Vodafone 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

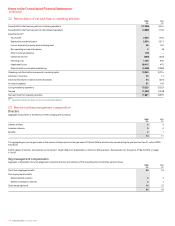

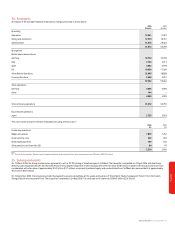

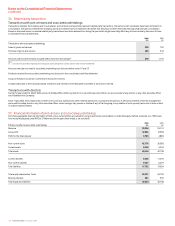

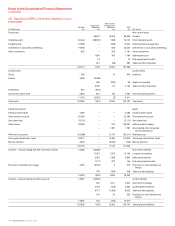

38. US GAAP information

The following is a summary of the effects of the differences between US GAAP and IFRS. The unaudited translation of pounds sterling amounts into US dollars is provided solely for

convenience based on the Noon Buying Rate on 31 March 2006 of $1.7393: £1. Amounts at 31 March 2005 and for the year then ended have been restated to give effect to the

modified retrospective adoption of SFAS No. 123 (Revised 2004), discussed in (j) below.

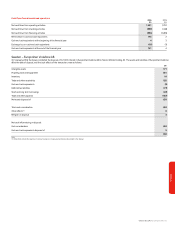

Net loss for the years ended 31 March 2006 2006 2005

Restated

Reference $m £m £m

Revenue (IFRS) 51,048 29,350 26,678

Items (decreasing)/increasing revenues:

Discontinued operations (1,642) (944) (1,108)

Basis of consolidation a(10,011) (5,756) (5,423)

Connection revenue b1,924 1,106 1,223

Revenue (US GAAP) 41,319 23,756 21,370

(Loss)/profit for the financial year (IFRS) (37,953) (21,821) 6,518

Items (increasing)/decreasing net loss:

Investments accounted for under the equity method c (2,139) (1,230) (5,440)

Connection revenue and costs b 17 10 16

Goodwill and other intangible assets d (24,870) (14,299) (15,534)

Impairment losses e26,745 15,377 475

Amortisation of capitalised interest f (188) (108) (105)

Interest capitalised during the year f 63 36 19

Other g(74) (42) 99

Income taxes h15,483 8,902 6,680

Minority interests i(165) (95) (108)

Cumulative effect of change in accounting principle: post employment benefits j ––(195)

Cumulative effect of change in accounting principle: intangible assets j ––(6,177)

Net loss (US GAAP) (23,081) (13,270) (13,752)

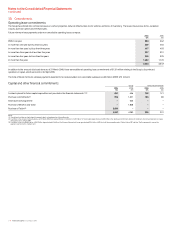

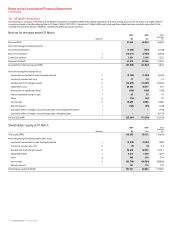

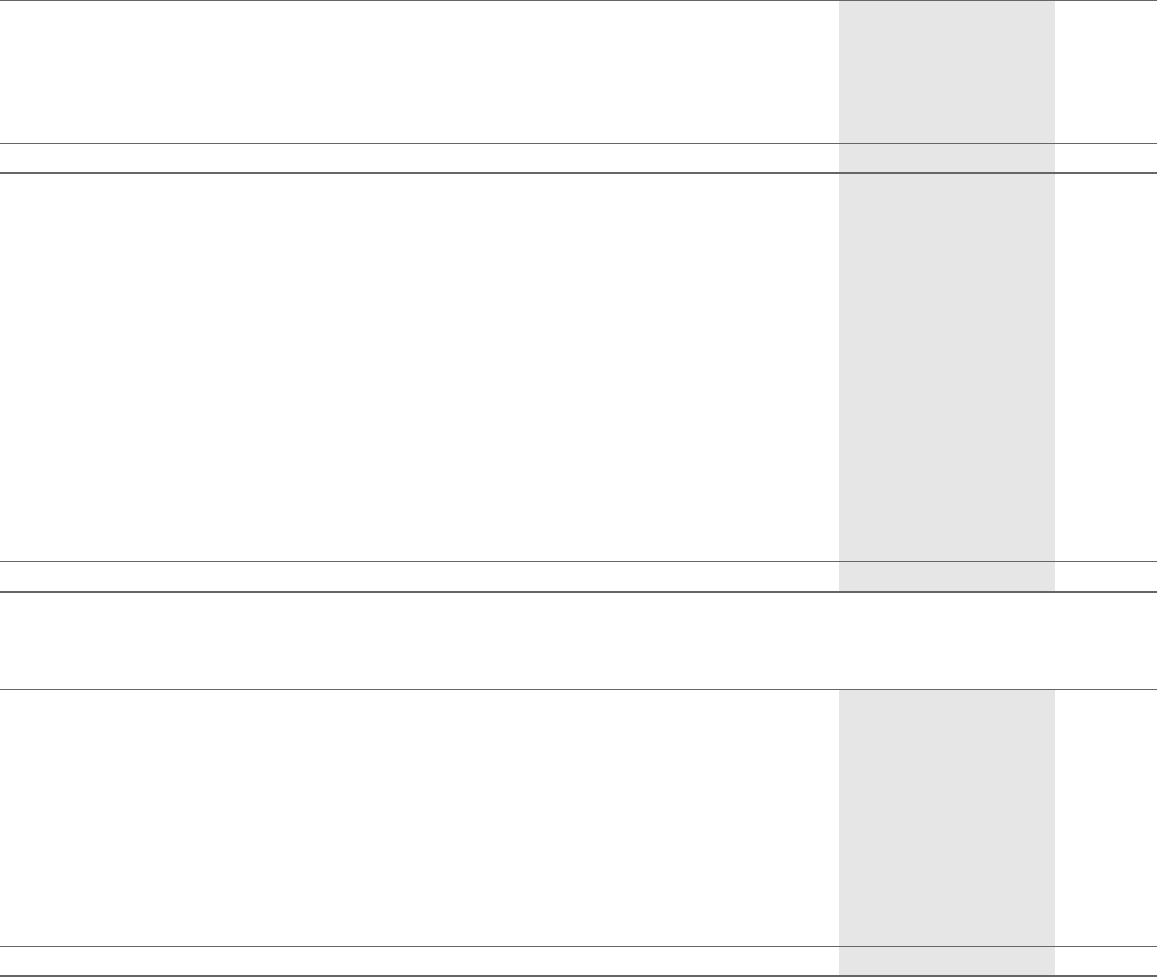

Shareholders’ equity at 31 March 2006 2006 2005

Restated

Reference $m £m £m

Total equity (IFRS) 148,383 85,312 113,648

Items (decreasing)/increasing shareholders’ funds:

Investments accounted for under the equity method c (3,978) (2,287) (982)

Connection revenue and costs b (9) (5) (14)

Goodwill and other intangible assets d 56,618 32,552 31,714

Capitalised interest f2,510 1,443 1,529

Other g365 210 104

Income taxes h(52,795) (30,354) (38,856)

Minority interests i197 113 152

Shareholders’ equity (US GAAP) 151,291 86,984 107,295