremental borrowing capacity this provides

enables an additional return of £3.0 billion to shareholders, which will be combined with

the £6.0 billion return of cash from the sale of Japan in early August. As a result, we do

not currently plan any further share purchases or other one-off returns to shareholders.

This £9.0 billion one-off return, together with the £6.5 billion share purchase

programme completed during the last year and £3.7 billion of dividends, gives an overall

return to shareholders of £19.2 billion.

Prospects for the year ahead

While we are delivering on cost reduction, revenue stimulation and emerging market

growth in the shorter term, the potential benefits from serving our customers’ total

communications needs will materialise over a longer timeframe.

For the year ahead, we expect operating conditions to remain challenging, with a

continued intense competitive environment and further regulatory pressure, but

nevertheless see continued growth in Group revenue. We are anticipating higher

customer investment, pricing pressures and further termination rate reductions to

impact growth in adjusted operating profit, however initiatives to deliver further cost

efficiencies are expected to mitigate this effect.