Vodafone 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Vodafone Group Plc Annual Report 2006

Business Overview

Introduction

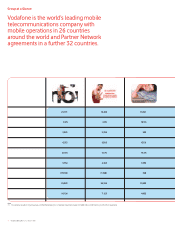

Vodafone Group Plc is the world’s leading mobile telecommunications company, with a

significant presence in Europe, the Middle East, Africa, Asia Pacific and the United States

through the Company’s subsidiary undertakings, joint ventures, associated undertakings

and investments.

The Group’s mobile subsidiaries and joint venture in Italy operate under the brand name

“Vodafone”. In the United States, the Group’s associated undertaking operates as Verizon

Wireless. During the last two financial years, the Group has also entered into

arrangements with a number of its associated undertakings and with network operators

in countries where the Group does not hold an equity stake. Under the terms of these

Partner Market agreements, the Group and its Partner Markets co-operate in the

development and marketing of certain services, often under dual brand logos. This has

expanded the Group’s global footprint in Europe, Asia Pacific and, most recently, South

America.

The Group provides a wide range of voice and data mobile telecommunications services,

including text messages (“SMS”), picture messages (“MMS”) and other data services, and

is continually developing and enhancing service offerings, particularly through third

generation (“3G”) mobile technology which is being deployed in the majority of the

Group’s operations. Services are provided to both consumers and corporate customers,

through a variety of both prepaid and contract tariff arrangements.

The Group’s mobile services are currently offered over a Global System for Mobile

Communications (“GSM”) network, on which a General Packet Radio Service (“GPRS”)

service is also provided and, in certain operations, over a Wideband Code Division

Multiple Access (“W-CDMA”) 3G network. The Group’s discontinued operation in Japan

operated a different technology to GSM. Where licences have been issued, the Group

has secured 3G licences in all jurisdictions in which it operates through its subsidiary

undertakings and continues to roll out mobile 3G network infrastructure. Vodafone

offered 3G services in 11 of its controlled operations at 31 March 2006.

The Group is managed and organised by business and geography. The Group has mobile

and fixed line telecommunications businesses, with the latter referred to as Other

Operations. Vodafone’s principal mobile operations are located in Germany, Italy, Spain,

the UK and the US with the Group’s Other Mobile Operations covering operations in

Europe, the Middle East, Africa and Asia Pacific. In addition, there are a number of central

functions which provide services to the mobile operations and allow the Group to

leverage its scale and scope and manage risk effectively. Other Operations principally

consists of the Group’s controlling interest in a fixed line telecommunications business

in Germany. On 1 May 2006, changes to the organisational structure were effected with

the objective of focusing the Group’s mobile businesses according to different market

and customer requirements.

The Company’s ordinary shares are listed on the London Stock Exchange and the

Company’s ADSs are listed on the New York Stock Exchange (“NYSE”). The Company had

a total market capitalisation of approximately £72 billion at 26 May 2006, making it the

fifth largest company in the Financial Times Stock Exchange 100 index and the twenty

second largest company in the world based on market capitalisation at that date.

Mobile Telecommunications

Local operations

The Company has equity interests in 26 countries, through its subsidiary undertakings,

joint ventures, associated undertakings and investments. Partner Market arrangements

extend the Group’s footprint to a further 32 countries.

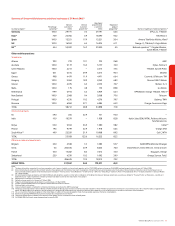

At 31 March 2006, based on the registered customers of mobile telecommunications

ventures in which it had equity interests at that date, the Group had approximately 170.6

million customers, calculated on a proportionate basis in accordance with the Group’s

percentage interest in these ventures, and 518.0 million registered venture customers.

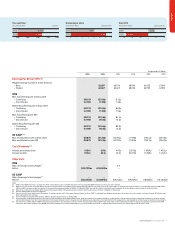

The table on the following page sets out a summary of the Company’s worldwide mobile

operations at 31 March 2006 and venture customer growth in the year then ended (the

“2006 financial year”).

Competition

The Group faces a high degree of competition in each of its geographic markets. It is

subject to indirect competition from providers of other telecommunications services in

the domestic markets in which it operates in addition to direct competition from existing

mobile telecommunications network operators and MVNOs who do not operate a

mobile telecommunications network. There are also new types of competitors, such as

fixed line operators offering combined fixed and mobile service offerings, and internet

based companies extending their services to include telecommunications. Competitive

pressures have adversely impacted the level of customer churn, although this has been

managed by reductions in tariffs and a continued focus on customer acquisition and

retention initiatives.

The Group expects that competition will continue from existing operators as well as from

a number of new market entrants, including those arising following the award of new 3G

licences and MVNOs. The scope of this increased competition, and the impact on the

results of operations, is discussed further in “Performance – Risk Factors, Trends and

Outlook”.

Many of Vodafone’s key markets are highly penetrated with over 100% penetration rates

in some, largely due to a number of customers owning more than one subscriber

identity module (“SIM”), which is, broadly, the Group’s basis for defining a customer. The

Group has estimated penetration rates at 31 December 2005 for its principal markets as

follows:

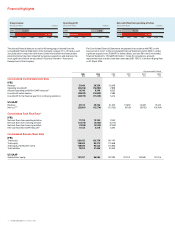

Market Penetration (%)

Germany 96

Italy 122

Spain 98

UK 109

US 69

A summary of the significant mobile competitors in its markets at 31 March 2006 is also

provided in the following table.

Contents

Page

Business Overview 12

– Introduction 12

– Mobile Telecommunications 12

– Non-mobile Telecommunications 19

– History and Development of the Company 19

Regulation 21