Vodafone 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 113

Financials

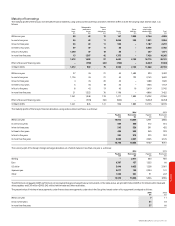

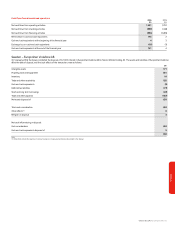

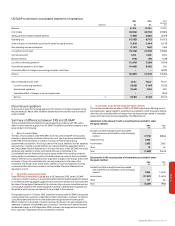

South Africa – VenFin Limited

On 26 January 2006, the Group announced that its offer to acquire a 100% interest in VenFin Limited (“VenFin”) had become wholly unconditional. VenFin’s principal asset was a 15%

stake in Vodacom Group (Pty) Limited (“Vodacom”). At 31 March 2006, the Group held an effective economic interest in VenFin of 98.7% and an effective voting interest of 99.3%.

The combined cash consideration for the Group’s 98.7% economic interest in VenFin was ZAR15.8 billion (£1,458 million).

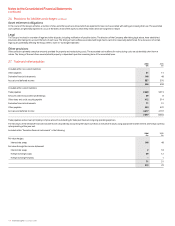

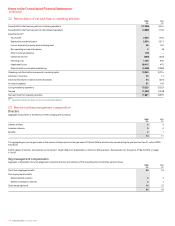

Book Fair value Fair

value adjustments value

£m £m £m

Net assets acquired:

Intangible assets 24 600 624(1)

Property, plant and equipment 216 – 216

Inventory 8–8

Trade and other receivables 74 – 74

Cash and cash equivalents 14 – 14

Deferred tax liabilities (1) (180) (181)

Short and long-term borrowings (36) – (36)

Current tax liabilities (20) – (20)

Trade and other payables (110) – (110)

169 420 589

Minority interests (9)

Goodwill 878

Total cash consideration (including £7 million of directly attributable costs) 1,458

Net cash outflow arising on acquisition:

Cash consideration 1,458

Cash and cash equivalents acquired (14)

1,444

Note:

(1) Intangible assets consist of licences and spectrum fees of £391 million and other intangibles of £233 million.

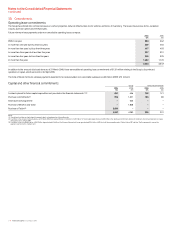

The goodwill is attributable to the profitability of the acquired business and the synergies expected to arise within that business after the Group's acquisition of VenFin.

Results of the acquired entities have been proportionately consolidated in the income statement from the date of acquisition.

From the date of acquisition, the acquired part of the entity contributed a loss of £30 million to the net loss of the Group.

On 20 April 2006, the Group completed the compulsory acquisition of the remaining minority shareholdings in VenFin, from which date the Group holds 100% of the issued share

capital of VenFin. As a result, the Group holds 50% of the share capital of Vodacom.

Across the acquisitions mentioned above, the weighted average life of licences and spectrum fees is 10 years, the weighted average life of other intangible assets is five years and

the weighted average of total intangibles is eight years.

Turkey – Telsim Mobil Telekomunikasyon

On 24 May 2006, the Group completed the acquisition of substantially all the assets and business of Telsim Mobil Telekomunikasyon (“Telsim”) from the Turkish Savings Deposit

and Investment Fund. The cash paid on this date was US$4.67 billion (£2.6 billion). It is impracticable to provide further information due to the proximity of the acquisition date to

the date of approval of the Consolidated Financial Statements.

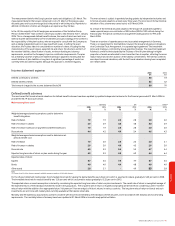

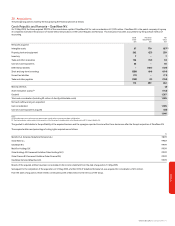

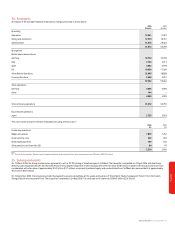

Pro forma full year information

The following unaudited pro forma summary presents the Group as if all of the businesses acquired in the year to 31 March 2006 had been acquired on 1 April 2005 or 1 April 2004,

respectively. The pro forma amounts include the results of the acquired companies, amortisation of the acquired intangibles assets recognised on acquisition and the interest expense

on debt incurred as a result of the acquisition. The pro forma amounts do not include any possible synergies from the acquisition. The pro forma information is provided for comparative

purposes only and does not necessarily reflect the actual results that would have occurred, nor is it necessarily indicative of future results of operations of the combined companies.

2006 2005

£m £m

Revenue 29,924 27,709

(Loss) /profit for the financial year (21,870) 6,239

(Loss) /profit attributable to equity shareholders (21,966) 6,131

Pence per share Pence per share

Basic (loss)/earnings per share from continuing and discontinued operations (35.09) 9.26

Diluted (loss)/earnings per share from continuing and discontinued operations(1) (35.09) 9.23

Note:

(1) In the year ended 31 March 2006, there are no dilutive ordinary shares as the Group recorded a loss for the financial year.