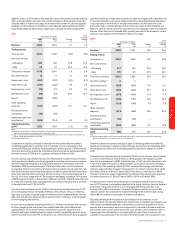

Vodafone 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

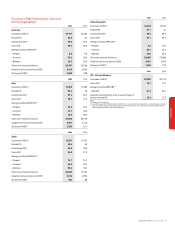

40 Vodafone Group Plc Annual Report 2006

Financial Position and Resources

continued

companies and Vodafone has no rights to receive dividends, except where specified

within certain of the companies’ shareholders’ agreements, such as with SFR, the Group’s

associated undertaking in France. Similarly, the Group does not have existing obligations

under shareholders’ agreements to pay dividends to minority interest partners of Group

subsidiaries, except as specified below.

Included in the dividends received from associated undertakings and investments was an

amount of £195 million received from Verizon Wireless. Until April 2005, Verizon Wireless’

distributions were determined by the terms of the partnership agreement distribution

policy and comprised income distributions and tax distributions. Since April 2005, tax

distributions have continued and a new distribution policy is expected to be set in the

future by the Board of Representatives of Verizon Wireless. Current projections forecast

that tax distributions will not be sufficient to cover the US tax liabilities arising from the

Group’s partnership interest in Verizon Wireless until 2015 and, in the absence of

additional distributions above the level of tax distributions during this period, will result in

a net cash outflow for the Group. Under the terms of the partnership agreement, the

board of directors has no obligation to provide for additional distributions above the level

of the tax distributions. It is the expectation that Verizon Wireless will re-invest free cash

flow in the business and reduce indebtedness for the foreseeable future.

During the year ended 31 March 2006, cash dividends totalling £511 million were

received from SFR in accordance with the shareholders’ agreement.

Verizon Communications Inc. (“Verizon Communications”) has an indirect 23.1%

shareholding in Vodafone Italy and, under the shareholders’ agreement, can request

dividends to be paid, provided that such dividends would not impair the financial

condition or prospects of Vodafone Italy including, without limitation, its credit rating.

No dividends were proposed or paid by Vodafone Italy during or since the year ended

31 March 2006 but a share purchase programme occurred during the financial year,

further details of which are provided on page 41.

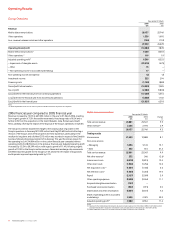

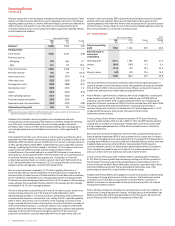

Acquisitions and disposals

The Group invested a net £3,643 million in acquisition and disposal activities, including a

net cash outflow of £56 million from the purchase and disposal of investments, in the

year to 31 March 2006. The acquisitions are described in more detail under “Business

Overview – History and Development of the Company”.

An analysis of the main transactions in the 2006 financial year, including the changes in

the Group’s effective shareholding, is shown below: £m

Acquisitions:

Czech Republic (nil to 100%) and Romania (20.1% to 100%)(1) 1,840

South Africa (35.0% to 49.9%)(1) 1,444

India (nil to 10.0%)(1) 849

Disposals:

Sweden (100% to nil) (658)

Other net acquisitions and disposals, including investments 168

3,643

Note:

(1) Amounts are shown net of cash and cash equivalents acquired.

On 17 March 2006, the Group announced an agreement to sell its 97.7% holding in

Vodafone Japan to SoftBank. The transaction completed on 27 April 2006 with the

Group receiving cash of approximately ¥1.42 trillion (£6.9 billion), including the

repayment of intercompany debt of ¥0.16 trillion (£0.8 billion). In addition, the Group

received non-cash consideration with a fair value of approximately ¥0.23 trillion (£1.1

billion), comprised of preferred equity and a subordinated loan. SoftBank also assumed

external debt of approximately ¥0.13 trillion (£0.6 billion).

Special distribution of £9 billion

On 17 March 2006, the Group stated that it will make a special distribution of

approximately £6 billion in the 2007 financial year of the £6.9 billion cash received

following the completion of the sale of the Group’s interest in Vodafone Japan. Through

targeting a lower credit rating, the Group now plans to return a further £3 billion,

resulting in a total distribution of approximately £9 billion.

This equates to 15p per ordinary share. Subject to shareholder approval, the method of

distribution will be in the form of a B share arrangement with a share consolidation,

which will reduce the Company’s shares in issue. The B share arrangement provides for

shareholder flexibility as to when and how cash is received, thereby allowing income tax

and capital gains management for some shareholders. The Company will post a circular

to shareholders, with full details of the B share arrangement and the consolidation, on or

around 13 June 2006.

The consolidation, which will replace existing ordinary shares with fewer new ordinary

shares, is intended to maintain the share price, subject to normal market movements,

and, consequently, historic comparability. For non-US shareholders, the B shares will be

redeemed by default, with shareholders receiving a capital distribution. They may,

however, elect for certain alternatives. Non-US shareholders can elect to receive the

15 pence as a one off dividend or elect to receive the capital distribution over time at

pre-determined dates. Payment in respect of the initial redemption is intended to be

made on 11 August 2006 and for any shareholders electing to receive the one off

15 pence per B share dividend payment is also intended to be made on 11 August 2006.

