Vodafone 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Vodafone Group Plc Annual Report 2006

Notes to the Company Financial Statements

continued

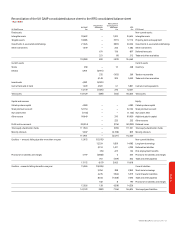

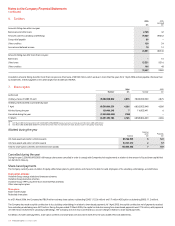

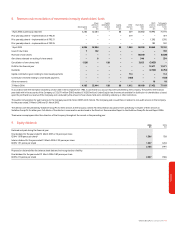

6. Creditors 2006 2005

(restated)

£m £m

Amounts falling due within one year:

Bank loans and other loans 2,143 42

Amounts owed to subsidiary undertakings 74,229 89,652

Group relief payable 89 –

Other creditors 120 34

Accruals and deferred income 10 12

76,591 89,740

Amounts falling due after more than one year:

Bank loans –16

Other loans 13,321 9,316

Other creditors 166 48

13,487 9,380

Included in amounts falling due after more than one year are other loans of £5,942 million, which are due in more than five years from 1 April 2006 and are payable otherwise than

by instalments. Interest payable on this debt ranges from 3.625% and 7.875%.

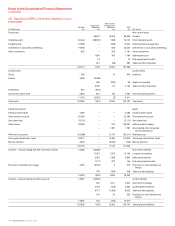

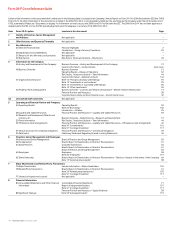

7. Share capital 2006 2005

Number £m Number £m

Authorised:

Ordinary shares of US$0.10 each 78,000,000,000 4,875 78,000,000,000 4,875

Ordinary shares allotted, issued and fully paid:

1 April 68,380,866,539 4,286 68,263,933,048 4,280

Allotted during the year 120,466,245 7 116,933,491 6

Cancelled during the year (2,250,000,000) (128) ––

31 March 66,251,332,784 4,165 68,380,866,539 4,286

Notes:

(1) At 31 March 2006 the Company held 6,120,129,348 (2005: 3,785,000,000) treasury shares with a nominal value of £352 million (2005: £205 million).

(2) At 31 March 2006, 50,000 (2005: 50,000) 7% cumulative fixed rate shares of £1 each were authorised, allotted, issued and fully paid by the Company.

Allotted during the year Nominal

value Proceeds

Number £m £m

UK share awards and option scheme awards 85,744,935 5 122

US share awards and option scheme awards 34,721,310 2 37

Total for share option schemes and restricted stock awards 120,466,245 7 159

Cancelled during the year

During the year 2,250,000,000 (2005: nil) treasury shares were cancelled in order to comply with Companies Act requirements in relation to the amount of issued share capital that

can be held in treasury.

Share-based payments

The Company currently uses a number of equity settled share plans to grant options and shares to the directors and employees of its subsidiary undertakings, as listed below.

Share option schemes

Vodafone Group savings related and sharesave schemes

Vodafone Group executive schemes

Vodafone Group 1999 Long Term Stock Incentive Plan and ADSs

Other share option plans

Share plans

Share Incentive plan

Restricted share plans

As at 31 March 2006, the Company had 786.9 million ordinary share options outstanding (2005: 1,122.6 million) and 7.7 million ADS options outstanding (2005: 11.2 million).

The Company has made a capital contribution to its subsidiary undertakings in relation to share based payments. At 1 April 2005, the capital contribution net of payments received

from subsidiary undertakings was £419 million. During the year ended 31 March 2006, the capital contribution arising from share based payments was £114 million, with payments

of £150 million received from subsidiary undertakings. The Company does not incur a profit and loss account charge in relation to share based payments.

Full details of share based payments, share option schemes and share plans are disclosed in note 20 to the Consolidated Financial Statements.