Vodafone 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Vodafone Group Plc Annual Report 2006

Operating Results

continued

The Group also increased its effective shareholding in its joint venture in South Africa,

Vodacom, from 35% to approximately 50% following the acquisition of VenFin.

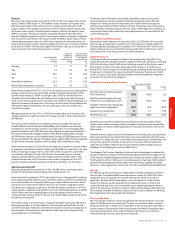

Other Mobile associated undertakings

SFR, the Group’s associated undertaking in France, reported strong growth in revenue

and operating profit, principally as a result of an 8.1% increase in average customers

compared with the previous financial year. Usage of both voice and non-voice services

increased in the year and SFR had a total of 5,268,000 Vodafone live! customers at

31 March 2006. SFR continues to grow its 3G base and at 31 March 2006 had registered

1,352,000 3G devices on its network.

On 30 November 2005, the French competition authority fined SFR €220 million for

engaging in anti-competitive agreements that distorted market competition. SFR is in

the process of appealing this decision.

On 7 April 2006, the Swiss Competition Commission notified Swisscom Mobile, the

Group’s associated undertaking in Switzerland, of its intention to impose a fine of

CHF489 million in relation to abusive pricing on the mobile wholesale call termination

market between 1 April 2004 and 31 May 2005.

Other Mobile investments

China Mobile, in which the Group has a 3.27% stake, and is accounted for as an

investment, grew its customer base by 21.9% in the year to 260.6 million at 31 March

2006. Dividends of £41 million were received in the year.

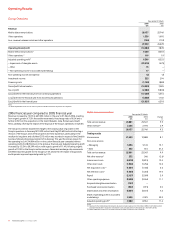

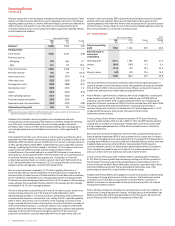

Common functions Years ended 31 March

2006 2005 Change

£m £m %

Revenue 145 123 17.9

Adjusted operating profit/(loss) 211 (85)

Common functions include the results of Partner Markets and unallocated central Group

costs and charges. Adjusted operating profit increased primarily due to a revision of the

charges made to Vodafone operating companies for the use of the Vodafone brand and

related trademarks which took effect from 1 April 2005.

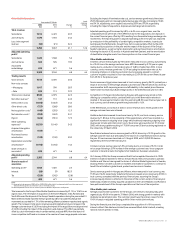

Other operations Years ended 31 March

2006 2005 Change

£m £m %

Revenue

Germany 1,320 1,095 20.5

Other 19 –

1,339 1,095 22.3

Adjusted operating profit/(loss)

Germany 139 64 117.2

Other (20) (45) (55.6)

119 19 526.3

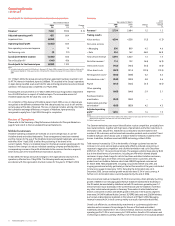

Other operations comprise interests in fixed line telecommunications businesses in

Germany, France and India.

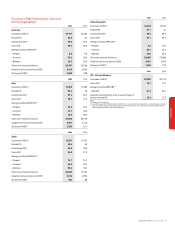

Germany

In local currency, Arcor’s revenue increased by 20.7%, primarily due to customer and

usage growth, partially offset by tariff decreases in the competitive market. The

incumbent fixed line market leader continues to drive this intensive competition,

although Arcor further strengthened its position as the main competitor. Contract ISDN

voice customers increased by 103% to 1,447,000 and DSL (broadband internet)

customers by 166% to 1,209,000 in the current financial year. Arcor increased its share

of the DSL market to 11%. Revenue growth and cost efficiencies led to the substantial

improvement in adjusted operating profit.

Other

The merger of Cegetel, the Group’s associated undertaking, and Neuf Telecom closed on

22 August 2005, giving the Group a proportionate interest of 12.4% in the leading

alternative operator for fixed line telecommunications services in France. The new entity,

Neuf Cegetel, has the largest alternative broadband network in France, with 70%

population coverage.

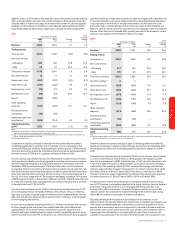

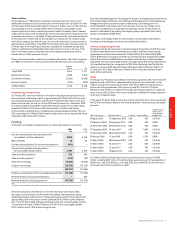

US GAAP Reconciliation

The principal differences between US GAAP and IFRS, as they relate to the Consolidated

Financial Statements, are the accounting for goodwill and intangible assets before

29 September 2005, the accounting for income taxes, the capitalisation of interest and

the timing of recognition of connection revenue and expenses.

In the year ended 31 March 2006, revenue from continuing operations under US GAAP

was £23,756 million compared with revenue from continuing operations under IFRS of

£29,350 million for the same period. The difference relates to the equity accounting of

Vodafone Italy under US GAAP, the treatment of Vodafone Sweden as discontinued

under US GAAP and the release of connection revenue deferred prior to the adoption of

EITF 00-21 on 1 October 2003, which is required to be recognised over the period a

customer is expected to remain connected to the network under US GAAP.

Net loss under US GAAP for the year ended 31 March 2006 was £13,310 million,

compared with a loss for the financial year under IFRS of £21,821 million for the same

period. The lower net loss under US GAAP was mainly driven by higher amortisation

charges of other intangible assets and share of result in equity method investments,

more than offset by income taxes and the reversal of impairment losses.

The reconciliation of the differences between IFRS and US GAAP is provided in note 38

to the Consolidated Financial Statements.