Vodafone 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

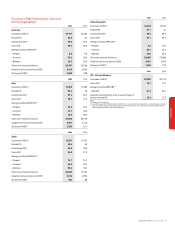

Vodafone Group Plc Annual Report 2006 27

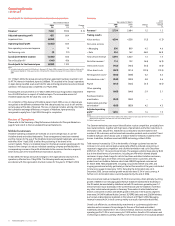

Property, plant and equipment

Property, plant and equipment also represent a significant proportion of the asset base

of the Group and hence the estimates and assumptions made to determine their

carrying value and related depreciation are critical to the Group’s financial position and

performance.

Estimation of useful life

The charge in respect of periodic depreciation is derived after determining an estimate

of an asset’s expected useful life and the expected residual value at the end of its life.

Increasing an asset’s expected life or its residual value would result in a reduced

depreciation charge in the Group’s income statement.

The useful lives of Group assets are determined by management at the time the asset is

acquired and reviewed annually for appropriateness. The lives are based on historical

experience with similar assets as well as anticipation of future events, which may impact

their life, such as changes in technology. Furthermore, network infrastructure cannot be

depreciated over a period that extends beyond the expiry of the associated licence

under which the operator provides telecommunications services.

Historically, changes in useful lives have not resulted in material changes to the Group’s

depreciation charge.

Cost capitalisation

Cost includes the total purchase price and labour costs associated with the Group’s own

employees to the extent that they are directly attributable to construction costs, or

where they comprise a proportion of a department directly engaged in the purchase or

installation of a fixed asset. Management judgement is involved in determining the

appropriate internal costs to capitalise and the amounts involved. For the year ended

31 March 2006, internal costs capitalised represented approximately 7% of expenditure

on property, plant and equipment and computer software and approximately 1% of total

operating expenses.

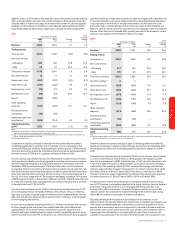

Taxation

The Group’s tax charge on ordinary activities is the sum of the total current and deferred

tax charges. The calculation of the Group’s total tax charge necessarily involves a degree

of estimation and judgement in respect of certain items whose tax treatment cannot be

finally determined until resolution has been reached with the relevant tax authority or,

as appropriate, through a formal legal process. The final resolution of some of these

items may give rise to material profit and loss and/or cash flow variances. See “Financial

Position and Resources”.

The growth in complexity of the Group’s structure following its rapid expansion

geographically has made the degree of estimation and judgement more challenging.

The resolution of issues is not always within the control of the Group and it is often

dependent on the efficiency of the legal processes in the relevant taxing jurisdictions in

which the Group operates. Issues can, and often do, take many years to resolve.

Payments in respect of tax liabilities for an accounting period result from payments on

account and on the final resolution of open items. As a result, there can be substantial

differences between the tax charge in the income statement and tax payments.

Significant items on which the Group has exercised accounting judgement include a

provision in respect of an enquiry from UK HM Revenue and Customs with regard to the

Controlled Foreign Companies tax legislation (see note 31 to the Consolidated Financial

Statements), legal proceedings to recover VAT in relation to 3G licence fees (see

“Contingencies” on page 39) and potential tax losses in respect of a write down in the

value of investments in Germany (see note 6 to the Consolidated Financial Statements).

The amounts recognised in the Consolidated Financial Statements in respect of each

matter are derived from the Group’s best estimation and judgement, as described above.

However, the inherent uncertainty regarding the outcome of these items means

eventual resolution could differ from the accounting estimates and therefore impact the

Group’s results and cash flows.

Recognition of deferred tax assets

The recognition of deferred tax assets is based upon whether it is more likely than not

that sufficient and suitable taxable profits will be available in the future, against which

the reversal of temporary differences can be deducted. Recognition, therefore, involves

judgement regarding the future financial performance of the particular legal entity or

tax group in which the deferred tax asset has been recognised.