It is expected that US shareholders and American Depositary Receipt (“ADR”) holders will

only be entitled to receive the return as a one off dividend.

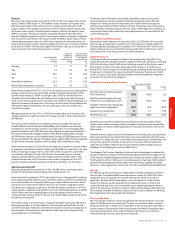

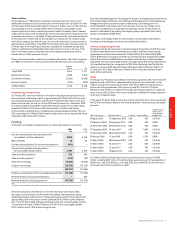

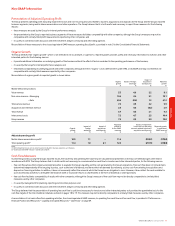

Share purchase programme

When considering how increased returns to shareholders can be provided in the form of

share purchases, the Board reviews the free cash flow, anticipated cash requirements,

dividends, credit profile and gearing of the Group.

On 24 May 2005, the Board allocated £4.5 billion to the share purchase programme for

the year to 31 March 2006, which was subsequently increased to £6.5 billion. For the

period from 1 April 2005 to 31 March 2006, the Company purchased 4,848 million shares

at a cost of £6.5 billion. The average share price paid, excluding transaction costs, was

133.37 pence, compared with the average volume weighted price over the same period

but excluding the period when shares could not be purchased, due to the announcement

of the discussions which led to the disposal of Vodafone Japan, of 133.87 pence. No

shares have been purchased since 31 March 2006. In addition to ordinary market

purchases, the Company placed irrevocable purchase instructions prior to the start of

some of the close periods and in advance of quarterly KPI announcements.

At its AGM on 26 July 2005, the Company received shareholder approval to purchase up

to 6.4 billion shares of the Company. This approval will expire at the conclusion of the

Company’s AGM on 25 July 2006. Shares can be purchased on market on the London

Stock Exchange at a price not exceeding 105% of the average middle market quotation

for such shares on the five business days prior to the date of purchase and otherwise in

accordance with the rules of the Financial Services Authority. Purchases are only made if

accretive to adjusted earnings per share.

As a result of targeting a lower credit rating and the £9 billion special distribution, the

Group has no current plans for further share purchases or other one off shareholder

returns.

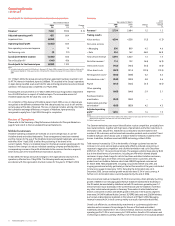

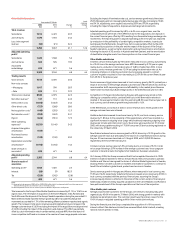

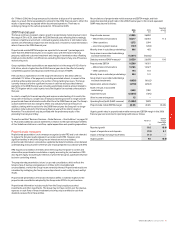

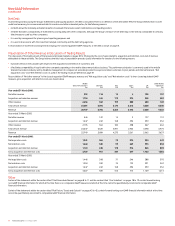

Details of shares purchased under the programme are shown below:

Total number of

shares purchased Maximum

Average price under publicly value of

Total paid per share, announced shares purchased

number of inclusive of share purchase under the

shares purchased transaction costs programme(1) programme(2 )

Date of share purchase ’000 Pence ‘000 £m

1 – 30 April 2005 321,000 139.33 321,000 4,053

1 – 23 May 2005 84,500 139.00 405,500 3,935

24 – 31 May 2005 110,000 139.49 515,500 3,782

1 – 30 June 2005 508,500 136.80 1,024,000 3,086

1 – 10 July 2005 145,500 137.23 1,169,500 2,887

11 – 27 July 2005 225,700 144.32 1,395,200 2,561

28 – 31 July 2005 – – 1,395,200 2,561

1 – 31 August 2005 297,900 150.57 1,693,100 2,112

1 – 30 September 2005 273,900 151.21 1,967,000 1,698

1 – 31 October 2005 368,000 146.76 2,335,000 1,158

1 – 14 November 2005 71,500 150.83 2,406,500 3,050

15 – 30 November 2005 564,000 128.23 2,970,500 2,327

1 – 31 December 2005 362,500 126.49 3,333,000 1,868

1 – 9 January 2006 165,500 129.63 3,498,500 1,654

10 – 24 January 2006 504,000 124.99 4,002,500 1,024

25 – 31 January 2006 76,500 121.17 4,079,000 931

1 – 28 February 2006 411,000 119.84 4,490,000 439

1 – 31 March 2006 358,000 122.42 4,848,000 –

Total 4,848,000 134.07 4,848,000 –

Notes:

(1) No shares were purchased outside the publicly announced share purchase programmes.

(2) On 24 May 2005, the Company announced it was allocating £4.5 billion to the share purchase programme to cover the

year to 31 March 2006, including those shares purchased between 1 April 2005 and 23 May 2005 under irrevocable

purchase instructions. This superseded the £4 billion programme announced in November 2004. On 15 November 2005,

the Company announced that it was increasing the allocation to £6.5 billion completing by March 2006.