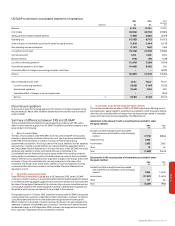

Vodafone 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

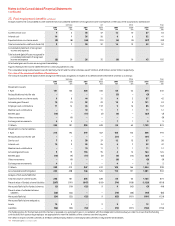

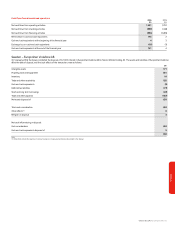

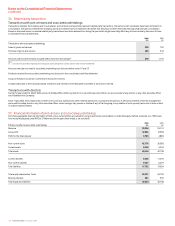

32. Reconciliation of net cash flows to operating activities 2006 2005

£m £m

(Loss)/profit for the financial year from continuing operations (17,233) 5,416

(Loss)/profit for the financial year from discontinued operations (4,588) 1,102

Adjustments for(1):

Tax on profit 2,520 1,433

Depreciation and amortisation 5,834 5,517

Loss on disposal of property, plant and equipment 88 162

Non operating income and expense 2(6)

Other income and expense (15) –

Investment income (353) (303)

Financing costs 1,123 900

Impairment losses 28,415 475

Share of result in associated undertakings (2,428) (1,980)

Operating cash flows before movements in working capital 13,365 12,716

Decrease in inventory 23 17

Decrease/(increase) in trade and other receivables 54 (321)

Increase in payables 81 145

Cash generated by operations 13,523 12,557

Tax paid (1,682) (1,578)

Net cash flows from operating activities 11,841 10,979

Note:

(1) Adjustments include amounts relating to continuing and discontinued operations.

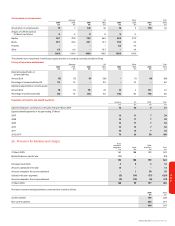

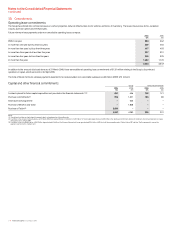

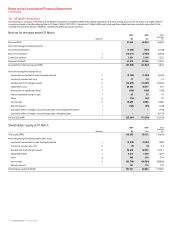

33. Directors and key management compensation

Directors

Aggregate emoluments of the directors of the Company were as follows:

2006 2005

£m £m

Salaries and fees 66

Incentive schemes 54

Benefits 21

13 11

The aggregate gross pre-tax gain made on the exercise of share options in the year ended 31 March 2006 by directors who served during the year was less than £1 million (2005:

£3 million).

Further details of directors’ emoluments can be found in “Board’s Report to Shareholders on Directors’ Remuneration – Remuneration for the year to 31 March 2006” on pages

61 to 69.

Key management compensation

Aggregate compensation for key management, being the directors and members of the Group Executive Committee, were as follows:

2006 2005

£m £m

Short term employee benefits 26 18

Post-employment benefits:

Defined benefit schemes 22

Defined contribution schemes 21

Share-based payments 16 22

46 43