Vodafone 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 75

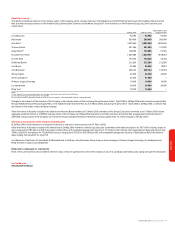

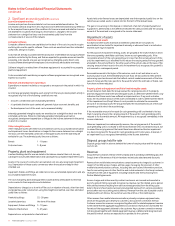

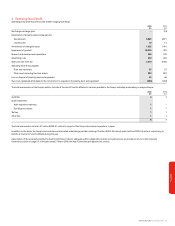

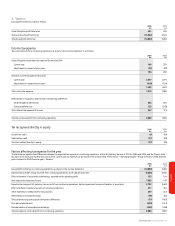

Notes to the Consolidated Financial Statements

1. Basis of preparation

The Consolidated Financial Statements are prepared in accordance with International

Financial Reporting Standards (“IFRS”) (including International Accounting Standards

(“IAS”) and interpretations issued by the International Accounting Standards Board

(“IASB”) and its committees, and as interpreted by any regulatory bodies applicable to

the Group as adopted for use in the European Union (“EU”), the Companies Act 1985

and Article 4 of the IAS Regulations. The Consolidated Financial Statements have been

prepared in accordance with IFRS, which differs in certain material respects from US

generally accepted accounting principles (“US GAAP”) – see note 38.

The preparation of financial statements in conformity with IFRS requires management to

make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenue and expenses during the reporting

period. For a discussion on the Group’s critical accounting estimates see “Performance –

Critical Accounting Estimates” elsewhere in this Annual Report. Actual results could

differ from those estimates. The estimates and underlying assumptions are reviewed on

an ongoing basis. Revisions to accounting estimates are recognised in the period in

which the estimate is revised if the revision affects only that period or in the period of

the revision and future periods if the revision affects both current and future periods.

Certain amounts in relation to the previous financial year have been reclassified to

conform presentation with the requirements of IFRS.

Amounts in the Consolidated Financial Statements are stated in pounds sterling (£), the

currency of the country in which the Company is incorporated. The translation into US

dollars of the Consolidated Financial Statements as of, and for the financial year ended,

31 March 2006, is for convenience only and has been made at the Noon Buying Rate for

cable transfers as announced by the Federal Reserve Bank of New York for customs

purposes on 31 March 2006. This rate was $1.7393: £1. This translation should not be

construed as a representation that the sterling amounts actually represented have been,

or could be, converted into dollars at this or any other rate.

2. Significant accounting policies

The Group’s significant accounting policies are described below.

Accounting convention

The Consolidated Financial Statements are prepared on a historical cost basis except for

certain financial and equity instruments that have been measured at fair value.

Basis of consolidation

The Consolidated Financial Statements incorporate the financial statements of the

Company and entities controlled, both unilaterally and jointly, by the Company.

Accounting for subsidiaries

A subsidiary is an entity controlled by the Company. Control is achieved where the

Company has the power to govern the financial and operating policies of an entity so as

to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the year are included in the

income statement from the effective date of acquisition or up to the effective date of

disposal, as appropriate. Where necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting policies into line with those used by

other members of the Group.

All intra-group transactions, balances, income and expenses are eliminated on

consolidation.

Minority interests in the net assets of consolidated subsidiaries are identified separately

from the Group’s equity therein. Minority interests consist of the amount of those

interests at the date of the original business combination and the minority’s share of

changes in equity since the date of the combination. Losses applicable to the minority

in excess of the minority’s share of changes in equity are allocated against the interests

of the Group except to the extent that the minority has a binding obligation and is able

to make an additional investment to cover the losses.

Business combinations

The acquisition of subsidiaries is accounted for using the purchase method. The cost of

the acquisition is measured at the aggregate of the fair values, at the date of exchange,

of assets given, liabilities incurred or assumed, and equity instruments issued by the

Group in exchange for control of the acquiree, plus any costs directly attributable to the

business combination. The acquiree’s identifiable assets and liabilities are recognised at

their fair values at the acquisition date.

Goodwill arising on acquisition is recognised as an asset and initially measured at cost,

being the excess of the cost of the business combination over the Group’s interest in the

net fair value of the identifiable assets, liabilities and contingent liabilities recognised.

The interest of minority shareholders in the acquiree is initially measured at the

minority’s proportion of the net fair value of the assets, liabilities and contingent

liabilities recognised.

Previously held identifiable assets, liabilities and contingent liabilities of the acquired

entity are revalued to their fair value at the date of acquisition, being the date at which

the Group achieves control of the acquiree. The movement in fair value is taken to the

asset revaluation surplus.

Interests in joint ventures

A joint venture is a contractual arrangement whereby the Group and other parties

undertake an economic activity that is subject to joint control, that is when the strategic

financial and operating policy decisions relating to the activities require the unanimous

consent of the parties sharing control.

The Group reports its interests in jointly controlled entities using proportionate

consolidation. The Group’s share of the assets, liabilities, income, expenses and cash

flows of jointly controlled entities are combined with the equivalent items in the results

on a line-by-line basis.

Any goodwill arising on the acquisition of the Group’s interest in a jointly controlled

entity is accounted for in accordance with the Group’s accounting policy for goodwill

arising on the acquisition of a subsidiary.

Investments in associates

An associate is an entity over which the Group has significant influence and that is

neither a subsidiary nor an interest in a joint venture. Significant influence is the power

to participate in the financial and operating policy decisions of the investee, but is not

control or joint control over those policies.

The results and assets and liabilities of associates are incorporated in the Consolidated

Financial Statements using the equity method of accounting. Under the equity method,

investments in associates are carried in the consolidated balance sheet at cost as

adjusted for post-acquisition changes in the Group’s share of the net assets of the

associate, less any impairment in the value of the investment. Losses of an associate in

excess of the Group’s interest in that associate are not recognised. Additional losses are

provided for, and a liability is recognised, only to the extent that the Group has incurred

legal or constructive obligations or made payments on behalf of the associate.

Any excess of the cost of acquisition over the Group’s share of the net fair value of the

identifiable assets, liabilities and contingent liabilities of the associate recognised at the

date of acquisition is recognised as goodwill. The goodwill is included within the carrying

amount of the investment.

The licences of the Group’s associated undertaking in the US, Verizon Wireless, are

indefinite lived assets as they are subject to perfunctory renewal. Accordingly they are

not subject to amortisation but are tested annually for impairment, or when indicators

exist that the carrying value is not recoverable.

Intangible assets

Goodwill

Goodwill arising on the acquisition of an entity represents the excess of the cost of

acquisition over the Group’s interest in the net fair value of the identifiable assets,

liabilities and contingent liabilities of the entity recognised at the date of acquisition.

Goodwill is initially recognised as an asset at cost and is subsequently measured at cost

less any accumulated impairment losses. Goodwill is held in the currency of the

acquired entity and revalued to the closing rate at each balance sheet date.

Goodwill is not subject to amortisation but is tested for impairment.

Negative goodwill arising on an acquisition is recognised directly in the income statement.

On disposal of a subsidiary or a jointly controlled entity, the attributable amount of

goodwill is included in the determination of the profit or loss recognised in the income

statement on disposal.

Goodwill arising before the date of transition to IFRS, on 1 April 2004, has been retained

at the previous UK GAAP amounts subject to being tested for impairment at that date.

Goodwill written off to reserves under UK GAAP prior to 1998 has not been reinstated

and is not included in determining any subsequent profit or loss on disposal.

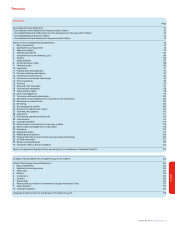

Financials