Historical differences between forecast and actual taxable profits have not resulted in

material adjustments to the recognition of deferred tax assets.

Performance

determined by discounting estimated future net cash flows generated by the asset,

assuming no active market for the assets exist. The use of different assumptions for the

expectations of future cash flows and the discount rate would change the valuation of

the intangible assets.

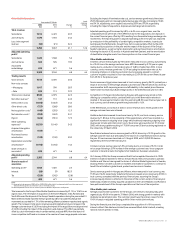

IFRS

On transition to IFRS, the Group has elected not to apply IFRS 3, “Business

Combinations”, retrospectively as the difficulty in applying these requirements to the

large number of business combinations completed by the Group from incorporation

through to 1 April 2004 exceeded any potential benefits. Goodwill arising before the

date of transition to IFRS, after adjusting for items including the impact of proportionate

consolidation of joint ventures, amounted to £78,753 million.

If the Group had elected to apply the accounting for business combinations

retrospectively, it may have led to an increase or decrease in goodwill and increase in

licences, customer bases, brands and related deferred tax liabilities recognised on

acquisition.

US GAAP

For acquisitions prior to 29 September 2004, the key difference from IFRS is that for the

acquisition of mobile network businesses, the excess of purchase price over the fair

value of the identifiable assets and liabilities acquired other than licences (“the residual”)

was allocated to licences, as opposed to goodwill. However, subsequent to this date and

due to the prohibition of this method of accounting following the issuance of EITF Topic

D-108 licences are valued using a direct valuation approach, with the residual being

allocated to goodwill. For other acquisitions, the residual has been and will continue to

be allocated to goodwill.

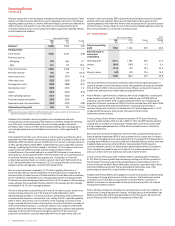

Intangible assets, excluding goodwill

Other intangible assets include the Group’s aggregate amounts spent on the acquisition

of 2G and 3G licences, customer bases, brands, computer software and development

costs. These assets arise from both separate purchases and from acquisition as part of

business combinations.

The relative size of the Group’s intangible assets, excluding goodwill, makes the

judgements surrounding the estimated useful lives and basis of amortisation critical to

the Group’s financial position and performance.

At 31 March 2006, intangible assets, excluding goodwill, amounted to £16,512 million

(2005: £16,149 million) and represented 13.0% (2005: 11.0%) of the Group’s total assets.

Estimation of useful life

The useful life used to amortise intangible assets relates to the future performance of

the assets acquired and management’s judgement of the period over which economic

benefit will be derived from the asset. The basis for determining the useful life for the

most significant categories of intangible assets is as follows:

Licences and spectrum fees

The estimated useful life is, generally, the term of the licence, unless there is a

presumption of renewal at negligible cost. Using the licence term reflects the period

over which the Group will receive economic benefit. For technology specific licences

with a presumption of renewal at negligible cost, the estimated useful economic life

reflects the Group’s expectation of the period over which the Group will continue to

receive economic benefit from the licence. The economic lives are periodically reviewed,

taking into consideration such factors as changes in technology. Historically, any

changes to economic lives have not been material following these reviews.

Customer bases

The estimated useful life principally reflects management’s view of the average

economic life of the customer base and is assessed by reference to customer churn

rates. An increase in churn rates may lead to a reduction in the useful life and an

increase in the amortisation charge. Historically, changes to churn rates have been

insufficient to impact the useful life.

Capitalised software

The useful life is determined by management at the time the software is acquired and

brought into use and is regularly reviewed for appropriateness. For computer software

licences, the useful life represents management’s view of expected benefits over which

the Group will receive benefits from the software, but not exceeding the licence term.

For unique software products controlled by the Group, the life is based on historical

experience with similar products as well as anticipation of future events, which may

impact their life, such as changes in technology.

Historically, changes in useful lives have not resulted in material changes to the Group’s

amortisation charge.